The role of central banks in the digital transformation of financial markets

Category: Macroeconomics

(Infographics Bogusław Rzepczak)

Although banking crises are perhaps not everyday occurrences, they cannot be considered to be special events, argue Charles Goodhart, member of the Monetary Policy Committee of the Bank of England (1997-2002) and Professor at the London School of Economics, and Dirk Schoenmaker, Professor of Banking and Finance at Rotterdam School of Management, Erasmus University. They studied 104 crises between 1974-1993 which resulted in bank failures or were their rescue.

In the publication issued in 1995, which everyone debating the issue of the location of banking supervision refers to, the authors argue that the world does not have one model of banking supervision, not to mention an optimal model. There are also no universal arguments in favor of supervision at the central bank or a separate agency. At half of developed countries, banking supervision is inside the central banks, and at the other half – in a separate authority.

Their book contains several other important conclusions. Systems with central banks exercising supervision were more supportive of the rescue of failing banks by other institutions from the sector (as a rule through acquisitions) than at the cost of the taxpayer. On the other hand, if the central bank is involved and organizes a bail-out then to a certain extent it assumes the credit risk. This, in the opinion of the authors, is the main argument in favor of separating the function of supervision.

At the same time, the researchers believe that concentrating supervision and monetary policy in one hand creates a greater chance that the central bank will be able to prevent the spread of the crisis to the whole system. Another important argument is that those tackling the crisis were rather unwilling to allow the collapse of a bank and its liquidation. In 73 out of the 104 cases studied, failing banks were often saved, although at a high cost. There are many arguments for and against. It turns out that there are also other arguments.

Central banks began to arise as early as the end of the 17th century (first in Sweden, then in England). However, it was a long time before they also began to take on the function of supervision of other banks. In the 19th century, they became gradually involved in the micro-management of the financial system jointly with commercial banks and in the joint rescue of threatened institutions. Bank of Prussia, for example, issued generally applicable regulations regarding the rediscount of bills of exchange in the middle of the 19th century.

Year 1866 was an important moment in the history of thought on the functions of the central bank. It was a year when a British institution, Overend Gurney, collapsed. It wasn’t the collapse itself, but rather the history of this event described later by Walter Bagehot in his book “Lombard Street” that was important.

In the book, Bagehot accused the Bank of England of not hurrying to save the failing institution, since it treated it as a commercial rival. The Bank of England, like other commercial banks, was at that time a joint stock company. From today’s point of view, it was not yet “conscious” of its role as a central bank.

Walter Bagehot helped it a lot in this respect. He formulated the function of the lender of last resort. When a commercial bank is at risk of losing liquidity the central bank should offer assistance by providing liquidity. It should provide liquidity at a high interest rate in order to discourage moral hazard among other banks. It should take as a collateral the best assets. Nothing more, nothing less, although recent times show that liquidity is sometimes provided at close to zero percent, while collateral is not necessarily of the highest quality.

The second thesis of Walter Bagehot is also important. The central bank may lend when the bank loses liquidity but is not insolvent. When it is insolvent, but it still maintains liquidity, in no circumstance should it lend to the bank. What does this reasoning lead to? The central bank should know whether a bank is solvent or not in order to be able to provide it liquidity support. The conclusion is that one can have certainty only when one exercises supervision of the banks oneself.

The function of the central bank as a lender of last resort and a manager of crisis began to crystallize between 1880-1914, according to Charles Goodhart and Dirk Schoenmaker. The Bank of England rescued (after Walter Bagehot’s criticism and no longer with procrastination) Baring Bros in 1890. The Bank of Prussia provided liquidity to commercial banks during the crises in the years 1857, 1866 and 1870, after which the German Reichsbank took over a similar role.

As a result of the crisis in 1907 in the United States, the Federal Reserve, the central bank of the United States, was established in 1913. However, originally its mandate was to maximize employment, stabilize prices and moderate long-term interest rates. It did not cover supervision.

This was because banking supervision already existed in the United States. The banking supervisory authority was a government institution, the Office of the Comptroller of Currency (OCC), established in 1863 as an independent office in the Treasury Department. It remains the supervision authority today, and interestingly, the OCC has a branch in London in order to exercise supervision of the operations of American banks there.

It was not until the Great Depression, which resulted in the collapse of one third of American banks, that the Federal Deposit Insurance Corporation (FDIC), an insurer of bank deposits, was established. Under the new banking law, the Banking Act, the FDIC also assumed responsibility for banking supervision, conducting the bankruptcy proceedings, including orderly bankruptcy, or resolution.

After the Great Depression, the new banking law (Kreditwesengesetzes) also came into force in Germany in 1934 and established the banking supervision authority there (Bankenaufsicht) outside the central bank. Today this is BaFin.

In the United States there is probably the most complicated supervision system in the world. Regulations which are significant for the whole sector and are a consequence of the post-crisis Dodd-Frank Act are agreed and issued jointly by five and even six different agencies supervising the banks.

Competencies often intersect in this structure as a result of historical factors and current needs. This is partly on an institutional basis, because certain supervisory institutions have powers over banks with specific features, but also on a sectorial basis, since more than one institution supervises a particular area of banking activity. On top of this, there is an overlap on a state-wide basis of supervision for the smaller credit institutions.

Charles Goodhart and Dirk Schoenmaker write that in the 19th century, apart from the previously mentioned supervising bank OCC, a self-regulatory system for the sector also developed. This consisted in banks creating clubs or trusts, which guarded against its participants succumbing to moral hazard, and on the other hand, hurried with help if needed. However, this system began to collapse in the face of growing domestic and international competition as well as deregulation of the sector from the 1970s onwards.

In turn, as Charles Calomiris, Professor at Columbia Business School writes, the Fed’s licensing policy which led to the birth of banking giants in the United States, played a part in this. Moreover, a similar policy, allowing the uncontrolled growth of banks, also thanks to mergers and acquisitions, was conducted in the United Kingdom and other European countries.

Apart from the OCC which regulates and exercises supervision of all the domestic banks and federal savings banks, as well as federal branches and subsidiaries of foreign banks, since 2010 the American central bank has also exercised supervision of a similar group of institutions. Since 2010, banks with assets above USD50bn are subject to supervision by the FDIC.

Banks are also supervised by the Securities and Exchange Commission (SEC) in so far as they are participants of the capital market, but also issuers and traders of instruments in the capital market. The next agency which has supervisory powers is the Office of Thrift Supervision (OTS). However, it supervises state-licensed savings banks and savings and credit unions.

The Commodity Futures Trading Commission (CFTC), which was created in 1920 as a division in the Department of Agriculture and at that time mainly dealt with corn contracts, is important, especially for the large American banks which have strong exposure in the derivatives market. Since 1974 the CFTC has ensured the transparency in the derivatives market, which is valued in billions of US dollars.

Unlike the European institutions (although law in this area has already changed), all American agencies can impose penalties on the banks. Apart from the discussion on the effectiveness of such penalties, the CFTC informs that since the outbreak of the crisis it has imposed 17 penalties totaling USD5.08bn on banks and brokers for manipulation of indices, exchange rates and the LIBOR rate.

As the financial market grew, institutions were created that covered successive areas. Supervision of the capital market in the United States, exercised by the SEC, was created in 1934. Since 1985, the capital market in the United Kingdom has been supervised by the Securities and Investments Board (SIB). In Germany, the Bundesaufsichtsamt für den Wertpapierhandel, created in 1995, fulfilled this role. In Poland, the Securities Commission was established along with the creation of the Warsaw Stock Exchange in 1991. Similarly, the development of the market prompted the establishment of sectorial supervision of asset management companies, insurance companies and pension funds.

In response to the crisis in the United States, which European banks also fell victim to, an EU construction of European agendas was born in 2010-2011 out of the spirit of “sectorial” supervision. This is the European Banking Authority (EBA), European Securities and Markets Authority (ESMA) and the European Insurance and Occupational Pensions Authority (EIOPA).

These institutions, established as a result of conclusions of the report of the Jacques de Larosiere group, were to create a European financial safety net. It was crowned by the European Systemic Risk Board (ESRB), in other words, macro prudential supervision. It was located at the European Central Bank.

Perhaps such a safety net designed in such a way would be sufficient, if it were not for the debt crisis and its interference in the situation of the banks. At the same time, it turned out that the European agendas were not equipped with sufficient prerogatives to be able to take measures, or with the possibility to impose sanctions. A stronger player was needed to rescue the euro area and ensure financial stability. In the middle of 2012, the ECB moved into action with its unconventional monetary policy. At the same time, the concept of a European banking union was born, which was to be a way to break the relationship between government debt and the situation of the banking sector.

Let’s go back slightly. Deregulation of the financial system, global competition among banks, the license policy, also including the Fed, and the growth of the whole financial system caused the existence of sectorial supervisory institutions to become more and more ineffective. The concept arose that there should be one supervisory authority for the whole financial system, in other words, consolidated supervision.

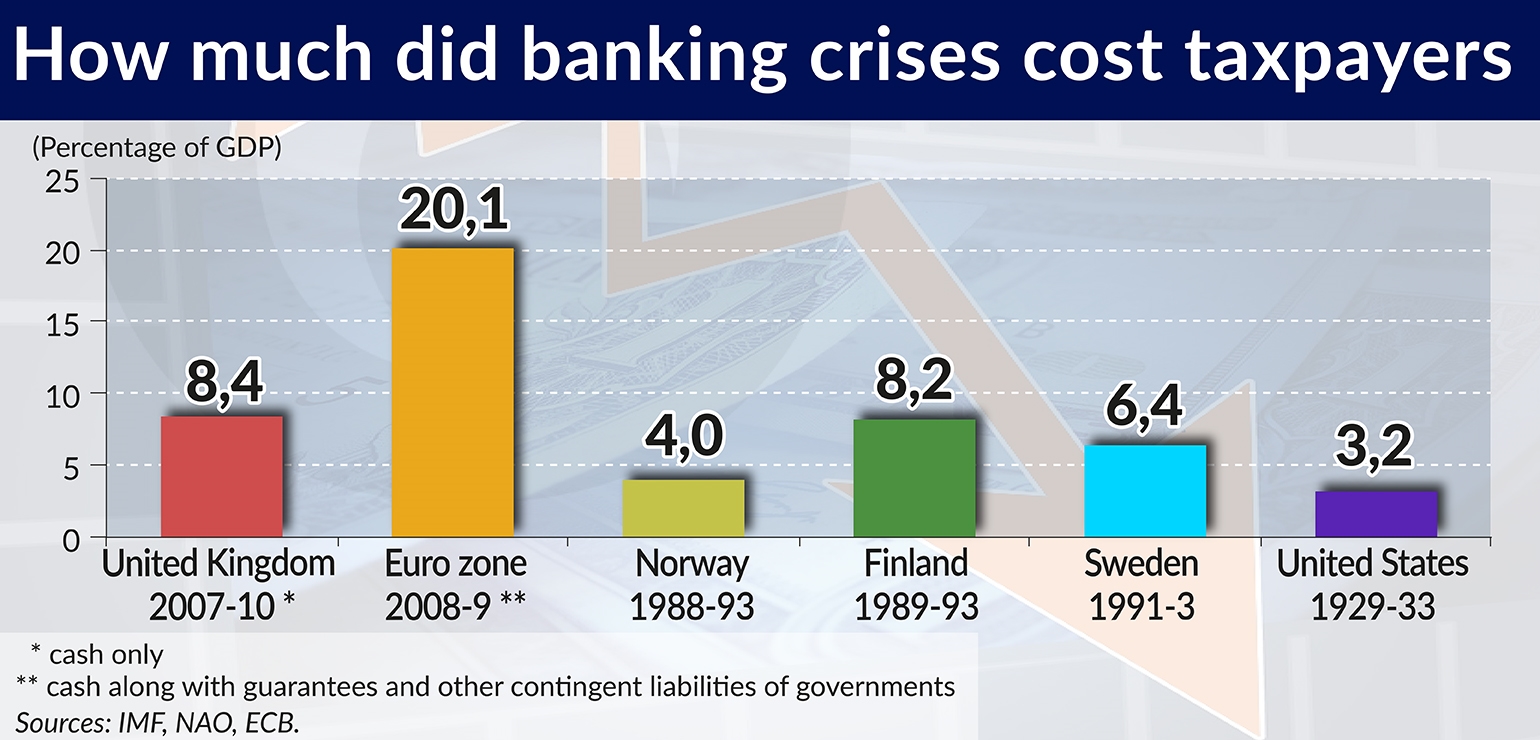

This concept first became established in the Scandinavian countries, which were hit by a big banking crisis towards the end of the 1980s and beginning of the 1990s. According to data of the International Monetary Fund, it cost taxpayers 8.2 per cent of GDP in Finland, 6.4 per cent in Sweden, and 4 per cent in Norway.

“The supervisory authorities were set on monitoring the compliance of banks with the provisions of law instead of monitoring the risk that they assumed. Contemporary knowledge at that time and the methods applied by the supervision authorities were insufficient to meet the new challenges which appeared along with the liberalization of the financial market and the growing risk in the banking sector. The supervisory authorities also did not have at their disposal sufficient funds necessary to increase their own effectiveness,” Olga Szczepańska and Paulina Sotomska-Krzysztofik of NBP summarize the causes of the Scandinavian banking crisis.

Since the whole of the financial market is to be supervised by a supervision authority, should this authority be the central bank? Should its competencies be extended so much to include supervision of the stock exchange, issuers, and trade of financial instruments? Should it deal with the protection of consumers, which is slowly becoming one of the most important aspects in financial stability thinking? In addition, should it supervise (and regulate) the shadow banking sector?

In 1997, supervision of banks was transferred from the Bank of England to the Financial Services Authority (FSA), an institution created on the foundations of the SIB. In Germany in 2002 the “sectorial” supervision authorities were incorporated into BaFin. The discussion broke out once again about whether the central bank should remain a supervisor of banks or transfer the banks to a consolidated supervision authority. It also took place in Poland during the creation of the Financial Supervision Authority in 2006 which consolidated supervision of the whole of the financial sector, including the banks.

According to the later publication of Charles Goodhart, the main reason for the establishment of consolidated supervision was the blurring of the structures of the financial system, the creation of large and complex universal banks operating in all markets. The competences of the central banks and their responsibilities would have to be extended to completely new fields. A second argument in favor of transferring banking supervision outside the central banks was the fear of conflicts of interest between monetary policy and supervision.

Let us imagine that the central bank has to provide liquidity to a bank that is in trouble. At the same time, it eases monetary policy. When the situation should persuade it to tighten monetary policy, it must act in contradiction to its primary objective. In turn, in the situation in which an interest rate hike is necessary in order to curb inflationary pressure, the central bank may hesitate whether rate increases will harm the stability of the banking sector.

When the first pillar of the banking union was created, the Single Supervisory Mechanism, it was decided to situate it at the ECB. At the time, the President of the Bundesbank, Jens Weidemann, opposed this idea, raising the argument of the possibility of a conflict of interests between monetary policy and supervision.

“[The] global financial crisis has swung matters decisively back in favor of central banks playing a key role in supervising banks. Arguments for separation put forward by European politicians citing conflicts of interest, reputational argument, economies of scope or the numbers of banks in the euro area are weak and ignore the many real benefits from the integration of monetary policy with banking supervision,” wrote Karl Whelan of the University College in Dublin in his analysis for the European Parliament which was presented as part of the discussion on the creation of the banking union.

He points out that the creation of the TARGET2 system that allows the settlement of banks with the central banks and between each other, lets central banks to react rapidly to problems which appear in the banking system. The central bank can access more tangible or intangible information in order to provide timely liquidity to a bank which has lost liquidity but is not insolvent. Moreover, according to Karl Whelan, intangible and confidential data gathered by the supervisory authority help to improve inflation forecasts, and therefore supervision creates a synergy with monetary policy. In addition, with a knowledge of the weaknesses of the banking sector, the central bank can better calibrate the transmission of monetary policy.

Two more arguments are added to this discussion. The first is that due to the creation of macro prudential supervision, the competences of consolidated supervision have been transferred to another, much more expanded level. The tasks of macro prudential supervision cover, among others, the monitoring of cross-border capital flows and wholesale funding provided to local banks by global institutions.

The second argument is that supervision exercised by the central bank – thanks to its role in carrying out bank resolution – always has a choice whether to provide liquidity or allow the bank to fail. A bank’s problems with liquidity are enough to launch the resolution process.

Finally, let us return to Charles Goodhart. He writes that the authority of the supervisory body, its quality and the competencies of its staff, its independence from external pressure and the adequacy of its funds to its tasks, are more important than the place in which supervision is situated. And that is a sufficient conclusion.