Tydzień w gospodarce

Category: Raporty

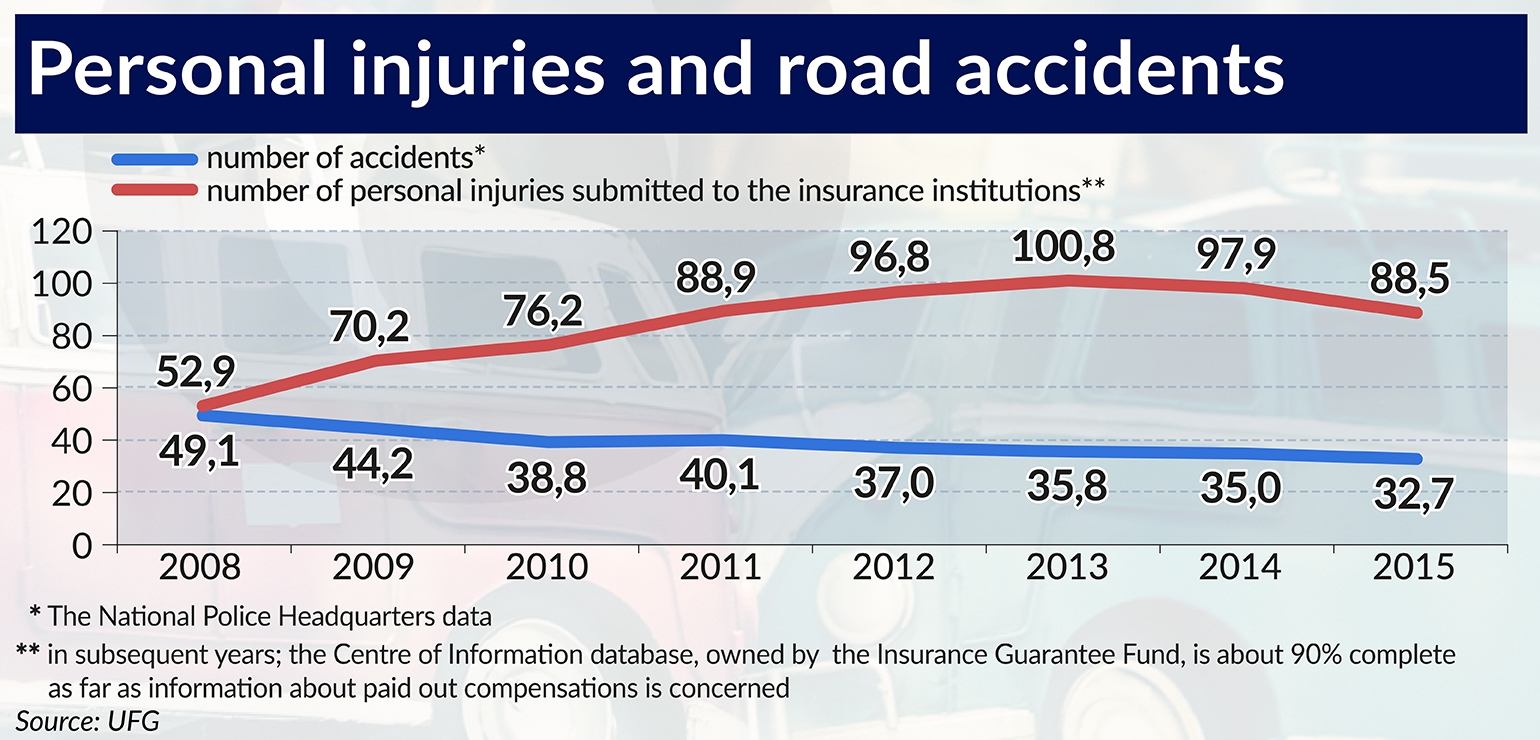

(infographics Bogusław Rzepczak)

This will benefit both the victims, who are currently receiving grotesquely low payouts, and the insurers, because it will be easier for them to plan the level of premiums. A recommendation, however, will not be enough for the full normalization of payouts.

If KNF introduces in its recommendations tables with the ranges of the possible sums paid out by insurers in the case of similar events, that would be a milestone in solving the problem of uncertain compensation amounts, which has been plaguing the industry for a long time and is a nightmare for the victims.

Dagmara Wieczorek-Bartczak, the Head of the Insurance and Pension Inspection Department at KNF, announced them at the Congress of the Polish Insurance Association in Sopot. She declared that the supervision authority is finishing work on a recommendation which will regulate the issue of payment of compensation for personal damages in respect of third-party liability motor vehicle insurance policies.

The document will entry into force at the beginning of 2017. The insurance industry, the ministries of finance and justice and the representatives of the medical community have all been invited to cooperate in the work on the regulation of compensation.

Already at the beginning of this year, KNF prepared recommendations concerning the process of determining and paying out compensation in respect of personal damages due to third-party liability insurance policies for motor vehicle owners, which are to enter into force by the end of 2016. This document regulates the principles of servicing personal damages, but omits the essential issue of the amount of compensation.

Compensation is provisions paid for non-material damages. It applies to situations where the victim has suffered harm, e.g. suffered physically and mentally as a result of an accident or suffered pain after the death of a loved one. The suffering caused by an accident or the loss of a spouse or a child cannot be measured with money, therefore it will always be a conventional amount. And this is where problems arise. Over the past four years, the payouts of compensation have increased by 60 per cent, although it has not been matched by an equally high growth in premiums, and in 2015 the technical loss from third-party liability insurance amounted to over PLN1bn – the highest in the industry’s history.

In some insurance institutions the payouts of compensation for non-material damages reach as much as 80 per cent of the compensation paid for personal damages from public liability insurances. The remaining 20 per cent are material damages, i.e. compensation of material damage, which can be calculated. In most countries of Western Europe these proportions are reversed.

“At the moment, not only the decisions of insurers differ significantly from the court judgments in similar cases, but also the courts grant the victims widely diverging amounts, even though the facts are similar,” says Dorota M. Fal, Advisor to the Management Board of the Polish Insurance Association.

Józef Zych, a long-time member of parliament and currently a judge of the Tribunal of State, addressed the differences between the amounts granted by the insurance institutions and those based on court judgments in his speech at the Congress of the Polish Insurance Association. The insurer offered PLN7,000 (EUR1,580.6) in compensation to a woman who lost her husband in an accident, and the court raised it to PLN150,000 (EUR33,870.3).

“As a lawyer, I would be embarrassed to offer compensation that is later increased by the court as much as 20 times the original value,” judged Józef Zych.

This example angered Tomasz Tarkowski, the president of Link4, who claims that the insurer’s proposal is only the beginning of the negotiations, because it is obvious that the court will raise the amount proposed by the insurance institution. According to him, if the insurance institution immediately paid out PLN150,000 instead of the PLN7,000 offered, then the court would award an even higher amount.

This illustrates how important it is to set the ranges of the paid out compensation amounts. On the one hand, insurers fear raising compensation, on the other hand, not all such cases are resolved by the court. Not every victim or someone who lost their closest family members in an accident has the energy, the money and the time to pursue their rights during long-term court proceedings, which the president of Link4 fails to take into account. In addition, the discrepancies in court rulings show that the issue of the amount of compensation is not clear to the courts either.

From the point of view of the insurance institutions, the biggest problem is the unpredictability of the amount of compensation, especially since it is often paid for harm suffered many years ago. In addition, although the law has only provided for compensation for the death of relatives since 2008, the Supreme Court has decided that it is also possible to claim compensation if the events occurred before the current regulations entered into force. The insurers could not take that into account when estimating the amount of premiums, however.

“The amount of the awarded compensation has to be predictable, and that is why for the past three years we’ve been trying to develop solutions allowing for their standardization. For insurers, the key issue is not the amount of the compensation, but its predictability, as it allows them to plan the amount of premiums at an appropriate level,” says Dorota M. Fal.

Including the compensation in tables could solve the problem, but it seems very hard to implement. Suffering is not only difficult to measure, but also hard to compare. Each case is different. The feelings of a wife after the death of her husband will be different if the couple was happy, and different if the deceased husband was a perpetrator of domestic violence. The loss of a child’s sole parent will affect it differently than the death of one of the two parents.

Just the determination of the group of persons entitled to compensation may be a source of problems. We have to at least consider patchwork families, same-sex relationships or informal relationships, which will not be easy to include in tables.

“By its very definition, compensation is supposed to compensate for harm which is not directly measurable, therefore an attempt to fully standardize it in the most complicated cases seems to be doomed to failure,” believes Bartłomiej Krupa, president of the Polish Chamber of Compensation Advisors and Intermediaries.

The idea of placing compensation within some framework means a social contract based on certain amounts, which are to be determined based on a reasonable basis. We can compare different cases and create a formula, and if any situations fall beyond the framework, there is always the possibility of submitting the matter to the court.

Not everyone will be happy with the possible regulation of compensation. An example is the compensation brokers and advisers, who to a large extent make a living by helping victims claim their rights in exchange for a commission. Therefore, they don’t care so much about the predictability of the compensation, only about their maximum level.

“What we need very much, however, is the introduction of minimum standards, in particular in the most common spine injuries resulting from road collisions,” says Bartłomiej Krupa. “Insurers routinely dispute the amounts of such benefits, in spite of the clear evidence in the form of medical records.”

The president of the Polish Chamber of Compensation Advisors and Intermediaries also points to the fact that it is impossible to fully standardize the paid out compensation because the law is undergoing changes. For example, the practice associated with payments for families of persons in a coma or a vegetative state is only being developed. In spite of these objections, Krupa believes that the changes will benefit the victims.

“The standardization of compensation would be beneficial to all the interested parties. Insurers could set premiums at an appropriate level, victims would know what amounts can be claimed and they would avoid investing in costly court proceedings, and it would be easier for judges to decide on matters of compensation,” summarizes Dorota M. Fal. “The introduction of tables with compensation ranges for specific cases is a good idea, but only on the assumption that the solutions proposed by KNF will be accepted by all stakeholders, and especially the criminal justice system.”

But that is not all. It is hard to imagine that the standardization of compensation for personal injury will be effective in a situation where the tables only bind the insurers, but not the courts. And that would be the case if the problem is only addressed with a recommendation of KNF.

The only effective solution would be to change the generally applicable law and introduce the standardization of compensation with an act of parliament. KNF and the insurers hope that this will be the next step in resolving the burning problem of compensation.