The possible reasons include the struggle for land and for the state-owned companies intended for privatization.

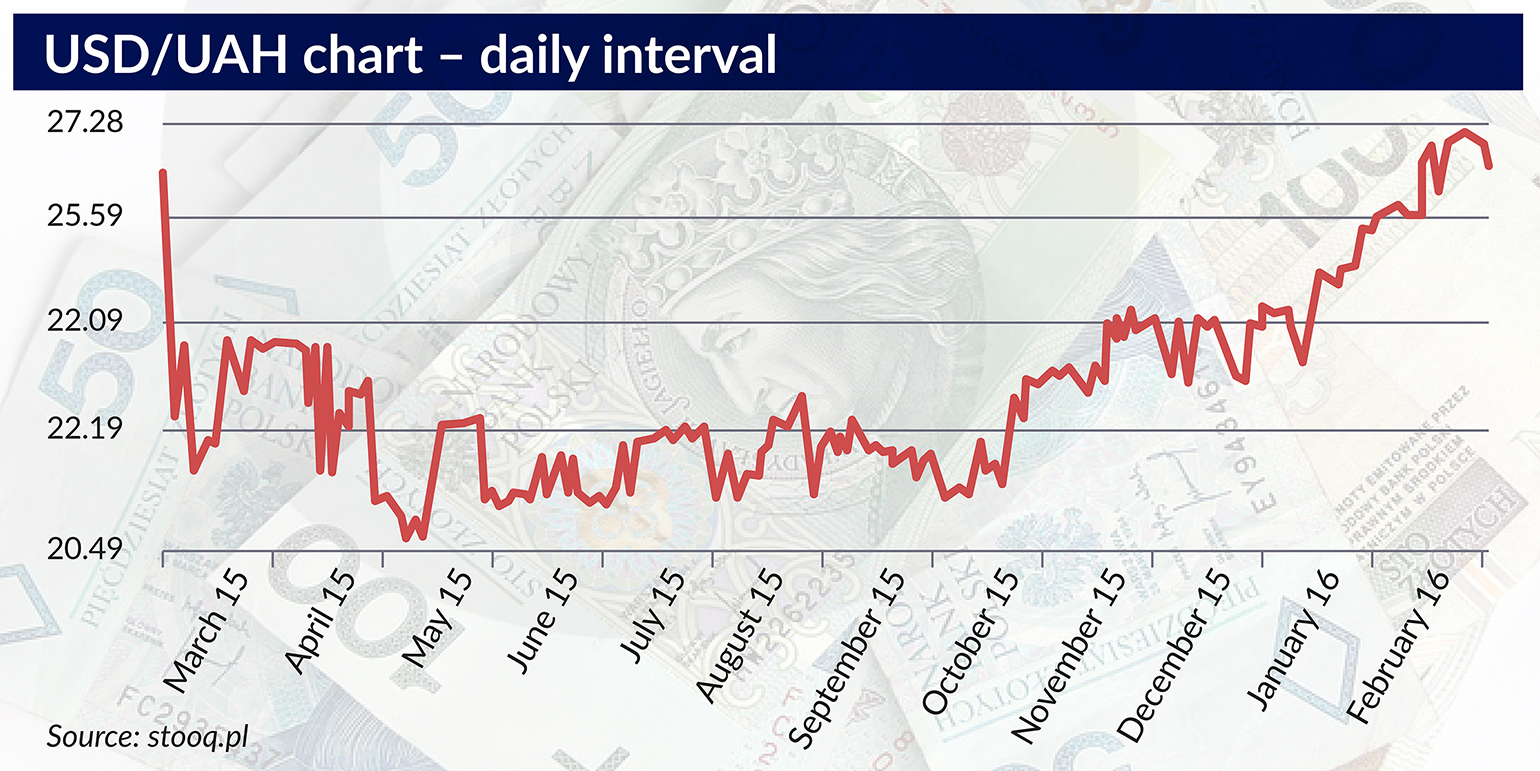

After a spell of relative stability in the foreign exchange market, lasting from April 2015, in mid-October the hryvnia once again began to plummet, and at the end of February 2016 the official exchange rate of the Ukrainian currency fell by nearly 30 per cent, from 21.2 hryvnia per dollar to 27 hryvnia per dollar. The total amount of the currency interventions on the interbank market from the beginning of the year to the end of February reached USD240m, with Ukraine’s foreign exchange reserves of USD13.4bn.

Strong dollar hurts farmers

The depreciation of the hryvnia has already harmed farmers and the agricultural business – by raising the costs of the sowing campaign – as Ukraine largely imports the fuels, fertilizers and pesticides, as well as the certified seeds. The Ukrainian Ministry of Agriculture has estimated that due to the depreciation of the hryvnia farmers will face a shortage of UAH12.6bn (USD488m) in funds needed to cover the expenses associated with the preparation of the sowing campaign, which have been estimated at UAH79.2bn (USD3bn). The shortfall will be as much as 22 per cent higher than in the previous year.

“In this situation the stability of the hryvnia is one of the main prerequisites for the development of the agricultural sector and the food security of the country,” admitted the Minister of Agriculture Oleksiy Pavlenko in February.

The drop in the value of the currency will have the most acute effect on medium-sized farmers – the main rivals of the oligarchs. These farmers produce for the domestic market and, unlike the big agro-holdings, do not have foreign currency inflows from exports. Weakened by the depreciation, the farm-ers will have limited ability to compete with the oligarchs for the one million hectares of land that the Ukrainian government wants to put up for sale.

Central bank explains and accuses

“The situation on the Ukrainian currency market is generally stable and the market should find a balance on its own,” Natalia Gontareva, the head of National Bank of Ukraine (NBU), argued in late January while accusing Ukrainians of boosting the dollar exchange rate with their panic.

Gontareva identified the factors which, in her opinion, caused the currency to slump: the casual factor – the Orthodox Christmas break lasting from 1 to 11 January, which supposedly had an effect of reducing the supply foreign currency, and fundamental factors – the deterioration in external economic conditions and the declines in prices on the global commodity markets, the cycle of interest rate hikes in the US, the depreciation of the currencies of Ukraine’s foreign trading partners, and the closing of the Russian market to Ukrainian exporters.

By late February, the deputy head of the central bank Oleg Chupriy had discovered a different reason for the weakening of the hryvnia: „The seasonal decline in business activity in January caused weaker inflow of foreign currency in February, while the political instability and delays in the resumption of cooperation with the IMF have an adverse impact on the expectations of the business community,” he stated in an official communique published by the central bank on February 23rd.

On the other hand, the former Minister of Economy Viktor Suslov blames the recent wave of hryvnia depreciation on the external debt of Ukrainian business. Companies are forced to buy the currency on the internal market in order to repay their obligations, which in turn leads to a shortage of dollars in the market, boosting its price.

De facto devaluation

Most experts, however, have different ideas about the causes of the sudden depreciation of the Ukrainian currency.

„The central bank has set the printing presses in motion. There are fewer and fewer dollars available in Ukraine and more and more hryvnia. That’s why our currency is tumbling,” observes the economist Olexiy Luponosov.

„Do not believe the central bank governors when they say that the hryvnia is falling because of the collapsing ruble. I will not be surprised if I hear the head of the NBU explaining that our currency is falling because the country is experiencing a flu epidemic. And, indeed, the hryvnia has fallen ill, it’s coughing,” observed Andriy Novak, chairman of the Committee of Economists of Ukraine, ironically in an interview with the news portal Akcent.

He emphasizes, for almost a year now there have been no economic reasons why the hryvnia should depreciate. All the key factors affecting the exchange rate of the currency are favorable and Ukraine should be seeing the hryvnia appreciate, not weaken.

Ukraine enjoys a positive balance of trade. According to initial estimates, the balance has improved by USD615m, mainly due to a sharp decrease in the purchase of Russian energy carriers. The balance of payments, which accounts for direct financial flows in addition to imports and exports is also positive – posting a surplus of USD900m compared to a deficit of USD13bn in 2014. There is also no direct pressure on the hryvnia resulting from the public debt. Ukraine has restructured its debt by securing a 4-year deferment of payments on its debts and its partial redemption.

„There are no grounds for depreciation. On the contrary – there is every reason for the currency to strengthen. Still, a gradual depreciation is taking place. And both the government and the National Bank of Ukraine are sitting back, posing as observers. That is because they, too, are evidently benefiting from these speculative activities. There is no other way I can explain it. Another popular explanation that we often hear from the head of the central bank is the withholding of the IMF loan tranche. However, each month the NBU reports an increase in its foreign exchange reserves, which have now reached USD13.5bn. I have only one explanation for this – a de facto devaluation through speculation on the financial market,” commented the chairman of the Committee of Economists of Ukraine.

According to Novak, one party interested in the speculative “devaluation” of the is also the Ukrainian government, which can boast that it has exceeded the revenue targets planned in the budget. „Depreciation helps the government to seemingly meet, or even exceed, its revenue targets. As we have repeatedly heard, the State budget has surpassed its revenue plans by 30 and more per cent. The same goes for local governments’ budgets. Although in reality we are dealing with an elementary inflationary effect. But nominally the figures expressed in the hryvnia are higher,” explains Novak.

This Novak’s opinion it’s confirmed by the latest official government data. According to these figures, in January budget revenues reached UAH34.7bn (USD1.3bn) – 33.6 per cent more than in January 2015 and 17.8 per cent more than planned in this year’s budget.

What’s in store for the hryvnia?

Meanwhile Ukraine is facing a further weakening of the hryvnia. This is due to the slump in the confidence in the ruling party and, consequently, the expected outflow of capital – assessed the analysts of Goldman Sachs in the latest report on the situation of our Eastern neighbor, published at the end of February. The situation was somewhat mitigated by the fact that Arseniy Yatsenyuk’s government has – for the time being – survived the motion of no confidence submitted in February.

„Ukraine’s direct economic gain consists in prolonging the work, so that it will be possible to complete the second review of the IMF cooperation program, which is necessary to obtain USD1.8bn in support. Judging from the statements of Ukraine’s authorities, the country has met most of the conditions necessary to complete the review, including those related to ensuring political stability,” the Goldman Sachs analysts wrote in their report.

At the same time, they are pointing to the political uncertainty which may result from the continued outflow of capital from the country and deposits from Ukrainian banks. In their assessment, this will increase the pressure on Ukraine’s foreign exchange reserves and could consequently lead to a de-crease in the value of the Ukrainian currency to the level of 30 hryvnia per dollar in the middle of this year.

According to Andriy Novak, any attempt to estimate the future exchange rate of the hryvna is as reliable as reading tea leaves – we do not know what the exchange rate policy of the government and the central bank is, whether they will respond to a decline in the exchange rate, and if so, at what level of depreciation. „The only thing that could be used as reference level is the exchange rate assumed in this year’s budget. The range of 24.1 – 24.4 hryvnia to the dollar was stated there. But the exchange rate has exceeded that already . Although I do not rule out that by the end of the year the hryvnia might rebound to somewhere near that level,” says Andriy Novak.

In his opinion, the Ukrainian central bank could realistically strengthen the exchange rate of the nation-al currency to hryvnia per dollar. „But with our leadership, I don’t believe it will happen. Simply due to the fact that a stronger exchange rate does not agree with their business interests. We can forget about ever reaching the level of 8, 10, 15 or even 20 hryvnia per dollar,” says Novak.

Vladimir Lartsev, former adviser to the head of the State Property Fund of Ukraine, points to another aspect of the depreciation of the Ukrainian currency. In his opinion, it is associated with the privatization of strategic state-owned companies announced for this year.

„It is no secret that our oligarchs keep their funds in foreign currencies in tax havens and Western banks, but the payment for the state-owned enterprises acquired in privatization tenders will be made in the hryvnia. It’s one of the reasons why the exchange rate of our national currency to the dollar is no longer 24.4, as assumed in the budget for 2016, but has exceeded 27 hryvnia. By the end of the summer (the payment deadline for the winners of privatization tenders), the dollar exchange rate will reach 29 or maybe even 30 hryvnia. In other words, the National Bank of Ukraine is gradually but deliberately allowing the hryvnia to depreciate in the interest of the oligarchs and the high-ranking government officials,” assesses Vladimir Lartsev.