Russia has finished this year’s turbulent stage of discussions on the amendment of the budget for the year 2016 and the preparation of the new budget for 2017 and subsequent years. The budget in itself – with a growing deficit, falling revenues and the need to transition to the stage of necessary spending cuts – is not, however, the thing that worries the authorities the most. The concerns of the authorities stem from the fact that a falling budget means the loss of the primary, and according to analysts, the only effectively working tool for controlling the processes of social and economic development – with emphasis on the former.

Saving by increasing expenditure

The year 2016 was supposed to be a crucial year for the budget as the savings program was supposed to be implemented. Spending cuts at a rate of 6-10 per cent were supposed to apply to almost all spheres, including the military. Social expenditure was supposed to be the only exception. Expenditure was supposed to be reduced from the RUB16.09 (USD260bn) trillion adopted in the budget to RUB15.78 trillion (approx. USD245bn), creating a base for further savings in subsequent years. The amount of RUB15.78 trillion was supposed to be frozen as the upper limit of expenditure throughout the years 2017-2019.

In the amendment of the budget for the year 2016 made in October, not only the expenditure was not reduced, but it was further increased from almost RUB16.1 trillion (USD161bn) to more than RUB16.4 trillion (USD266bn). As a result, the deficit increased from the planned 3 per cent of GDP (RUB2.36 trillion, USD38.2bn) to 3.7 per cent of GDP (RUB3 trillion, USD48.7bn), and according to predictions at the end of the year it could even reach 3.9 per cent of GDP.

Interestingly enough, expenditure increased in spite of its reduction in 11 out of 14 sections of the budget. The principal “culprit” for this situation is the military sector, for which an additional amount of almost RUB700bn (USD11.4bn) was allocated. Contrary to what one might think, this does not represent a deepening of the militarization of the economy. The additional amount will be allocated for state-owned banks which have been involved in the implementation of the “Armaments Program until 2020”, providing loans in 2010 for the amount of over RUB1.2 trillion (USD19.5bn) for the enterprises of the military-industrial complex with government guarantees. The repayment of most of these loans falls on this year.

Despite the official declarations of the special treatment and protection of social spending in this difficult period, it is precisely the social spending that is feeling the effects of austerity the most. The Russian Supreme Chamber of Control (Schotnaya Palata) has noted, in its official reports, the degradation of this sector. Large savings in the budget are achieved through the decision to freeze wages in the budgetary sphere in 2016 and to maintain the freeze in subsequent years.

The greatest profits, however, were brought by the savings in retirement pension expenditure. In 2016, pensions were indexed only by 4 per cent instead of the full rate of inflation from the previous year, i.e. by 12.9 per cent (level of inflation in 2015). In January 2017, each retired person will be paid a lump sum of RUB5,000 (USD81,2) as compensation. This trick is seen as a pre-election bonus for the new year (the presidential elections are planned for 2018). According to various estimates, each of the pensioners has lost from RUB12,000 (USD194.7) to RUB16,000 (USD259.6) on the lack of a full indexation, so this one-time payment does not compensate for the loss, especially as it is not included in the base used for the calculation of the indexation in the following years.

The budget savings (and thus the losses of the retirees) from this change will amount to RUB150bn (USD2.4bn) in 2017 and RUB250b (USD4.06bn) in 2018. The budget received even more savings thanks to freezing the capital part of the pensions. Because of this, expenditure decreased by about RUB900bn (USD14.6bn) in the years 2014-2016, and after the extension of this decision for the years 2017-2019 by a further RUB1.3-1.4 trillion (USD21.09-22.7bn).

In the opinion of many analysts, the departure from the indexation of pensions prescribed by the law is a de facto admission of the State to a financial collapse and the inability to meet the assumed social obligations.

It won’t get any better

In the coming years the geopolitical and economic conditions unfavorable for Russia will continue, both internally and externally. This will result in the consolidation of the economic collapse, which will lead to many years of stagnation, with a GDP growth rate of 1-2 per cent annually. In this scenario, the collapse of the Russian budget will intensify.

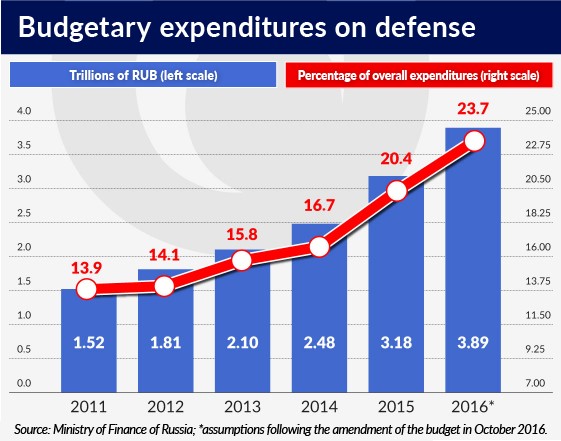

In the development of the budget for 2017 and the years 2018-2019 it was assumed that sanctions against Russia and the Russian counter-sanctions would be maintained, and that a weak economic climate on the oil market, with prices at the level of USD50 per barrel, would continue in the next three years. In the absence of prospects for increased budget revenue, which will fall in 2019 to 13.3 per cent of GDP, the lowest level in 20 years (it was lower only in the crisis year of 1999 – at 12.8 per cent), a decision was made to introduce significant cuts in expenditures. They will amount to 6, 9, and 11 per cent, respectively, in the next three years. This also applies to defense expenditure, which will be reduced by 6 per cent annually from RUB3.9 trillion (USD63.3bn) in 2016 to RUB2.8 trillion (USD45.4bn) in 2019, and its share in the total expenditure will decrease from 23.7 per cent in 2016 to 17.9 per cent in 2019.

This will not eliminate the budget deficit; however, it allows the progressive reduction of its size from 3.2 per cent of GDP in 2017, to 2.2 per cent in 2018 and 1.2 per cent in 2019.

The adopted structure of the budget for the years 2017-2019 means further belt tightening and the lack of prospects for overcoming the economic crisis. The subsequent stages of the work on the budget showed that the authorities have focused primarily on controlling the budget deficit, the size of which has significantly exceeded the acceptable level. Because the authorities were unable to balance the budget on the basis of the previously adopted projected macroeconomic figures, they utilized certain accounting tricks – according to many analysts these practices are detached from economic reality – by changing the forecast of the basic budgetary figures – the level of inflation (affecting the level of expenditure) and the exchange rate (affecting the level of revenue).

Inflation, which determines, among others, the level of indexation of pensions and other budgetary expenditure, was reduced from the previously adopted level of 4.9 per cent in 2017 and the level of 4.4 per cent and 4.1 per cent in the following two years, to the level of 4 per cent for the whole period of 2017-2019. In the previous official analyses and programs (including those of the Central Bank of Russia) the achievement of the target inflation level of 4 per cent was only planned for 2020.

The trick in relation to the exchange rate, whose level determines the size of the budget revenue by up to 50 per cent, consisted in a revision of the forecast of the strengthening of the ruble (from RUB67.5 per USD in 2016, RUB65.5 in 2017 and, respectively, RUB65.0 and RUB64.4 in subsequent years) to its weakening (to RUB67.5 per USD in 2017, RUB68.7 in 2018 and RUB71.1 in 2019).

The weakening of the ruble should not come as a surprise if we consider the fact that according to the estimates of the Ministry of Finance of Russia, with the crude oil price at the level of USD40 per barrel, the weakening of the ruble to USD exchange rate by RUB1 results in additional budget revenue of RUB60bn (USD973.5m). This procedure also significantly increases the budget revenue in the event of an increase in oil prices. Its increase by USD1 above USD40 per barrel means additional revenue of RUB144bn (USD2.3bn) in the absence of changes in the exchange rate, and of only RUB87bn (USD1.4bn) in the case of an appreciation of the ruble.

According to the Ministry of Finance, if there were no changes in the forecast parameters in relation to the exchange rate and inflation, there would be a shortage of RUB200bn (USD3.2bn) in the budget in the year 2017, and additionally the budget expenditure would have to be reduced by RUB170bn (USD2.8bn) in 2018 and by about RUB180bn (USD2.9bn) in 2019.

With regard to the budget for the years 2017-2019 and the basic macroeconomic figures, on paper the authorities managed to balance what will be very difficult to achieve in reality.

What is the source of these problems?

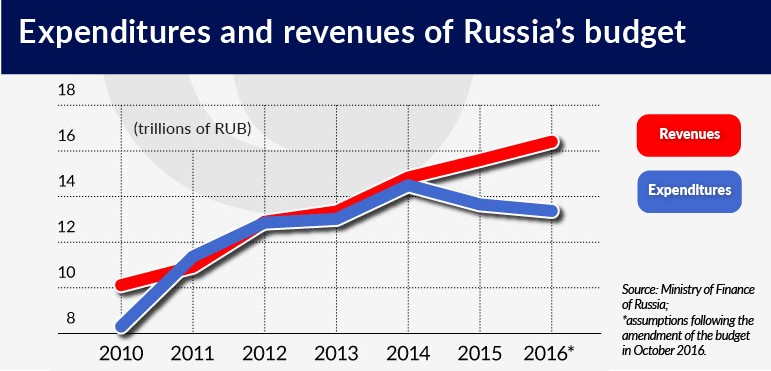

The deteriorating condition of the Russian budget is not a process associated exclusively with the decline in oil prices. The deficit in the Russian budget first appeared in the years 2012-2014, in spite of the highest prices of this commodity in history, which reached USD100-110 per barrel. This process was then aggravated along with the decline in oil prices in the years 2015 and 2016. The primary causative factor of the budgetary problems was first and foremost the unrestrained growth in expenditure. In the last five years (2011-2016) it has increased by 50.1 per cent. In the same period the revenue has only grown by 17.6 per cent.

The increased expenditure concerned the involvement of budgetary resources in the financing of investments in the framework of government programs and those resulting from political decisions, such as the Winter Olympics in Sochi, the FIFA World Cup, the Universiade in Kazan, the meeting of the Pacific Basin countries in Vladivostok, the bridge to Crimea, the military engagement in Syria and Donbass.

A broad stream of budgetary funds was also used for the financing of social expenditure, such as increases in retirement and disability pensions and wages in the budgetary sphere.

The defense sphere has become the biggest beneficiary of the rapid growth in budgetary expenditure. The funds allocated for this purpose doubled in the years 2011-2015, recording an increase of almost 110 per cent (from RUB1.52 trillion, USD24.7bn, in 2011 to RUB3.18 trillion, USD51.6bn, in 2015). In the same period, the GDP of Russia increased by only 1.7 per cent, which in turn led to an increase in the share of defense spending from 2.55 per cent of GDP in 2011 to 3.84 per cent in 2015. Its share in the total budget expenditure has also increased (from 13.9 per cent to 20.4 per cent). In 2016 this expenditure will increase by more than 22 per cent, its share in the total budget expenditure will reach 23.7 per cent, and its share in GDP will amount to 4.7 per cent.

Forced changes or a repeat of history

Russia is weak like has never been before. It is weak through its helplessness and lack of ideas for functioning in the conditions of an unbalanced budget and the resulting need to reduce expenditure. The authorities, which had become used over the years to functioning in the conditions of a large budget, treated the budgetary resources as a tool for controlling the economic processes and an effective instrument to curb social unrest.

It is therefore no wonder – as seems clear from the lively discussion on the budget for the current year, 2017 and subsequent years – that the authorities would like to have a balanced budget, would not like to raise taxes and cut spending, particularly in the sphere of defense. However, it has not developed any scenario or idea for leading the country out of the crisis (apart from waiting for the improvement of the international situation), which is the primary reason for the deteriorating situation of the budget.

The biggest uncertainty regarding the development of the situation stems from the reaction of that part of the population which is most affected by the growing difficulties of the Russian budget. Pensioners and the broadly defined public sector, until this point the most faithful voters and the group having the most favorable opinion of the government’s activities, may feel frustrated by the rapid loss of what they have gained in recent years.

One symbolic illustration of the possible scale of discontent could be the confrontation of President Vladimir Putin’s promises included in the famous May 2012 Decrees with the reality of life. The President promised (and obliged the government to pursue appropriate actions in this area), among other things, that real wages increase by 1.5 times until 2018. Meanwhile, at the end of 2015 wages amounted to 96.5 per cent in relation to the 2012 level. According to expectations in 2016, they will reach 96.8 per cent, and if we were to accept the official parameters of the budgets for the year 2017 and the years 2018-2019, this ratio is supposed to reach 99.1 per cent in 2018. Instead of a 50 per cent increase there is a drop of almost one percentage point.

Russians are getting poorer for the third consecutive year. If we include the results from September 2016, the decrease in real incomes has been going on continuously for 24 months. Budgetary savings are achieved primarily at the expense of reduced social expenditure – the indexation of pensions, financing of education, health care and others. The authorities are constantly talking about the priority treatment of social obligations towards the population, but this does not stop them from implementing these obligations with amendments reflecting the current geopolitical and economic situation.

The dissatisfaction of those who will lose the most could be all the greater due to the fact that their forced contribution to the balancing of the budget will not lead to an increase in the effectiveness of budgetary expenditure. Significant financial resources are still directed to the defense sector and the financial sector, among others, for supporting state-owned banks. Only one of them, Vnesheconombank (WEB), requires urgent recapitalization in the amount of approx. RUB1.25 trillion (USD20bn).

The maintenance of sanctions against Russia and the lack of prospects for radical changes of the situation on the international oil market, with fluctuations of oil prices at the level of USD40-50 per barrel, forces Russia to take measures relating both to further cuts in budget expenditure, and increasing revenue, which means higher taxes, dividends from public companies, including in particular, from the oil and gas sector, and privatization.

Based on previous experience in this regard, we can expect that the presidential elections in 2018 will limit the willingness to cut expenditure, especially social spending, and to impose new taxes, or increase the existing taxes. An alternative solution is to increase the scale of public debt, both on the internal market and internationally, although due to the sanctions, the latter would cost Russia dearly. After all, Russia has already gone down this path once before, which ended in the 1998/1999 crash. Will we see history repeat itself?

Jerzy Rutkowski is a former advisor to the Poland’s Minister of Economy and Minister of Development.