Still in the middle of last year, when the Basel Committee on Banking Supervision (BCBS) gathered opinions on the shape of proposals for the next package of prudential reforms for banks, it seemed that they would be implemented quickly enough, so the reform of the sector will be completed by 2020. The BCBS package was even called Basel IV. It heralded a revolution that was supposed to completely change the banks’ risk assessment, the principles of their operation and also transform their business models.

In October 2016, Secretary General of the BCBS William Coen announced, during a meeting at the Institute of International Finance in Washington, that the work would be concluded before the end of last year. The BCBS met in late November in Santiago in Chile to finally approve its position. But was unable to do that.

By the end of 2016 bank supervisors and central bankers were not able to agree on a fundamental issue ‒ whether the introduction of new reforms, aimed at reducing the risk still taken on by the banking sector, would fulfil this goal, or whether it would harm lending to the economy. Or simply speaking: whether the BCBS had gone too far. Besides, there were opinions that European banks would be affected by the new reforms much more strongly than, for example, American banks, which would endanger their competitiveness.

At the beginning of January 2017, during a meeting of the Group of Governors and Heads of Supervision (GHOS), which is a body overseeing the BCBS, it was decided that more time was needed to complete the work. But the amount of time needed is not known thus far. The official statement referred to the “nearest future”.

It is not the case that the final and very important stage of the reform of the banking sector and the prudential rules was entirely scrapped. “Completing Basel III is an important step towards restoring confidence in banks’ risk-weighted capital ratios, and we remain committed to that goal,” Mario Draghi, the President of the GHOS and the President of the European Central Bank, said in a statement.

The problem is in calibrating the rules in such a way that they achieve the intended purpose and at the same time are universally accepted and applied worldwide. The EU seems to be saying: our economy is a bit different, it has different needs, and consequently we need slightly different rules for banks.

Everything in the story is true, except for the fact that banks are truly global. If they are treated differently in different regions, it is certain that they will accumulate their risk there. And that risk could explode under certain adverse circumstances, just like it did in the 1990s in Korea, Argentina, and then in the center of the developed world ‒ in 2008 in the United States, and in 2011 in Europe.

Program for the completion of the reforms

Why has the work on what is now called Basel IV taken so long and why haven’t the planned changes been introduced together with Basel III? The reason is that these are very complex issues which required many empirical studies. Basel III was an emergency measure undertaken when it turned out after the outbreak of the crisis that banks did not have enough capital and especially good-quality capital, and therefore it was necessary to force them to increase such capital as soon as possible. The introduction of further regulations required a very detailed analysis of the structure of assets and the banks’ methods of assessing their risk.

Basel III raised the minimum values and capital buffers and ordered banks to meet them. The minimum for the CET1 core tier capital increased to 4.5 per cent from the 2 per cent provided by Basel II. It was introduced to the European law in 2014 as the CRD IV/CRR package. Even before that the BCBS believed that raising the minimum values and adding buffers would not be enough to ensure that the banking sector is more secure and less risky.

The fact that the minimum values and the capital buffers were not sufficient was already recognized by some countries, such as Switzerland, where they were immediately raised. The TLAC and the MREL, i.e. the bank’s eligible liabilities, are being introduced to be converted into capital in the event of bankruptcy, and used to cover losses. They are introduced because there are serious concerns whether the required capital would be sufficient to cover losses if the bank collapsed.

The BCBS presented the program for the completion of the reforms in a report for the G20 at the end of 2015. It had previously analyzed the areas in which changes were necessary. The most important of these changes concern the assessment of the risk of the bank’s assets and linking them with the risk weights. After all, the answer to the question of whether a bank actually has sufficient capital to cover losses depends on the level of risk of its assets.

In theory, the risk of the bank’s assets should be measured very accurately, because the internal ratings-based approach (IRB), introduced in 2004 by Basel II, was supposed to link the bank’s capital needs to its risk profile. It turned out that this was only a theory.

The BCBS came to surprising conclusions. The first one is that on average banks globally “reserve” 75 per cent of the capital for credit risk. An additional 15 per cent is linked to operational risk, and 5 per cent to market risk. The Committee started wondering if operational risk, market risk and credit valuation adjustment (CVA ‒ only 2 per cent of the capital) are indeed appropriately “priced” by the banks.

And since credit risk determines the size of capital ‒ are the banks properly assessing it? It turned out that banks sometimes treat identical exposures in different ways, by assigning different risk weights to them, which results in smaller or larger consequences for capital. The risk of the same hypothetical portfolio would have a lower weight in one bank and a higher weight in another bank.

Underestimated capital requirements

What are the effects of such practices? In 10 out of 32 banks tested worldwide, the capital reserved for credit risk was lower than the median, and in one bank it was 2.2 percentage points lower. In 22 banks, the difference in relation to the median was at least 1 percentage point. This indicates that banks significantly differ in their assessment of risk, and that they sometimes happen to underestimate it. This is often accepted by the local supervisory authorities.

The BCBS found that this is happening due to the use of the IRB for the measurement of risk. The banks themselves determine the risk of credit exposure, using internal risk assessment models which take into account several parameters. This provides the basis for the risk weight assigned to the exposure, and consequently ‒ the capital requirement.

There were no major differences in the risk assessment of portfolios in the case of more risky borrowers or loans to households. However, there were quite significant differences in the parameters used in the models, and especially in relation to the Probability of Default (PD) and the Loss Given Default (LGD).

There was a big problem in the risk assessment of portfolios with a historically small default percentage, because in their case it is hard to adopt reasonable risk parameters due to the lack of data. This was especially true for the estimation of the LGD for exposures to government debt and to other banks.

It turned out therefore that Basel II, which allowed the banks to use advanced statistical and mathematical methods ‒ which should more accurately reflect the institution’s sensitivity to risk and its exposure ‒ in reality provided an incentive for the underestimation of many risks. “The capital requirements stemming from internal models were usually significantly lower than capital requirements under the Standardized Approach,” wrote the analysts from Capgemini in a study concerning BCBS’s proposal.

Meanwhile the BCBS concluded: “One of the lessons from the financial crisis is that not all credit risk exposures are capable of being modelled sufficiently reliably or consistently for use in determining regulatory capital requirements.”

Limitation of the IRB approach

The conclusion is that it is necessary to reduce the complexity of the regulations, to improve the comparability of banks in terms of risk, and to reduce the discrepancies in the amount of capital requirements due to credit risk. The capital requirement calculated using the Standardized Approach would be a reference point for the risk weights adopted in the IRB approach, and these could not be lower than 75 per cent of the risk weight for the Standardized Approach.

The BCBS proposed a return to the simple risk weights in the case of certain exposures, especially where the differences in risk assessment between banks are the greatest. If banks do not have sufficient data, they should adopt a certain minimal “conservative” level of parameters such as PD or LGD for certain exposures. Finally, the BCBS also wants banks to provide the specification of the estimation of parameters if they want to use the IRB approach. The use of internal models with unknown parameters does not allow the market to properly assess the risk profile of the bank.

The IRB approach would be replaced by the Standardized Approach in the case of exposures to banks, other financial institutions, large corporations with assets exceeding EUR50bn and exposures to equity instruments. The A-IRB approach (advanced internal ratings-based approach) could not be used in the case of exposure to corporations belonging to groups with consolidated revenues exceeding EUR200m, specialized financing (i.e. project finance) and to equity instruments.

This is not all, of course, as in late 2015 the BCBS proposed a review of the risk weights in the Standardized Approach in relation to those adopted in 1988, i.e. in Basel I. The BCBS indicated that its intention was not to increase the capital requirements in general, but to increase the sensitivity of the weights to risk. Of course this could mean that some banks will need more capital in order to cover the risk.

Simple risk weight approach

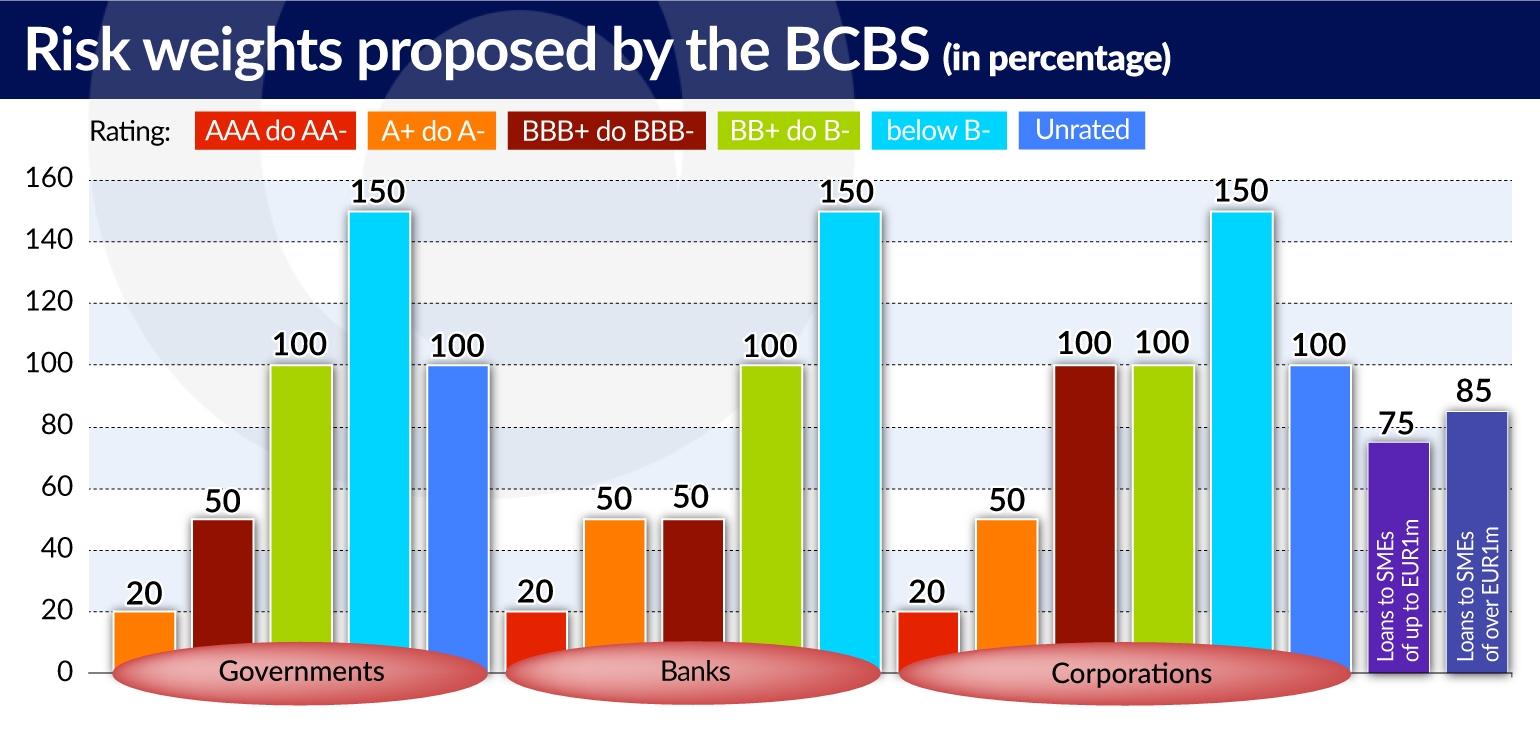

The Basel Committee proposes for external ratings to be used as the basis for determining the risk weights for exposures towards banks. And so, for the debt of banks with ratings from AAA to AA- the risk weight is supposed to be 20 per cent, and for banks with a rating below B- it is supposed to be 150 per cent. The preferential risk weight for exposures with maturity below three months in the interbank market towards banks with investment-grade ratings is 20 per cent, but the risk weight for exposures towards those with ratings from BB+ to BB- is already 50 per cent. The same risk weights are applied for exposures towards other financial institutions with the exception of insurance companies.

In the case of exposure to businesses, banks must first of all carry out due diligence. If it does not show risk higher than indicated by the rating, then the risk weights start at 20 per cent for companies with ratings from AAA to AA-, and end at 150 per cent for companies with a rating below BB-. The basic risk weight for unrated companies is 100 per cent.

And finally, the small and medium-sized enterprises (SMEs). The BCBS proposes for exposures to this sector to have a risk weight of 85 per cent, but if they can be treated as retail exposures (with a value lower than EUR1m), then the risk weight would be 75 per cent.

The risk weight for mortgages is currently 35 per cent, but according to the new proposals it would be dependent on the LTV, i.e. the ratio of the value of a loan and the value of property. With an LTV ratio below 40 per cent, the risk weight would be 25 per cent, and with an LTV ratio from 90 to 100 per cent the risk weight would be 55 per cent.

However, the rule is that this applies to already built and completed properties, rather than holes in the ground, and that the property is not for rent. Otherwise, the risk weights increase significantly, even up to 120 per cent. When it comes to foreign currency loans that are not collateralized by the borrower’s foreign currency flows or a contract hedging against foreign exchange risk, the bank will add 50 per cent to the underlying risk weight, which can reach a maximum of 150 per cent.

Government debt cannot have a „zero” risk weight

This is only a small part of the new proposals, which have already been softened under the influence of public discussion. One of its key elements is the reminder that banks should assign risk weights to the purchased debt of governments and public institutions. This is seemingly nothing new, since they were introduced much earlier, but in the case of European law these recommendations were ignored. Consequently, in the European Union the risk weight for the banks’ exposure towards EU governments is “zero”.

Another suggestion of the BCBS concerns the measurement of operational risk by banks. There will be no major changes here compared to the current approach, but in general the modifications involve improving and simplifying methodologies, as well as increasing banks’ sensitivity to risks associated with IT systems and cybercrime.

The BCBS also intends to clarify issues related to the Leverage Ratio, which shows the relation between the bank’s capital and its total assets, and not just risk-weighted assets. The reforms will clarify, among others, the measurement of the bank’s exposure to derivatives, the treatment of transactions of purchase and sale of financial assets, the method of calculating off-balance sheet items and additional requirements for global systemically important banks.

We should recall that in addition to this, from 2019 the banks will face the introduction of new capital requirements for market risk, revised in relation to Basel II, and that the BCBS intends to issue additional recommendations for the credit valuation adjustment (CVA), i.e. the method of calculating the difference between the value of the risk-free portfolio and the portfolio value that takes into account the possibility of default by a counterparty.

Why does the EU oppose to the reform

The EU financial institutions are afraid of the proposed changes and they are the main force blocking the reforms and the reason why the announcement of their final shape was postponed. The EU regulators are currently unable to accept increased risk weights for government debt.

If the BCBS proposals entered into force, European banks, and especially the largest ones, would have to significantly increase their capital. According to the sample calculations of the Bloomberg agency, in the case of Deutsche Bank the risk-weighted assets represent only 28 percent of its total balance sheet, while the average in the case of large American banks is 50 percent.

In addition, the EU sees the development of SMEs as one of the most important drivers of economic growth. The risk weights for loans to SMEs ‒ 85 or 75 percent ‒ seem to be too high in this context.

“A solution we could not support is one which would weigh unduly on the financing of the broader economy in Europe,” said the European Commissioner for financial services Valdis Dombrovskis during the last year’s conference of the European Banking Federation.

It is not certain, however, whether higher capital requirements would reduce the banks’ capacity to provide loans. Some studies indicate that only banks with strong capital are able to finance the economy. In reality, the European problem is the prevalence of weak banks with extensive and poor quality assets. And maintaining such a situation will certainly not help in financing the economy.