Short-long path to Eurozone

Declared supporter of replacement of Croatian Kuna (HRK) with Euro is Boris Vujčić, who serves as the governor of the Croatian National Bank. In an interview for the talk show ‘Nedeljom u dva’, broadcasted by the public Croatian television, he clearly stated that “economic interest of Croatia and people living there is very clear – introduce Euro as soon as possible. Why? Because benefits are larger than the potential loses. And we do not have much to lose,” he explained.

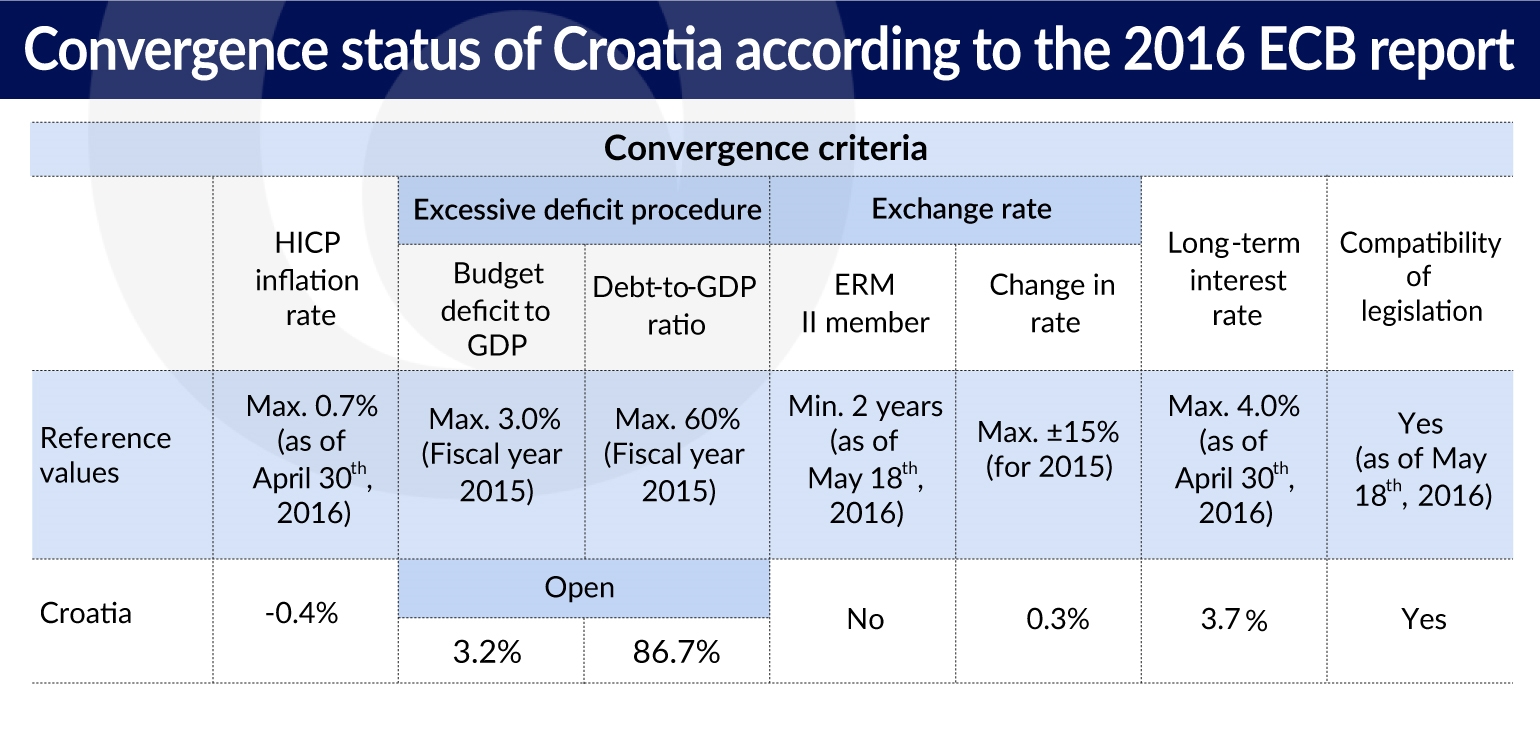

Vujčić siad that Croatia has already met the criteria of joining the Eurozone in the past (specific rate of inflation, public debt and budgetary deficit, stability of exchange and interest rate). Once the excessive budget deficit procedure will be finalised, which is hoped to happen this year, Zagreb will be able to apply for the membership in the Eurozone. Then, the biggest challenge will be negotiations with the European Commission and the European Central Bank, claims Vujčić.

Vujčić remains optimist also despite the criticism of the former chief economist of the ECB, Otmar Issing, who recently claimed that the Euro project is doomed due to its irresponsible politicization. The governor notes, that by the given term of approximately 5 years the future of the Eurozone will be decided and Zagreb will be able to determine its action accordingly. Whether adopting the Euro or not, the relevant reforms are needed and will bring benefits anyway.

Benefits and costs

First of all, Croatia faces the exchange rate risk. “In Croatia approximately HRK500bn (approx. EUR66bn) is tied to Euro”, says Vujčić. “It means that 1 per cent of depreciation will increase the debt by HRK5bn.” Subsequently to joining the Eurozone, the interest rate will decrease. Environment for banking sector in Croatia will be safer and therefore more “bank friendly”. Replacing Croatian national currency with Euro will have a positive impact on international ratings of the country.

The largest cost of introduction of Euro in Croatia would be the inflation. Interestingly, as Vujčić indicates, the praxis shows that the perception of the inflation rate by the consumers has been more important than the real inflation, which principally was lower. In other words prices of daily consumed products increase more than the one of estates, cars, refrigerators, etc.

The great pact

In general, liberal government of Croatia supports the idea of joining the Eurozone. In fact, adoption of Euro, together with joining the Schengen zone and economic development of the country, could become, as Croatian daily Jutarnji List reports, key missions of the current government. “The Prime Minister Andrej Plenković and the governor of the Croatian National Bank agreed to coordinate policy about joining the euro zone, as it is the safest option when one is concerned about the long-term stability of the Croatian,” writes Gojko Drljača in his article “The Great Pact”.

Similar view on the Eurozone has Zdravko Marić, the minister of finance of Croatia. “Solely, the payment of interest on the public debt, cost us HRK12bn. The amount that is larger than the entire budget of the Ministry of Education,” states Marić in relation to Croatian dependency on the Euro exchange rate. Fortnight, after the great pact was agreed upon, the government adopted ambitious plan of decreasing public debt to 75 per cent of the GDP. „The government and a large part of our experts have identified public debt as one of the key risks, challenges and weaknesses in the macroeconomic field of our economy, and therefore holding a high place on the list of priority activities of the Government,” said Martić. „Everything that we are planning to do in terms of accelerating economic growth and reducing the structural imbalance aims to be recognized by the financial markets, capital markets, and the rating agencies, so Croatia reclaim an (desired) investment grade rating, and thus reduce the risk and the total price at which we borrow money,” added in spirit of the Great Pact.

Worries

The decision to join Eurozone, however, will face some serious obstacles. According to the Eurobarometr survey, the share of respondents against adoption of Euro increased from 42 per cent in 2014 to 47 per cent in 2016. At the same time support for joining the Eurozone dropped from 55 per cent to 47 per cent in the same period. It is unclear whether referendum will be held in this circumstances, however, as emphasized by Boris Vujčić, a serious public debate on pros and cons should organised.

Before the Croatian accession to the EU, the government ignored growing fears of some part of the society regarding membership in the Union. Referendum held in 2012 has been won by pro-European votes by 66 per cent. However, couple of public polls from previous years showed majority of respondents opposed the membership in the EU.

All in all, arguments presented by Boris Vujčić refering to the monetary and fiscal policy, while popular concerns refer to the increase of prices and sensitive, in post-Yugoslav sphere, issues of the state sovereignty. Even significant increase of exports, which is the result of the EU, did not affect the life of Croats. With 15 per cent unemployment, unclear future of the Eurozone itself, and strong post-Yugoslav trauma haunting Croatian society (ca. 10 per cent of Croats has a status of the 1995 war veterans) Plenković and Vujčić will need to think of other arguments.

Viable option considered by the ruling elites of liberal orientation is to introduce relevant reforms anyway. Membership in the shaking Eurozone would then be of secondary question and could be played politically according to the circumstances.

Jan Muś is a lecturer at the Vistula University.