(Pixabay, StockSnap, Public domain)

People aged 55 to 74, who are classified as the Baby Boomer generation are the largest age group living in the European Union — at the end of 2018, Baby Boomers accounted for almost one quarter of the EU’s 512.4 million inhabitants. Meanwhile, according to Eurostat data, on average only 38 per cent of them use online banking services.

Denmark in the lead

By far the largest percentage of people aged 55 and above using online banking services are in Denmark (86 per cent). Other countries with the highest shares of online banking users among Baby Boomers include two Nordic member states of the EU — Finland and Sweden, as well as the Netherlands. In Estonia, which ranks 5th in terms of internet banking use among Baby Boomers, this share is significantly lower and reaches 59 per cent.

Meanwhile, in the countries of Central and Southeast Europe the share of Baby Boomers using internet banking is lower than the average in the EU. In Poland, like in Slovenia, online banking services are used by 21 per cent of Baby Boomers, which is still more than in countries such as Portugal and Greece.

Age makes a difference

When analysing the data concerning the use of internet banking among Baby Boomers, it is worth paying attention to the heterogeneity of this age group. The Baby Boomer generation consists of people who are still professionally active, as well as those who are already retired. This, in turn, translates into different income levels, different size and structure of expenditure, and, consequently, also varying demand for banking services.

The internet and personal computer technologies emerged when people from the Baby Boomer generation were already middle-aged. The younger generations, and especially the Millennials and Generation Z, were raised on the internet and are described as “digital natives”. As a result, they are able to intuitively and seamlessly absorb the new solutions available online.

Meanwhile, the Baby Boomer generation had to break the psychological barrier associated with the new and unfamiliar technology and “learn” how to use it. Unfortunately, people’s cognitive abilities decline with age, which is also a factor inhibiting the exploration and acceptance of novelties.

For this reason, with respect to the Baby Boomer generation it is essential for banks to follow the good practices in the design of websites as set out in the Web Content Accessibility Guidelines 2.0. The Baby Boomer generation can be further divided into two subgroups: the “Younger Boomers” (55-64 years old) and the “Older Boomers” (65-74 years old), which exhibit significant differences when it comes to the use of internet banking. In these two age cohorts the average share of people using online banking in the 28 countries of the EU is 44 per cent and 30 per cent, respectively.

The greatest differences between the two cohorts are recorded in the Czech Republic, Slovakia, and in the Baltic states: Lithuania, Latvia and Estonia. In these countries the percentage of people aged 55-64 who use internet banking is more than 20 percentage points higher than in the “older” Baby Boomer group.

Significant differences between the two cohorts, reaching over a dozen percentage points, are also recorded in the European Union’s most populous member states: Spain (a difference of 17 percentage points), Germany (15 percentage points) and France (13 percentage points). Poland also belongs to this group, with a difference of 14 percentage points in the share of online banking users between the two cohorts. The smallest differences are found in Denmark (6 percentage points), Luxembourg (4 percentage points), Bulgaria (4 percentage points) and Romania (2 percentage points).

Baby Boomers in Greece are disconnected

However, we should also pay attention to the values that provide the basis for comparisons between the two subgroups of the Baby Boomer generation. For example, in Greece online banking is used by only 12 per cent of Baby Boomers in total, wherein the share of users is 18 per cent among people aged 55-64, and only 5 per cent among people aged 65 and over.

This means that the share of people using online banking services in the “older” Baby Boomer cohort is approximately 72 per cent lower than in the group of “younger” Baby Boomers (even though the difference is only 13 percentage points).

On the other hand, in the United Kingdom — which is on its way out of the European Union — online banking services are used by 53 per cent of people from the Baby Boomer generation, with the share of users reaching 58 per cent among people aged 55-64 and 47 per cent among those aged 65 and over.

This means that with a difference of 11 percentage points, which is comparable to that recorded in Greece, the share of online banking users among the “older” Baby Boomers is only about 19 per cent lower than among the “younger” Baby Boomers. In Poland, the percentage of people aged 65-74 who use internet banking is 13 per cent and is more than two times lower than among those aged 55-64 (27 per cent).

Based on analyses of the situation in individual countries, it is generally the case that the lower the share of online banking users among the Baby Boomer generation as a whole, the greater the differences between the younger and older age cohorts (of course, with a higher share of online banking use recorded in the group aged 55-64).

Women are less tech-savvy than men

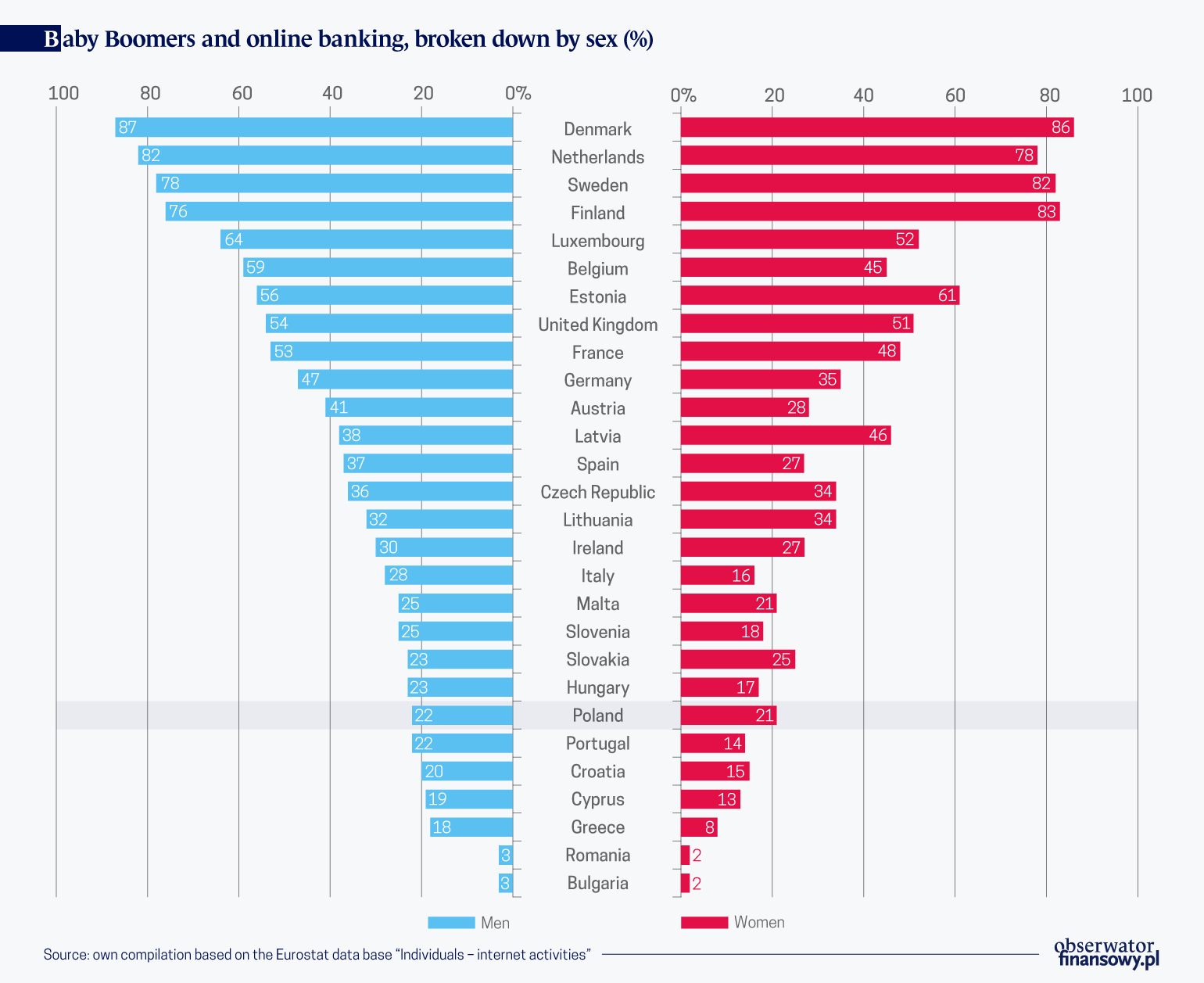

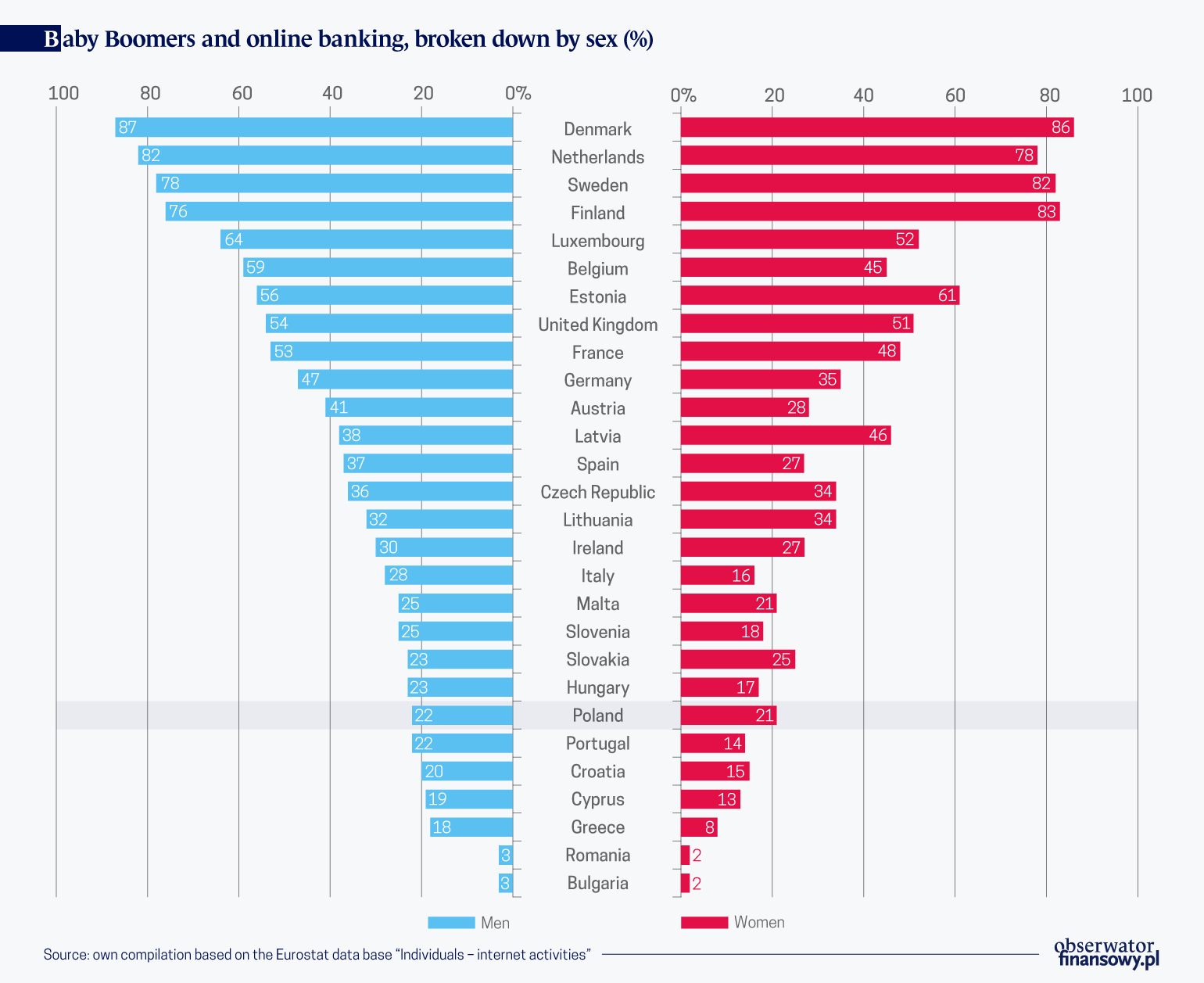

An analysis of the data provided by the Eurostat shows that even though the category of sex differentiates the shares of online banking users among Baby Boomers to a slightly lesser extent than age, in the vast majority of EU countries men use online banking more frequently than women.

The average share of people using online banking in the EU is 41 per cent for men and 34 per cent for women. The difference between the share of men and women using online banking services is the largest in Belgium (14 percentage points) and Austria (13 percentage points), and among the most populous countries — in Germany and Italy (12 percentage points). In Poland this disparity only amounts to 1 percentage point — internet banking services are used by 22 per cent of men and 21 per cent of women.

Data on the use of internet banking broken down by sex reflect the cultural differences between the individual EU member states from different geographical locations. In terms of the use of online banking services, the data show the emancipation of women in the Nordic countries and the neighboring Baltic countries, as well as the dominant role of men in the countries of Southern Europe, which translates into lower economic activity, and, consequently, lower levels of women’s financial independence.

Education matters

The factor that determines the use of online banking services among the Baby Boomers to a much greater extent than sex and age is education. The lowest share of internet banking users is recorded among people with low levels of education.

In the EU the average share of internet banking users among people with low levels of education amounts to 19 per cent, but the differences between individual countries are significant. There are only 5 countries where the share of online banking users among people with low levels of education exceeds 40 per cent.

This group is dominated by Scandinavian countries. The highest share of online banking users among people with low levels of education is recorded in Denmark (78 per cent). Other countries with similarly high shares include the Netherlands (66 per cent), Sweden (63 per cent) and Finland (58 per cent), as well as Belgium, where 41 per cent of individuals with low levels of education use internet banking services.

Unfortunately, in Poland, just like in Hungary and Greece, this share is only 3 per cent, which is among the worst results in the EU.

The use of internet banking services is significantly greater among people with secondary education. On average across the EU 39 per cent of people with secondary education use online banking services. The highest percentage of internet banking users is found, unsurprisingly, among people with higher education. Within the EU, the average share of users of online banking among people with tertiary education is 63 per cent, and differences between the individual member states are much smaller than in the case of other education levels.

A comparison of the share of online banking users among people with secondary and tertiary education shows that Poland is among the three countries with the greatest difference between the two groups. This difference reaches 40 percentage points in Poland, 41 percentage points in Slovakia, and 45 percentage points in Lithuania. For comparison, the disparity between these two groups is only 5 percentage points in Denmark and Sweden, and 6 percentage points in the Netherlands.

One of the countries with the smallest difference is also Bulgaria (a difference of 8 percentage points), but these data paint a different picture when relative differences are analyzed. In Bulgaria online banking services are only used by 1 per cent of people with secondary education and by 9 per cent of people with higher education, therefore the value of this indicator for those with secondary education is 89 per cent lower than for people with tertiary education.

In the Baby Boomer generation people with higher education and in the age group of 55-64 years old clearly dominate among the users of online banking. Poland is among the countries where the share of online banking users with such a profile is rather low. One administrative measure which could help to improve this situation are the changes in the Labor Code. In accordance with the new legislation, salaries are now paid to the employee’s bank account, unless the worker specifically requests payment in cash.

The possibility for individuals to open free bank accounts could be another incentive for the use of internet banking among people from the Baby Boomer generation, and especially the younger, economically active age cohort within that generation. The requirement to offer such accounts is imposed on Polish banks. However, banks should primarily focus on carefully diagnosing the needs of this group of clients in relation to the electronic channels of distribution of their services.

Because it is more difficult for older people to navigate the virtual environment, it is very important for banks to limit the scope of changes introduced in the user interfaces and to ensure – in accordance with the concept of age-friendly banking — that they are adapted to the psycho-physical limitations typical for older age.