Tydzień w gospodarce

Category: Raporty

The marketing success achieved by Tesla, an American manufacturer of electric vehicles (EV), spurred big automotive companies, which for years have been sluggish in the development of EV projects, to strongly accelerate their activities in this segment of the automotive market. Tesla has set the bar pretty high. Thanks to batteries Tesla cars have a greater range than the competitors’ cars and, in addition, the company is developing a network of fast charging stations, which is important for current and future users.

The electric rivalry of car makers gained pace in the fall of 2016. Summarizing the announcements of automotive giants such as Daimler, BMW, Volkswagen Group, Toyota and Mazda, it is clear that the production of electric cars will grow rapidly in the coming years. In the past year it increased by 60 per cent to 550,000 electric vehicles. An increase in sales of approx. 40 per cent is expected this year. As a result, according to the estimates of EV Volumes, at the end of this year there will be approx. 2.1 million electric passenger cars driving on the roads across the world.

The analysts at Bloomberg New Energy Finance look even further into the future. They forecast that 41 million electric vehicles will be sold in 2040, constituting 35 per cent of global car sales.

Mass production of electric cars is not possible without an increase in the production of batteries, a further reduction of their cost (between 2010 and 2015 the price of a battery measured by the cost of storing 1 kWh of energy fell by over 60 per cent) and an improvement in the range achieved by electric cars on a single charge. According to the estimates of Bloomberg New Energy Finance, by 2022 the prices of batteries powering the engines of electric vehicles will fall so much that the cost of purchase and use of an electric car will be comparable to the cost of a car with an internal combustion engine. We should also expect improved battery efficiency and longer battery life. Toyota is currently working on such solutions in a consortium with a state-financed scientific and research laboratory and four universities.

Research and development works related to the improvement of the technical parameters of energy storage and the development of innovative methods of charging the battery are supposed to be one of the issues addressed by the cluster „Polish Electric Bus – supply chain for electromobility”, which creation is planned by a group of Polish companies (including SKB Drive Tech Solaris Bus & Coach) and technical universities (the University of Science and Technology in Kraków, Poznań University of Technology and Warsaw University of Technology).

Currently lithium-ion batteries are used for the storage of energy required to power electric cars. They are also used to power smartphones and laptops, as well as, for example, in passenger airplanes. In order to produce such a battery we need lithium, so this lightest of metals is nowadays called a „white fuel”.

According to Goldman Sachs, the production of the battery used in the Tesla Model S cars requires as much lithium as is consumed in the production of batteries for more than 10,000 smartphones.

In recent years the market for lithium-ion batteries has grown by dozens of percent per year, mainly due to the batteries used in consumer electronics. The research firm Transparency Market Research forecasts that between 2015 and 2024 its value will increase from USD29.7bn to USD77.4bn. Citi Research provides slightly different estimates and claims that between 2015 and 2020 the value of the market of lithium-ion batteries will increase from USD24bn to USD40bn.

The scale of the expected growth of market value is influenced by two factors. The first is the expected increased production of batteries used in electric cars, consumer electronics and systems storing energy produced by photovoltaic cells. The second is the expected increase in battery performance, manifested by lower consumption of lithium required to obtain the same battery capacity, and as a result the decline in battery unit prices.

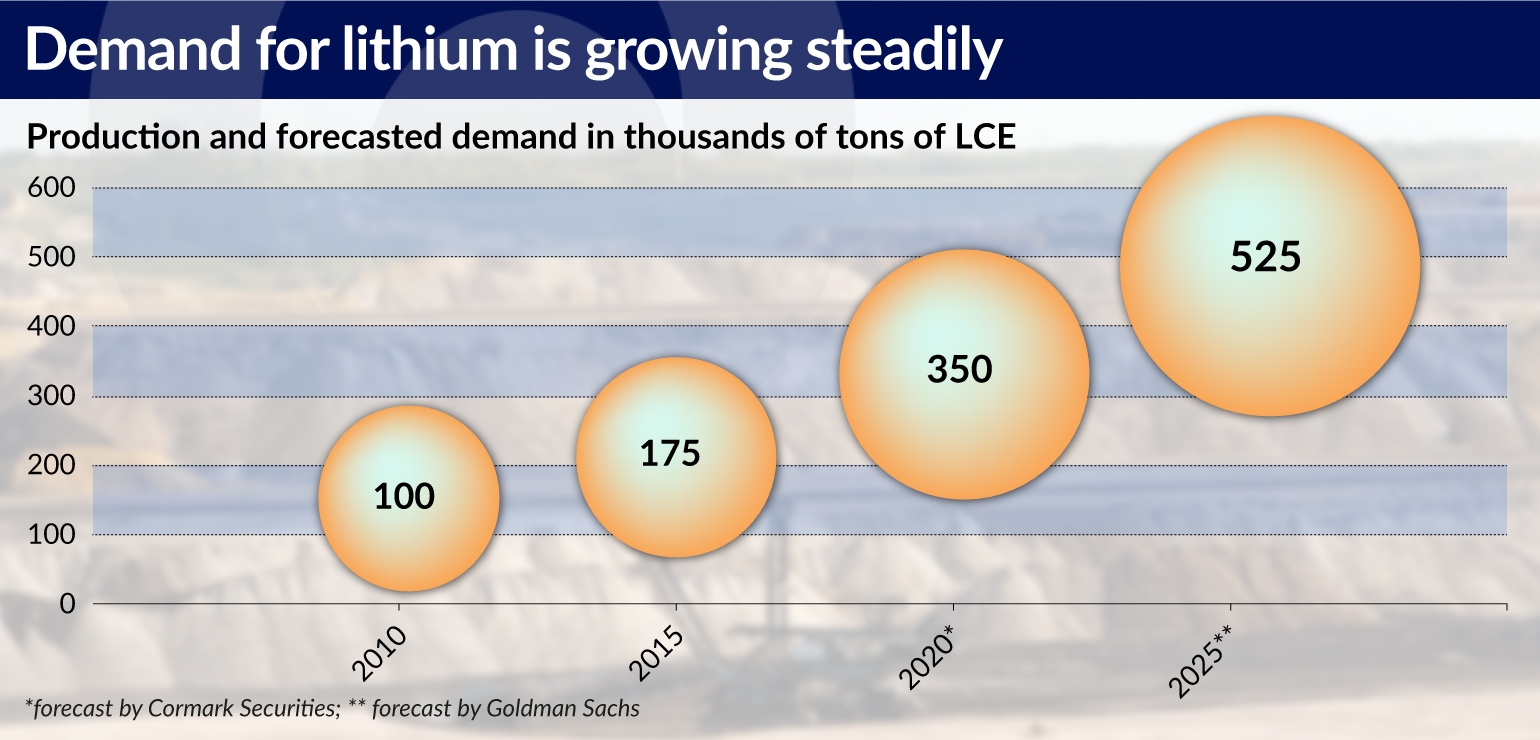

It is estimated that this year’s production of lithium – expressed in lithium carbonate equivalent (LCE) – will reach approx. 185,000 tons and will be approx. 10,000 tons more than in 2015. Forecasts concerning demand in the coming years vary greatly. Some – like Luke Kissam, the CEO of Albemarle, an American mining company – say that demand will increase by another 20,000 tons of LCE until 2021 and that the operating mines should meet the current needs. Analysts from Sanford C. Bernstein Ltd. predict that by 2025 the production capacities of the existing, currently built and planned mines will increase by 70 per cent and that at least until that time there should be no problems with satisfying demand.

Others – like the analysts of the investment bank Investec – are convinced that demand may be greater than supply. Cormark Securities claims that by 2020 the consumption of lithium will have doubled compared to 2015. In turn, the consulting company Stormcrow Capital assesses that demand will exceed supply in 2023. Goldman Sachs estimates that the demand for lithium will triple by 2025.

It is hard to tell who is right on this issue. A lot will depend on the engineers involved in the research and development of batteries and the actual demand for batteries for cars and energy storage systems. Today, according to Goldman Sachs analysts, the production of batteries for a car such as Tesla Model S requires 63 kg of LCE, which is the same amount that is used in the production of 10,000 batteries for smartphones. If Tesla’s currently developed battery factory – known as the Megafactory – reaches the planned production capacity of 500,000 batteries per year, it will need as much lithium as is currently consumed in four years of smartphone battery production.

For many years lithium remained on the sidelines of mainstream interest in raw materials. One of the reasons was that the annual value of the market was approx. USD1bn. Besides, there were never any problems with supply. As a result, it is not traded on commodity exchanges.

The production of lithium is highly concentrated. Four companies are responsible for 85-90 per cent of output, namely the American Albemarle and FMC, the Chilean Sociedad Química y Minera de Chile (known as SQM) and the Australian Talison. The latter company is controlled by Albemarle and the Chinese Tianqi Lithium, which hold 49 per cent and 51 per cent of its shares, respectively. In addition, in the United States and in Canada there are dozens of smaller companies which are about to engage in or are already carrying out lithium mining.

Some of them have gone bankrupt in recent years, because they have underestimated production costs. Others, such as Rockwood, a company carrying out mining activities in Chile, have been taken over. In January 2015 Rockwood was bought by Albemarle for USD6bn. The shares of SQM are gradually being bought out by Potash Corporation of Saskatchewan, a Canadian group. At the end of November it made a tender offer for a package of 1.7 per cent of the shares. If it completes the purchase, it will control 29 per cent of the Chilean company’s shares before the end of 2016. When it reaches 32 per cent of the shares, it will have to make a tender offer for all the remaining shares. The Chinese Tianqi Lithium would also like to acquire SQM shares.

The presence of lithium is limited as well. The largest known deposits are located on the border of Argentina, Bolivia and Chile, as well as in Australia, China (Tibet) and the USA (North Carolina and Nevada). Some deposits are also found in Mexico and Canada.

Mining is going on mainly in Australia, Chile, China, Argentina and the USA. According to the United States Geological Survey, the world lithium resources whose extraction is profitable today amount to 75 million tons of LCE. The entire global resources are estimated at 217 million tons of LCE, more than half of which is located in South America, and approx. 36 million tons in the USA.

According to Stormcrow Capital, increased output in Chile is hampered by the attitude of the government, which restricts the production of lithium. In Bolivia, which has the largest known lithium deposits in the world, the main obstacles holding back investment include the economic climate, the weather (rain in particular) and the overlap of lithium deposits with other minerals. In Argentina the political and economic situation has been a problem for years, but the change of president gives hope for increased investment.

Lithium-ion batteries are currently mainly produced in China, South Korea and Japan. The largest producers include Japanese Panasonic and Automotive Energy Supply Corporation (AESC), as well as Korean LG Chem and Samsung SDI. The most important Chinese manufacturers are BYD (with Warren Buffett among its shareholders) and Epower.

Today, the batteries for Tesla cars are manufactured by Panasonic, but Tesla plans to launch its own Megafactory next year. Because of potential problems with the supply of lithium Tesla is now intensely seeking contacts with manufacturers. It has its sights set on companies with an established position and new players alike. Therefore, it is dealing with both Albemarle and Pure Energy Minerals, which is about to launch its mining activity in Nevada. Tesla is also ready to invest in the construction of mines in Mexico and in increasing the production capacities in Chile.

The growing demand and the uncertainty of whether it will be met with supply in the future, have a direct impact on the price of lithium. In the summer of 2016, in China the transactional price of a ton of lithium which can be immediately used for battery production without additional processing, leapt to USD20,000 and was nearly three times higher than the average price in 2015. The prices of lithium carbonate and lithium hydroxide also went up, but their hikes were not as drastic as in the case of pure metal purchased by factories for battery production. They did not exceed several dozen percent and the prices stood about 50 per cent higher than in 2014.

There is one more problem associated with lithium prices – the market. Lithium is traded on local markets, which means that prices can vary greatly, there is no futures market, and the spot market is very shallow. In addition, lithium is sold in various forms and with various purity levels. On top of this, the majority of transactions are concluded directly between battery manufacturers and mining companies, which further reduces the transparency of this market.

There is no consensus as to the sustainability of lithium price increases. Analysts from Sanford C. Bernstein Ltd. state bluntly that this is a typical speculative bubble similar to those which often occur in the commodities market. Experts from Macquarie Bank expect lithium prices to continue to grow until mid-2017, and then to start stabilizing at a lower level. Macquarie Bank is convinced that major manufacturers will increase lithium production to maintain their market share and push out new players who are just launching production.

The price of lithium could be impacted if the batteries in which it is used are replaced by other solutions, e.g. by fuel cells. According to experts, however, this will not happen earlier than in 10-15 years. Until then, demand for lithium will continue to grow.