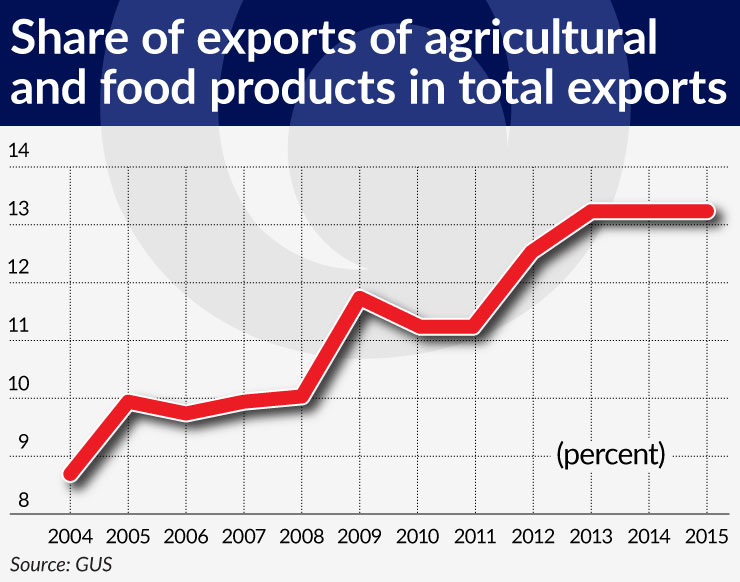

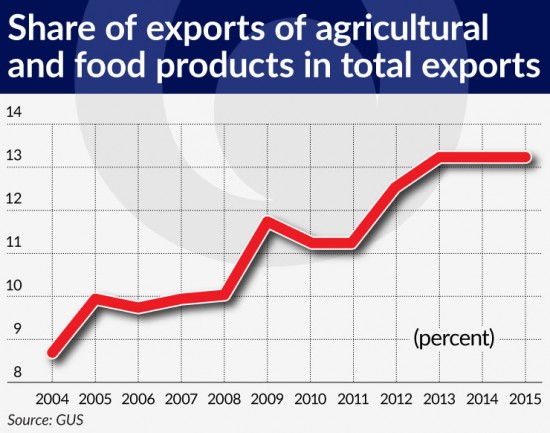

In 2015, the exports of agricultural and food products amounted to EUR23.6 billion, representing 13.2 per cent of the total Polish exports. At the same time, Poland has for years posted a positive balance of food trade, amounting to EUR7.7bn in 2015. Over 80 per cent of Polish exports of agricultural and food products are within the European Union.

(Infographics Łukasz Rosocha)

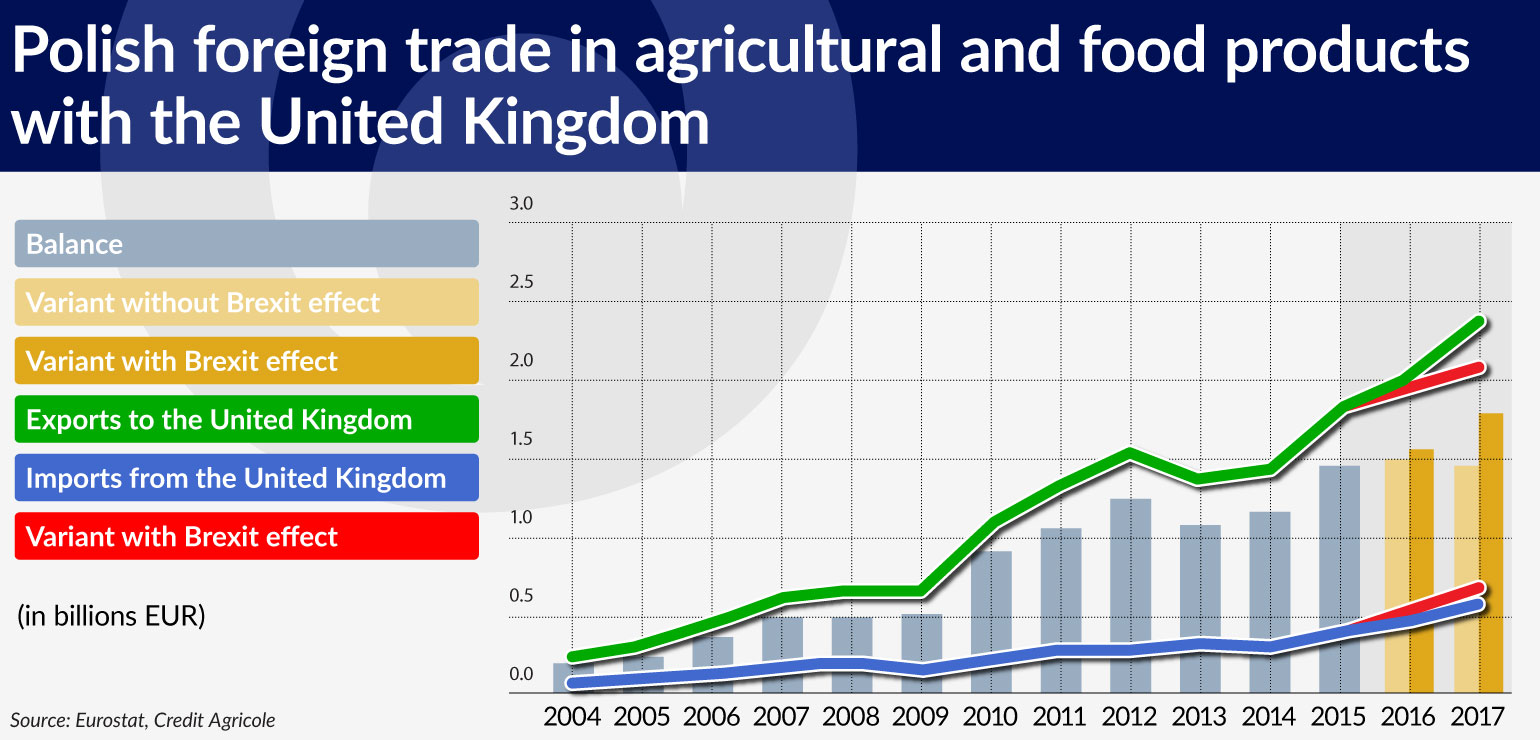

The United Kingdom accounted for 9 per cent of Polish exports of agricultural and food products, thus being the second biggest importer (Germany was the biggest one with a 22 per cent share). Due to the UK’s considerable share in the geographical structure of Polish food exports, the referendum result in favor of Britain’s exit from the EU gives cause for concern about the prospects of Polish agricultural and food exports.

Establishing the terms of the agreement defining the conditions of Brexit will be a complex process which is unlikely to be completed in two years’ time. This means that the EU Treaties, including the legal regulations permitting free movement of people, goods, services and capitals between the EU countries, will continue to apply to the United Kingdom for a few more years after the start of the negotiations. Hence the rules for conducting trade between the United Kingdom and the EU will in all likelihood remain unchanged in the coming years. Nevertheless, their shape after the United Kingdom leaves the EU are uncertain and will depend on the conditions negotiated by both parties.

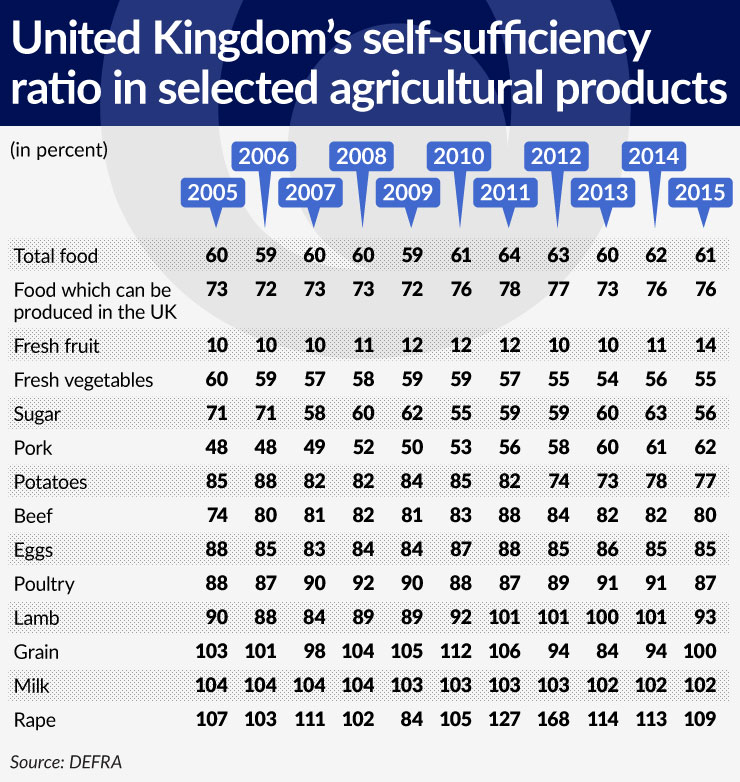

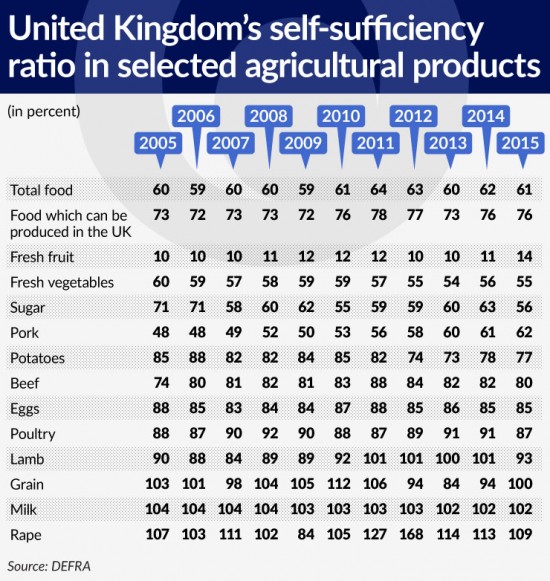

The United Kingdom is not self-sufficient in terms of food production which makes it dependent on imports of agricultural and food products. According to data from the British Ministry of Agriculture – the Department for Environment, Food and Rural Affairs (DEFRA) – the self-sufficiency ratio (production/consumption) of the United Kingdom in agricultural production in 2015 was 61 per cent. It should be noted that the ratio also takes into account foods which due to the climate zone cannot be produced in the United Kingdom.

Excluding this type of agricultural products, the self-sufficiency ratio in 2015 was in the order of 76 per cent. Domestic demand exceeding domestic production applies to the majority of basic types of food, has a permanent nature and is largely the result of low price competitiveness of British agricultural production vis-a-vis foreign food.

(Infographics Łukasz Rosocha)

As a consequence, the United Kingdom has for many years recorded a deficit in trade in agricultural and food products, which stood at approx. EUR25.3bn in 2015. The primary source of British food imports are EU countries (71 per cent). In 2015, the main exporters of food to the United Kingdom were the Netherlands (21.5 per cent of the total British food imports), Ireland (9.0 per cent) and France (6.5 per cent). Poland with its 2.5 per cent share was the 8th biggest exporter.

Considering the strong dependence of the United Kingdom on food imports from the EU, the introduction of tariff- or non-tariff barriers to mutual trade in agricultural and food products would cause food prices increase in the United Kingdom. Thus it can be expected that the United Kingdom, while negotiating the framework for future cooperation with the EU, will strive to keep the conditions of trade in agricultural and food products with the EU as similar to the current ones as possible.

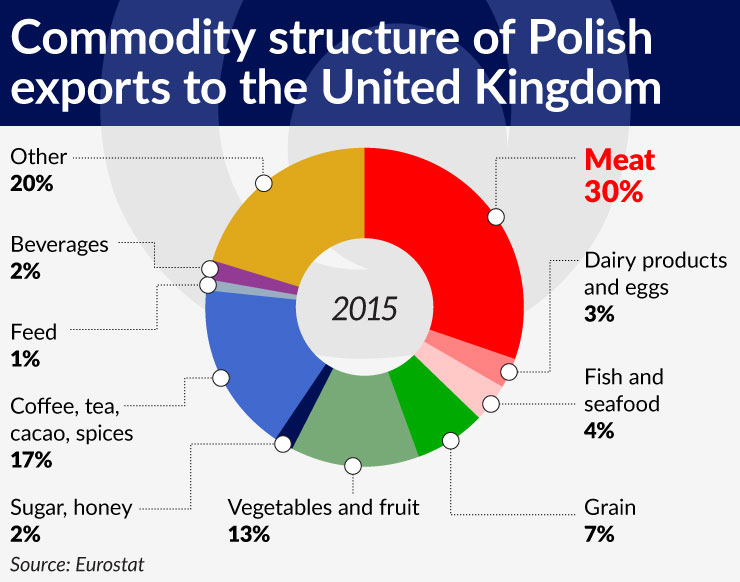

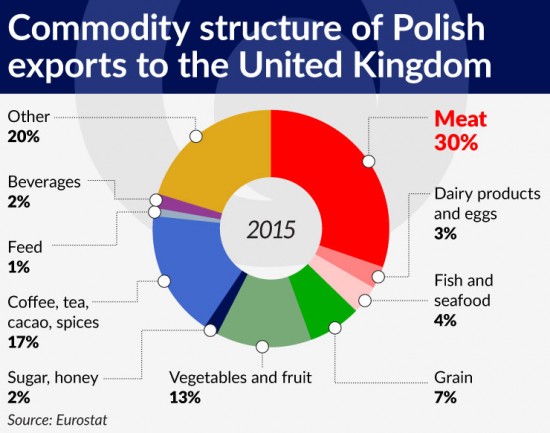

Poland’s balance of trade in food with the United Kingdom has been positive for many years at a level of EUR1.45bn which accounted for 18.8 per cent of the total surplus in Polish foreign trade in food. In terms of the commodity structure, meat accounts for the largest part of Polish food exports to the United Kingdom (30 per cent of the value of those exports), followed by coffee, tea, cacao, spices and related products (17 per cent), as well as fruit and vegetables (13 per cent).

(Infographics Łukasz Rosocha)

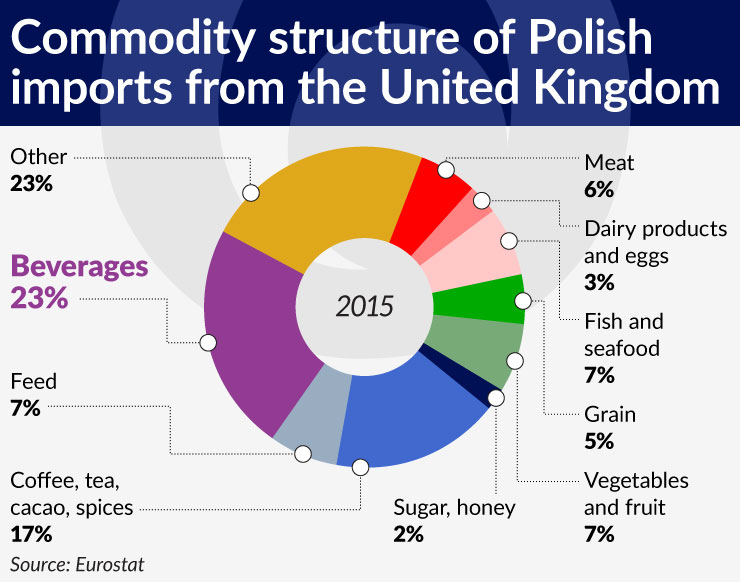

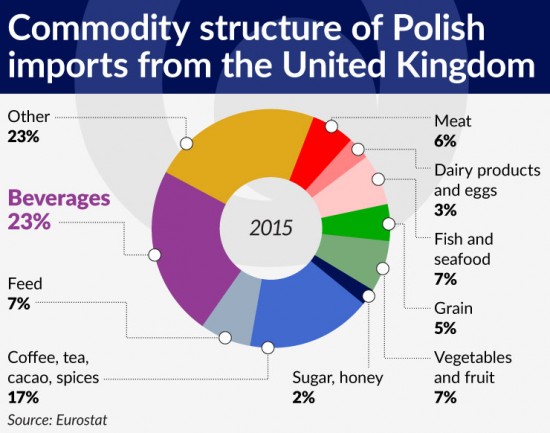

The source of success of Polish food in the United Kingdom in recent years has been its very strong price competitiveness and the demand for Polish products from Poles living in the UK (according to the Statistical Office of Poland (GUS) data, in 2014 there was a population of 685,000 Polish emigrants in the United Kingdom). In the imports of British food, the most important groups of products are beverages (23 per cent) and coffee, tea, cacao and spices (17 per cent).

(Infographics Łukasz Rosocha)

Foreign exchange rates

In order to assess the short-term effect of Brexit on food trade between the United Kingdom and Poland, econometric models have been developed, describing the dynamics of Polish exports and imports to/from the United Kingdom. The basic explanatory variables in both equations were the GBP/PLN exchange rates. Additionally, wage levels in both countries were included in the imports and exports equations, in order to reflect both the purchasing power and manufacturing costs in Poland and the United Kingdom.

According to the Crédit Agricole forecasts of the EUR/GBP and EUR/PLN rates, the GBP/PLN rate will reach its local minimum of 5.06 at the end of Q4’16, while the following quarters will see it climb mildly to 5.12 by the end of 2017. If the above forecast is fulfilled, the rate will not recuperate to the pre-referendum levels at least for the next two years. The permanent weakening of the pound, by changing price relationships, changes the price competitiveness of British food production, which may lead to a reduced demand for Polish agricultural and food products and an increased demand for British products in Poland.

As a result, the Polish exports of agricultural and food products to the United Kingdom can be expected to increase by 7 per cent in 2016 and by 6 per cent in 2017, as compared with the 26 per cent increase in 2015. On the other hand, imports of agricultural and food products from the United Kingdom will grow by 29 per cent in 2016 and by 32 per cent in 2017, as compared with the 27 per cent increase in 2015.

The main reason for the slower export growth amid steeper import growth will be the lasting strengthening of the PLN against GBP in the period covered by the forecast. The growth of Polish exports to the United Kingdom will be further reduced by the falling price competitiveness of production due to the rising labour costs in Poland.

In 2016, the surplus in the balance of food trade will rise to EUR1.48bn, and in 2017 it will drop to EUR1.44bn as compared to EUR1.45bn in 2015.

Considering the results of models, assuming no Brexit and based on a different path of the GBP/PLN rate, in the horizon of 2 years the Polish exports of food to the United Kingdom will stand at approx. EUR300m (1.3 per cent of the total Polish food exports in 2015) less than if the United Kingdom remained in the EU. Imports will increase by approx. EUR100m (0.6 per cent of the total Polish food imports in 2015).

The surplus in the Polish food trade in the forecast horizon will be approx. EUR400m lower (4.8 per cent of the surplus in the Polish food trade in 2015) than in the event of a “remain” referendum result. Despite the predicted lower export growth as compared to the “remain” scenario, the likelihood that it turns negative is low. The expansion of Polish exporters to the United Kingdom will most probably be continued in the coming years, although its pace will not be as fast as in the past years.

On the assumption that after the United Kingdom leaves the EU, the conditions of trade between them will not deteriorate significantly, the Polish exports to the United Kingdom can be expected to increase. The primary risk factors are the developments of the pound to the zloty exchange rate and the future shape of the UK-EU agreements.

Jakub Olipra is an economist at the Macroeconomic Analysis Department of Crédit Agricole Bank Poland.