Tydzień w gospodarce

Category: Trendy gospodarcze

Russian economy is based on fuel exports and with these funds could have created a diversified source of sustainable economic growth. That didn’t happen. So where did all these trillions go?

The first obvious answer is that the money went to the accounts of extraction companies and fuel producers. But this is an erroneous assumption. If these trillions were kept on the bank accounts of the oil companies, then industry’s largest global company Rosnieft or the gas giant Gazprom would have a much higher capitalization, and neither of them would demand multi-billion prepayments for future oil and gas supplies. Rosnieft probably would not have taken USD50bn loan in order to purchase its competitor TNK-BP.

These additional money was partly used to build foreign exchange reserves and Russian sovereign wealth funds and to finance Russia’s foreign investment expansion. However, the bulk of the funds were siphoned off abroad to the private accounts of the continuously growing group of the most affluent citizens of Russia, who are active in the foreign financial markets, or in the real estate markets.

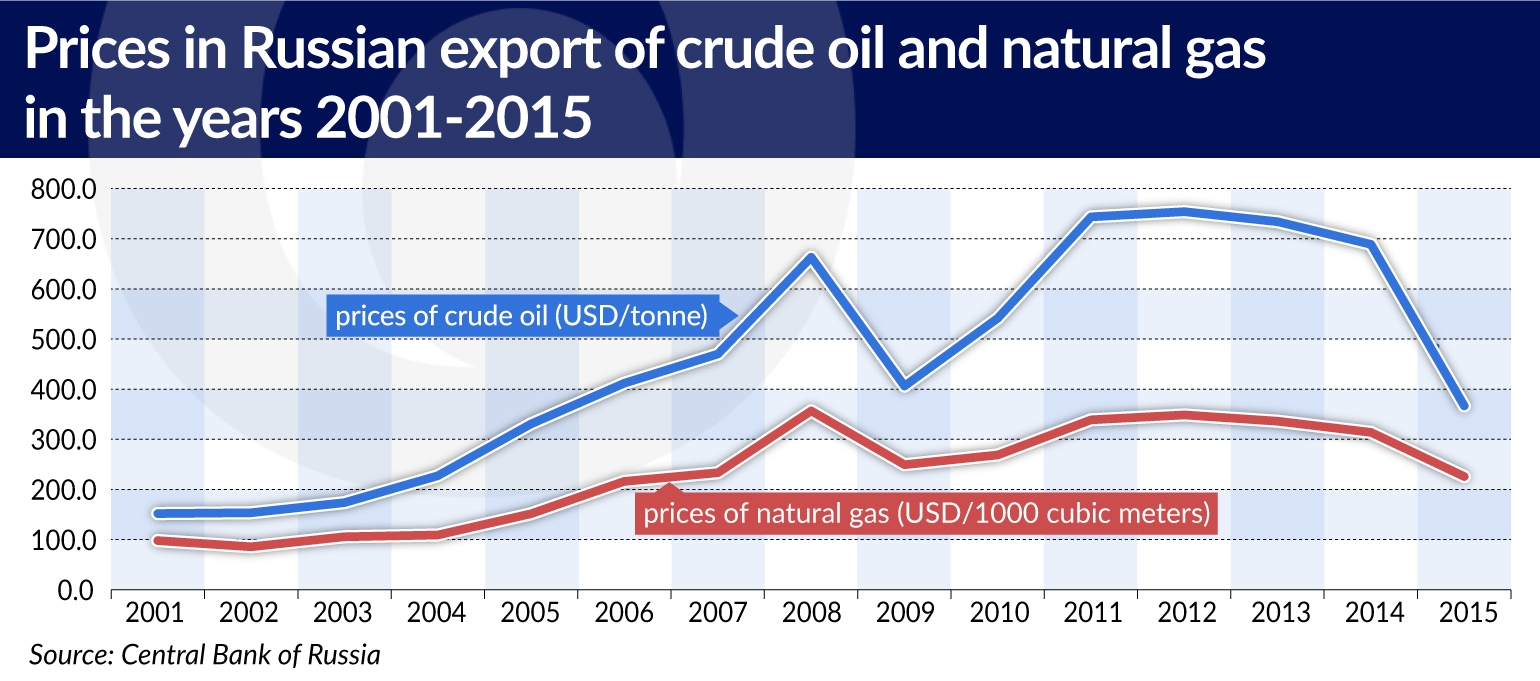

Since 2001, the average annual prices of Russian crude oil have increased four or even fivefold. Prices of gas and other commodities have been increasing at a similar rate. As a result, in the years 2002-2015 the revenues from their sales increased by USD2.42 trillion. Almost 88 per cent of the revenue growth came from price increases and only 12 per cent from increased volumes of exports.

After taking into account the estimated volumes and prices of the export of oil, natural gas and petroleum products from 2016, in 2002-2016 revenue increased by a total of over USD2.53 trillion, and together with other commodities, by approx. USD3 trillion.

Such a huge inflow of funds creates an opportunity to build a lasting foundation for fast economic growth. Russia did not seize this opportunity.

Even in the first decade of the 21st century, the results were still satisfactory. The Russian economy was expanding 1.5 times faster than the global average, despite the deep slowdown in 2009 (when Russia’s GDP decreased by 7.8 per cent). However, since 2010 the growth rate of the Russian economy has been chronically lagging behind the global growth rate – over the last 10 years Russia’s growth has been over two times lower. Since 2007, the world economy has expanded by 38 per cent, while the Russian economy has grown by less than 16 per cent. The poor performance recorded in recent years has reversed the positive effects achieved in the previous period. According to data from the IMF, in 2000-2016 the global economy grew by 89 per cent, while the Russian economy grew by 85.6 per cent.

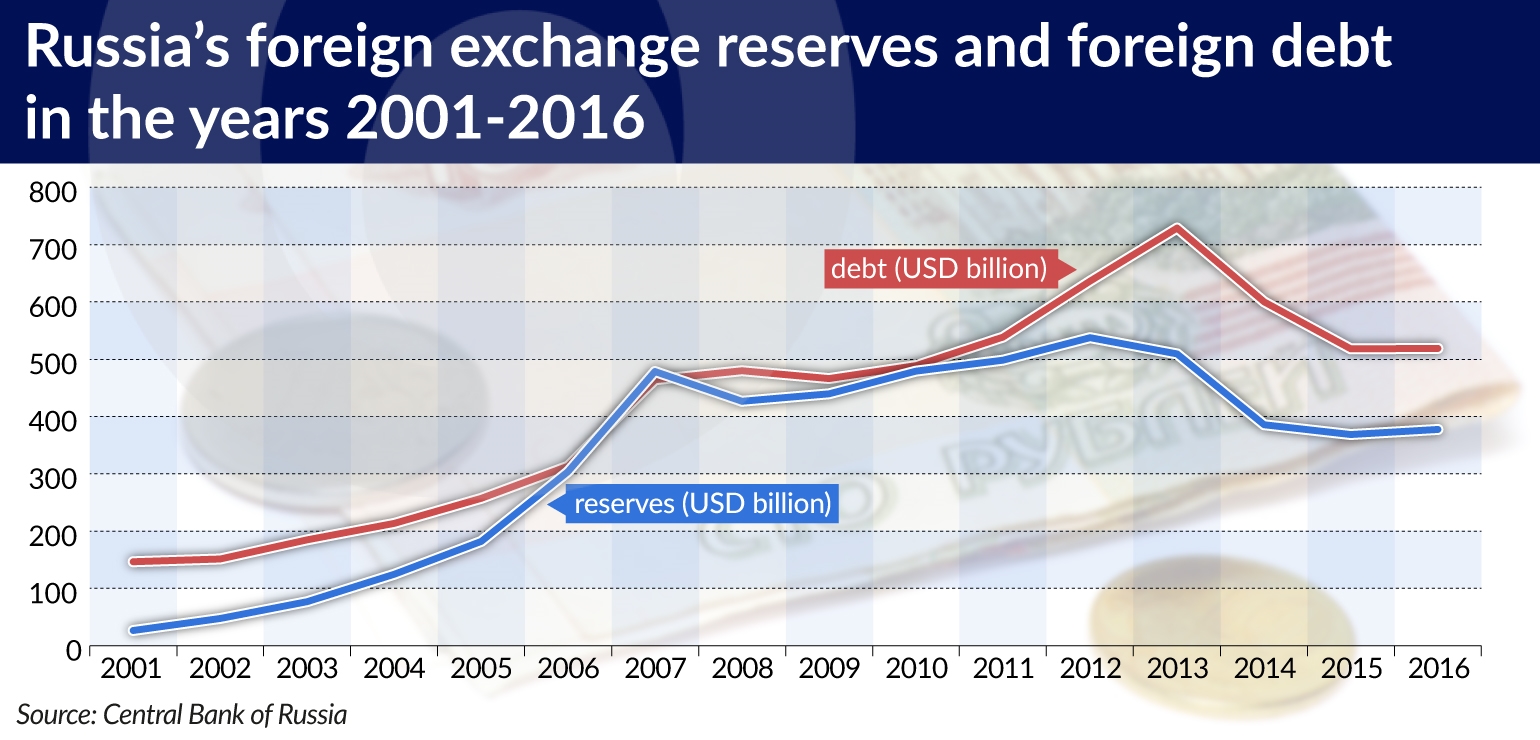

Russia’s great success was the rapid growth of its foreign exchange reserves. In just 7 years – from 2001 to 2008 – these reserves increased from only USD36.6bn to USD600bn. They later quickly decreased (by almost half) as a result of the economic sanctions imposed on Russia and the necessity of repaying foreign debt without the possibility of refinancing in the international financial markets – in 2014-2016 Russian foreign reserves dropped to USD377.7bn. Overall, Russian foreign reserves increased by USD341.1bn in the period between 2001 and 2016.

However, the level of foreign exchange reserves should be perceived against the background of Russia’s rapidly rising foreign debt. In 2016 it was USD372.1bn higher than in 2001. This means that in the years 2002-2016 the foreign debt increase was over USD30bn higher than the increase of foreign exchange reserves. In oil producing countries and other countries with a large surplus in foreign trade turnover, the funds derived from these surpluses are accumulated in special sovereign wealth funds. In Russia they are kept in the Reserve Fund and the National Welfare Fund.

During the peak period in August 2008, the resources accumulated in the Reserve Fund reached USD142.6bn. The financing of the deepening budget deficit, especially in 2016, led to the reduction of this amount to only USD16bn by the end of 2016. The resources accumulated in the National Welfare Fund amounted to USD71.9bn by the end of 2016. This fund reached its peak value of USD94.3bn in April 2011. The amount accumulated in both Russian sovereign wealth funds – as of the end of 2016 – is USD87.9bn, which indicates that the foreign exchange reserves and the sovereign wealth funds absorbed only a fraction of the money flowing into Russia as a result of growing prices of exported fuel and other commodities in the years 2002-2016. The largest part of the money derived from oil exports was transferred abroad.

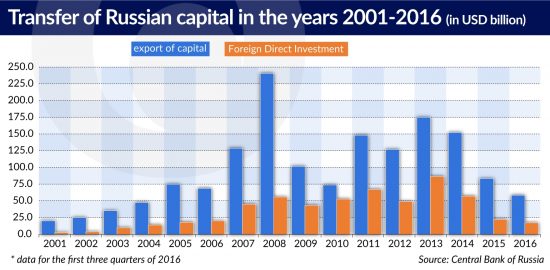

According to the official data of the Central Bank of Russia (CBR), USD1.56 trillion worth of capital was siphoned off from Russia in the years 2001-2016. The year 2008, with an outflow of capital of USD240.6bn and the year 2013 with an outflow of USD174.9bn, were the record years.

This outflow of capital is partly attributable to the withdrawal of foreign investors from the Russian market. However, the scale of the phenomenon was only larger in 2009, when foreign capital accounted for USD42bn of the total outflow of nearly USD102bn, and in recent years, when nearly USD125bn of foreign capital was withdrawn from Russia in 2014- 2016 (representing 42.5 per cent of the total capital outflow).

It is difficult to precisely determine the scale that capital has been illegally siphoned off from Russia. According to some estimates this phenomenon could have reached tens of billions of US dollars per year.

The so-called questionable transactions shown by the CBR in the annual balance of payments certainly have the features of illegal capital exports. This category includes, “operations that have the characteristics of fictitious activities associated with trade in goods and services, the purchase and sale of securities, the granting of loans and the transfer of funds to private accounts abroad, the purpose of which is the cross-border transfer of money.”

According to these statistics, in 2004-2016 nearly USD320bn was siphoned off from Russia. The scale of annual transfers was usually in the range of USD25-30bn, although in some years the amounts were significantly higher, e.g. in 2007 – USD34.5bn, in 2008 – USD50.6bn, in 2011 – USD33.3bn, and in 2012 – USD38.8bn.

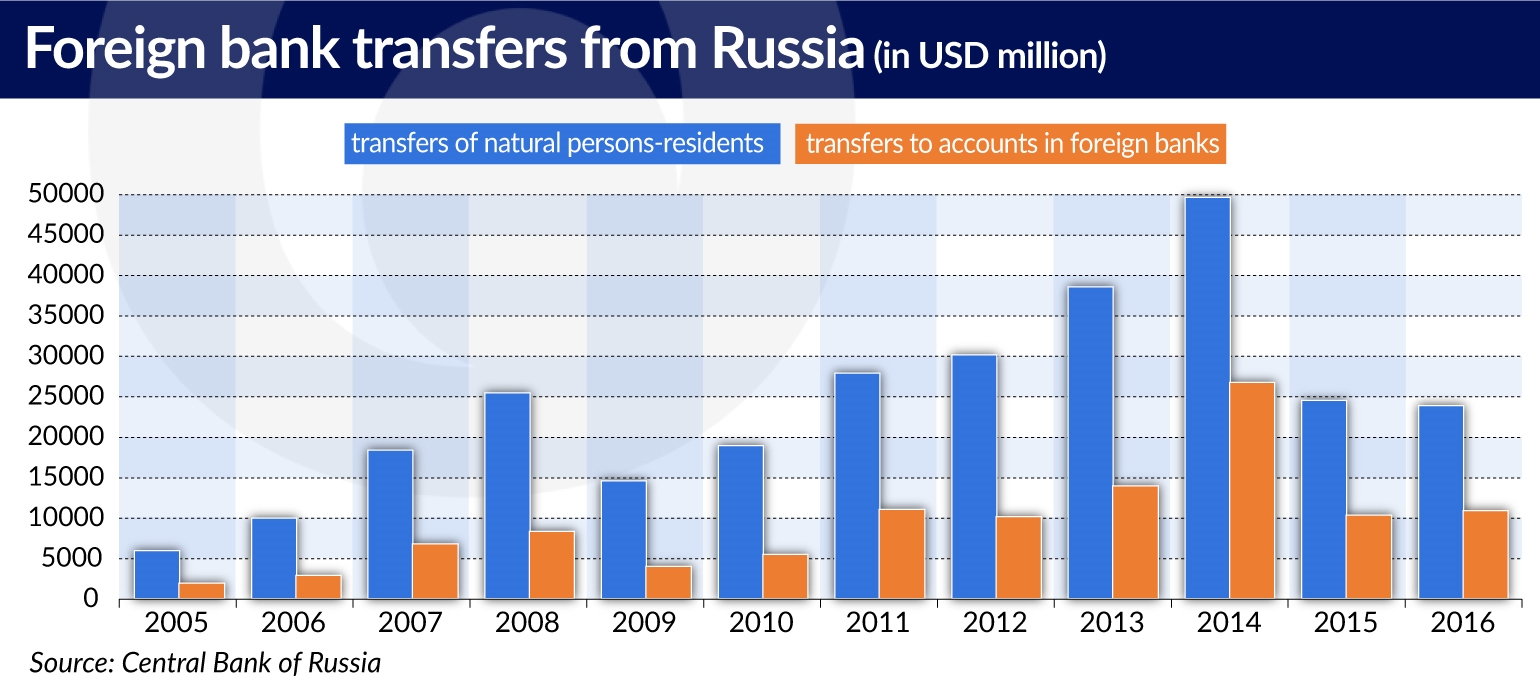

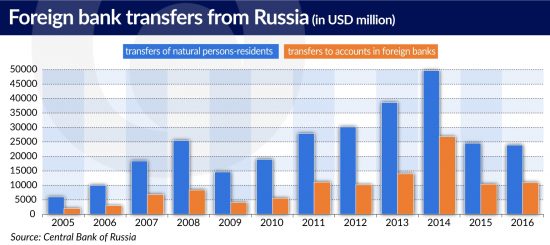

According to CBR statistics, in 2005-2016 foreign transfers of natural persons-residents reached USD290bn, including transfers to foreign bank accounts amounting to nearly USD114bn. However, experts estimate that the actual scale of illegal export of capital from Russia is significantly higher than what is shown in official statistics.

What was the money spent on? Certainly not on foreign direct investment. In light of the scale of capital exports, Russian direct investment abroad is not impressive. According to CBR statistics, the aggregate value of such investment reached USD403.3bn (as of the Q3’2016). After accounting for portfolio investment and other types of investment, the total value of Russian foreign investment is just over USD812bn. Meanwhile, the value of Russian assets abroad reached USD1.23 trillion (CBR data as of 1.10.2016). This is a clear sign that the majority of the money was spent abroad by private individuals and not by companies.

The estimates of Russian analysts indicate that the aggregate value of foreign investments of Russian individuals amounted to USD1.3-1.55 trillion at the end of 2011. This includes funds kept on accounts with foreign banks (USD750bn) and the value of purchased real estate (USD150-250bn).

Considering the fact that the years 2012-2016 were a period of record high investment activity of Russians in the foreign markets, it can be estimated that at the end of 2016 the assets of Russian individuals accumulated abroad were worth at least USD1.7-1.9 trillion (including USD0.9-1.0 trillion on bank accounts).

The investment activity of Russians abroad is mostly associated with the real estate market and the securities market. The CBR calculates that in 2009-2016, transfers of individuals for the purchase of real estate abroad reached USD11.4bn. However, the actual scale of these transactions is much higher. The annual real estate purchases outside of Russia were estimated at USD15bn (there has been a decline in transactions in the last two years).

Russians are purchasing real estate in Cyprus, Montenegro and Bulgaria, but also in Spain, Egypt and Finland. The middle class accounts for 25-40 per cent of Russian investment in real estate abroad, while the wealthiest Russians account for the remaining part. The latter are buying properties in the Cote d’Azur, Paris, London, Miami, Austria, Switzerland, and Italy.

No precise data is available on the scale of portfolio investment of Russian individuals, although there has been a noticeable increase in such transactions in recent years.

The situation is similar in the case of funds kept in foreign bank accounts. The latest reliable data were published a decade ago – the Bank for International Settlements (BIS) reported that by the end of 2005 Russians kept USD150bn in foreign bank accounts, and in the summer of 2006 this amount reached USD220bn. In 2009, the well-known political scientist Zbigniew Brzeziński claimed that a total of USD500bn belonging to the Russian elites was deposited in American banks.

There is no other data available. Analysts point out that the statistics of the BIS are incomplete, as they only cover the 48 reporting countries, not to mention the fact that they do not include hidden deposits.

The growing wealth and affluence of Russian citizens is most often seen through the prism of the spectacular investment decisions of Russia’s richest individuals, i.e. the Russian oligarchs. Forbes magazine included 77 Russian billionaires in its ranking of the world’s richest people in 2016 (with a fortune of at least USD1bn). Their combined assets are estimated at USD282.6bn. Seven of them (with assets ranging from USD10.5 to 13.3bn) were listed in the top 100. Fifteen years earlier only seven oligarchs from Russia were included on the list, with combined assets of USD13.2bn. We can clearly see that in Russia money breeds money very quickly. It is only the deteriorating situation in the international fuel market that has negatively affected their financial condition – the number of Russian billionaires decreased from 110 in 2014 to 77 in 2016, and the value of their assets decreased by almost USD145bn.

The representatives of the newly rich Russians are also increasingly active in the division of the country’s wealth. According to the annually published Credit Suisse Global Wealth Report, in 2016 there were 79 thousand dollar millionaires in Russia. And although the ranks of millionaires are expanding – one report of the Boston Consulting Group indicates that the fastest-growing group of millionaires is that with assets ranging from USD5-100m – it is difficult to recognize the expansion of their wealth as the development of the middle class. In a country with nearly 147 million inhabitants, the vast majority of Russians have never seen any of the money or any other significant benefits associated with the additional proceeds from the export of oil and other commodities.

The billions of dollars that were flowing into Russia in the last dozen or so years were not used to change the economic model, or to pursue the necessary diversification of the economy that would provide sustainable sources of growth independent of the level of oil or gas prices.

They have undoubtedly provided a certain development stimulus, which was initially stronger but significantly lost momentum later on. During these dozen or so years Russia grew more slowly than the global average, and after all, Russia sees itself as a country that is catching up, which requires a faster growth rate than in other developed and developing countries. Data on assets, per capita income, and other indicators, confirm that progress is being made, but this progress is disproportionate in relation to Russia’s material capabilities and its global power ambitions.

We are looking for trillions of dollars. Sovereign wealth funds or foreign investment companies have “only” received billions. A part of this capital certainly fuelled the budgetary sector: increases in pensions, disability pensions and wages in the budgetary sphere. This gave ordinary Russians an illusory sense of participation in the oil boom, and enabled the authorities to avoid embarrassing questions about the fate of the bulk of the proceeds from the sale of oil. Now, however, when the real incomes of Russians are falling for the third consecutive year, these questions are beginning to emerge.

Rich Russians have amassed billions on their foreign bank accounts and brokerage accounts or in real estate. And although a significant part of the transfers reported by the Central Bank of Russia is carried out legally, analysts concede that there is no full overview of the situation. The Russians are use mechanisms of cross-border transfer of funds that are generally well-known across the world (fictitious agreements and contracts), and they have even perfected some of them.