Podgorica, Montenegro (Roberto Maldeno, CC BY-NC-ND)

Montenegro signed CEFTA on 2006 and ratified it a year later, in July 2007. The goal was to lift restrictions on flow of people, goods and ideas, increase exchange of goods and creation of the common market for the participant member states (Western Balkan countries and Moldova). The spill-over effects of CEFTA would be attracting more foreign direct investments, economic growth, increase in technological level of production, efficiency and modern management, diversification and higher quality of products and eventually acceleration of the process of accession to the EU and WTO.

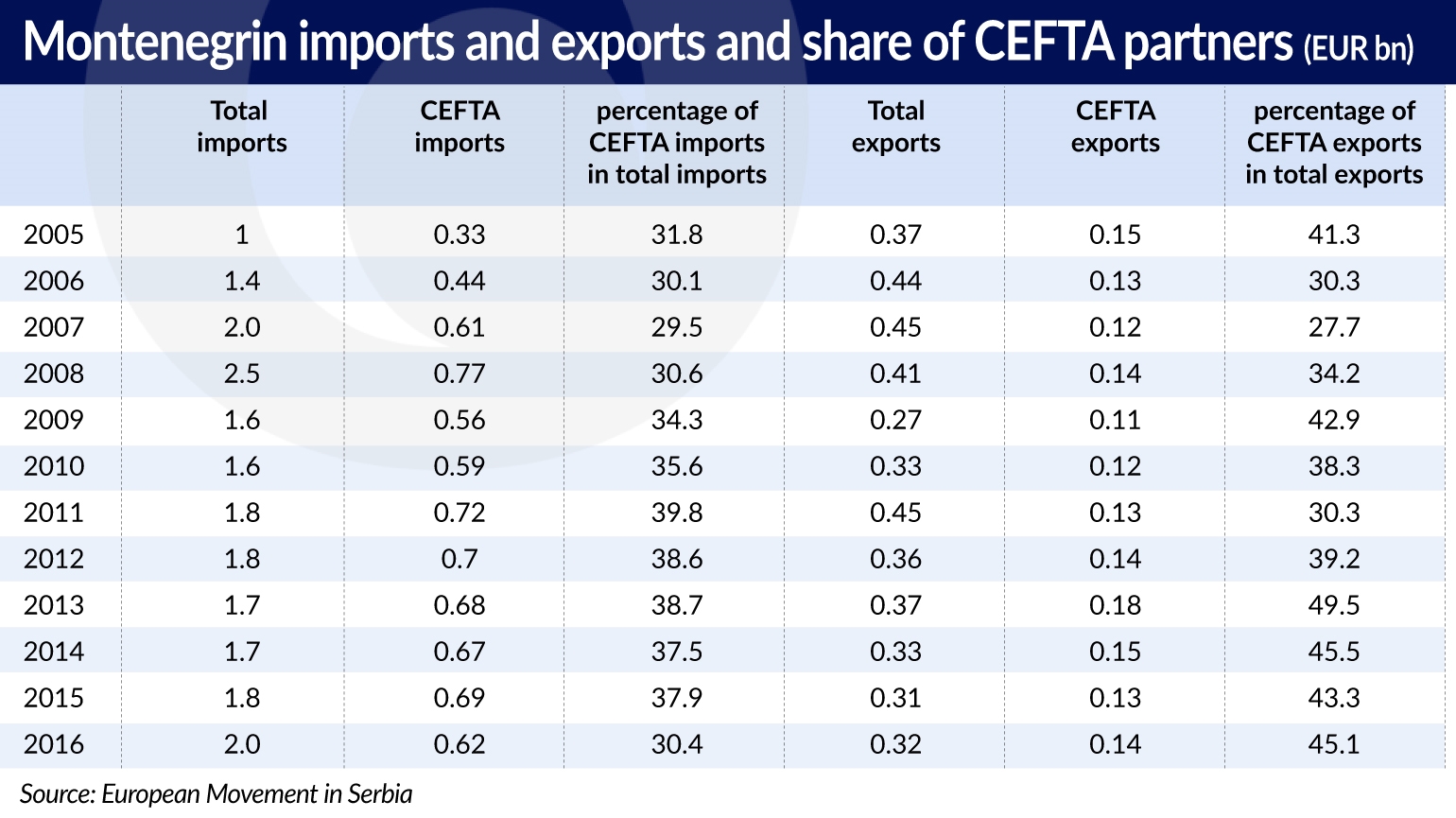

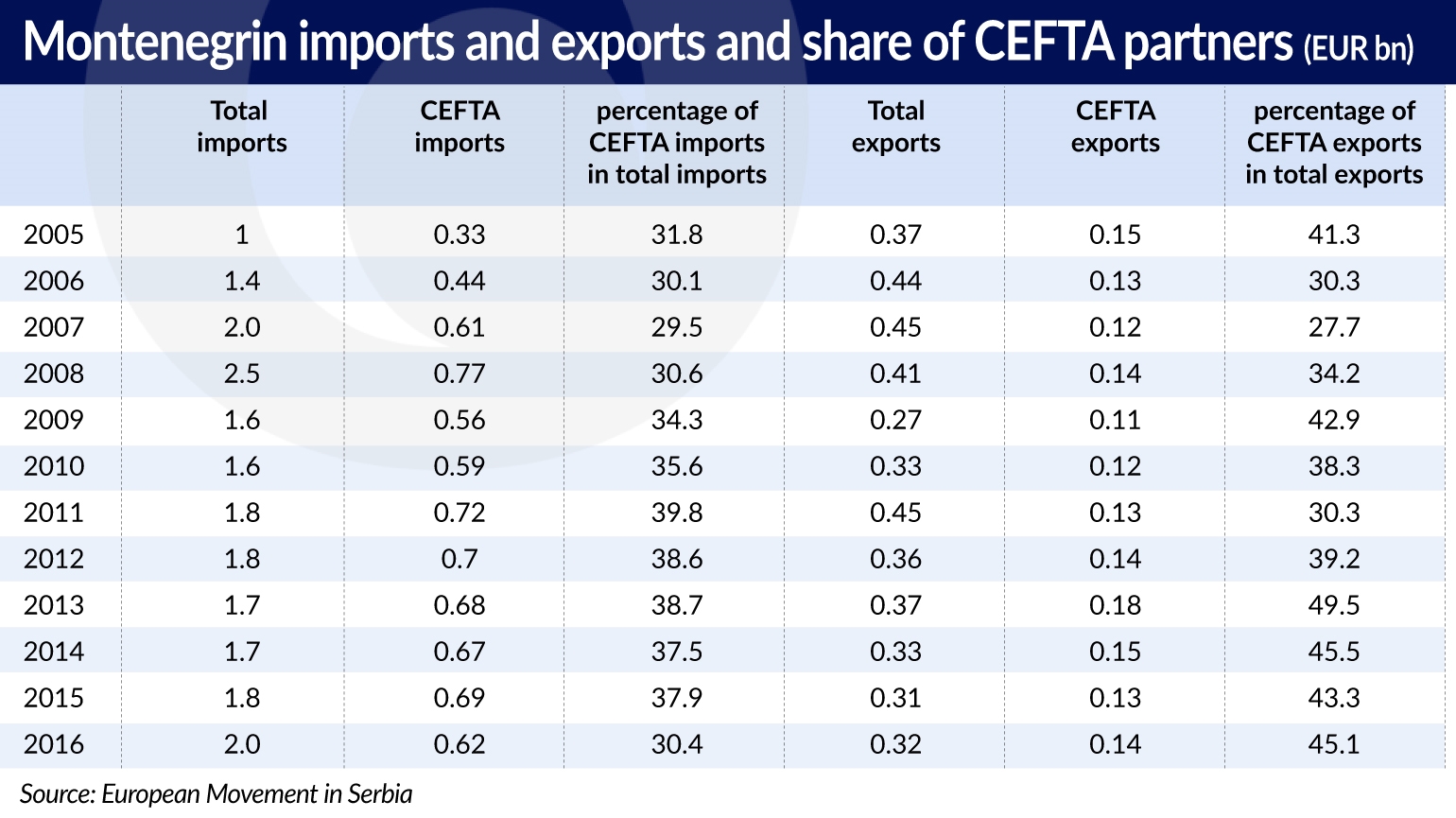

Two years ago, at the tenth anniversary of signing CEFTA, Ljiljana Filipović, the Vice-President of the Economic Chamber of Montenegro said, during the roundtable organised by the Chamber, prised CEFTA, claiming that there was an evident growth in the exchange since the beginning of the application of the Agreement. In the ten-year period, the share of Montenegrin exchange with CEFTA countries in total ranged from 32.7 per cent (in 2007) to 44 per cent (in 2011). After Croatia joined the European Union in July 2013, this share was slightly lower and in the last two years (2014 and 2015) it was around 39 per cent.

12 years after signing the agreement, a closer look at the trade statistics shows that its positive effects remained surprisingly limited.

While imports, both total and CEFTA, doubled, the exports actually decreased. At the same time the share of CEFTA exports and imports remained on a comparable level. Even if signing CEFTA helped in increasing trade dynamics of Montenegro, it did not produce incentives strong enough to fully develop Montenegro exports capacities.

Major Partners

Serbia remains Montenegro’s main partner within CEFTA. The northern neighbour has the highest share in both imports and exports. In 2016, trade with Serbia constituted 72.7 per cent of total CEFTA imports and 64.2 per cent of total CEFTA exports. The significantly increasing trade deficit (EUR291m of imports and EUR132m of exports in 2005, and EUR456m of imports and EUR82m of exports in 2016) shows that the split of the State Union of Serbia and Montenegro, which took place in 2005, did not improved situation of a smaller of the two partner countries. Montenegro exported to Serbia mainly raw aluminium, electricity, chemical and animal products and imported food products, machines, chemical, animal and mineral products.

Next two CEFTA partners are Bosnia and Herzegovina (BiH) and Kosovo. The later overtakes some part of the Serbian goods that otherwise — for political reasons — cannot be send south to Serbian former autonomous province, which declared independence almost 10 years ago. Kosovar export to the Serbian market finds its way through different channels. The difference between exports and imports from Kosovo is significant — 13 per cent of total CEFTA exports as opposed to 0.5 per cent of total CEFTA imports of Montenegro. BiH is nominally poor but still relatively large market (the second largest after Serbia). In 2016, Montenegro imported from BiH 17.8 per cent of total CEFTA imports (metals, milk, chemical and mineral products and food products) and exported to BiH 18.1 per cent of total CEFTA exports (metal, food products and mineral products).

Macedonian share in imports and exports is relatively balanced. Montenegro imported from Macedonia (food and medical products) 4.3 per cent of total CEFTA imports and exported to Macedonia (mostly wood products, metals and food products) 3.1 per cent of total CEFTA exports. In 2016, Montenegro exported (wood products, metals and food products) to Albania double the imports share — 9.8 per cent of total CEFTA exports, as opposed to 4.5 per cent of total CEFTA imports (mineral and vegetable products, and metals). Trade with Moldova remains on an insignificant level.

Montenegro’s trade with other countries of the Western Balkans changed only in terms of imports, while exports decreased slightly. The commodity structure of intra-CEFTA trade is also dominated by non-demanding technologically products, such as: sawn and rough wood, raw aluminium, wine or wheat flours. That makes it not only vulnerable to a political situation in each of the countries but also limited in terms of benefits for domestic economy and social development. Producing wood and raw aluminium will not boost the IT sector or other technologically advanced sectors of economy.

Business and the government

Public authorities share relatively optimistic view of the Economic Chamber of Montenegro regarding CEFTA. “Montenegrin government remains optimistic, based on the structure of the economy between 2006 and 2014, as well as projections for 2015-2018. It can be concluded that it is being restructured into the economy based on services, which will — at the end of the period — account for almost 80 per cent of gross value added. The additional protocol to CEFTA on trade in services will improve the uniformity and quality of services, enable free movement of workers in the region, as well as improve trade statistics of services,” said Goran Šćepanović, a former Director General of the Ministry of Economy.

Montenegro remains the most integrated economically country of CEFTA. Around 40 per cent of its trade is linked to one of the CEFTA partners, while in other CEFTA countries the share is around 15 per cent.

Jan Muś is a lecturer at the Vistula University.