According to the data of the annual report on “Central and Eastern Europe Private Equity Statistics 2016” prepared by Invest Europe, the trade association of companies managing PE and VC funds, and Gide, the French law firm, last year’s investment in the region was only EU14m higher than in 2015. The number of companies which invested funds in our region decreased from 353 in 2015 to 337 in 2016.

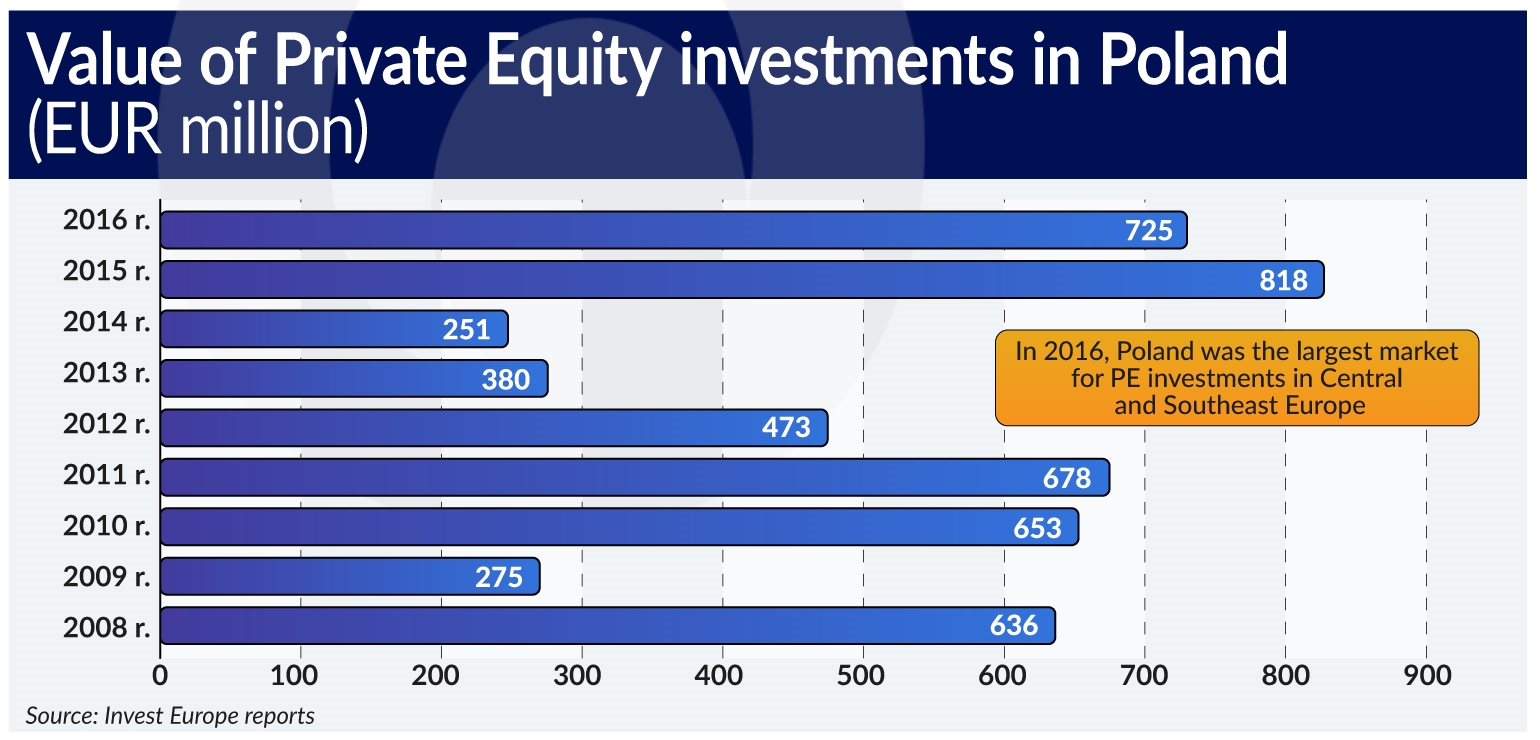

Poland was the biggest market, with investment of funds worth EUR725m (a decline of 11 per cent as compared with 2015) and 82 companies in which the funds invested (a decline of 36 per cent as compared with 2015). The value of investment in Poland was four times higher than in the countries occupying the second and third position in the ranking, i.e. the Czech Republic and Lithuania. Last year’s investment in these two countries amounted to EUR168m and EUR156m, respectively. In 2015, Poland was also the largest investment market of PE and VC funds in the region. In 2014, with investment at a level of EUR258m, Poland was ranked third, overtaken by Serbia (EUR329m) and the Czech Republic (EUR296m).

The authors of the report underline that Central and Eastern Europe is still a small market for investments of PE and VC funds. Last year, the region accounted for only 3 per cent of the total value of investments of the funds in Europe. Investments of the funds in companies from the region in 2016 made 0.12 per cent of the region’s GDP, whereas in the whole of Europe this indicator amounted to 0.33 per cent.

As much as three-fourths of the money invested last year by PE and VC funds in the CEE region was allocated for company buyouts. In 2015, a total of 43 such transactions were conducted, against 39 in 2015. Investment in company growth through increasing their capital represented the second most important type of transaction. In total, such investment transactions were worth EUR285m. The third type of transaction was investments in start-ups at various stages of development. A total of EUR100m was invested in start-ups in 233 transactions, i.e. the same amount as in 2015.

The total value of investment of the funds in start-ups in the region at various stages of development has remained at a level of approximately EUR100m for several years. At the same time, the authors of the report underline that the total value of investment in start-ups makes only 2.3 per cent of all investments in the region, whereas across the entire Europe this ratio amounted to 7.5 per cent. The average value of investments in the Central and Eastern European start-ups – EUR0.43m – was clearly lower than the European average (EUR1.4m).

The funds invested most of the money – almost EUR366m – in companies from the sector of consumer goods and services. The second largest sector in terms of money invested was the ICT industry, i.e. information and communication technology (almost EUR345m), and the third one – biotechnologies and health protection (EUR240m). Most frequently, the funds invested in ICT companies (135 firms), companies from the sector of consumer goods and services (69) and those offering products and services for business (42). If only start-ups are taken into account, most money was allocated in ICT companies (49 million to 111 start-ups in total), companies from the sector of consumer goods and services (EUR17m to 37 companies) and biotechnologies and health protection (EUR14m to 28 start-ups).

In Poland, investment in company growth last year increased by over 42 per cent, to EUR113m, whereas investment associated with buyouts decreased by over 15 per cent to EUR581m. The funds invested EUR21.4m in 46 start-ups at various stages of development, against EUR28.9m invested a year earlier in 88 such firms. In 2016, the funds invested nearly EUR10m more than in Poland in 73 Hungarian start-ups. A year earlier, the value of investment in Polish start-ups was over EUR4m higher than the value of investment in Hungarian start-ups.

The data presented in the report indicate that last year PE and VC funds raised EUR621 from investors for investment in the CEE region, i.e. 62 per cent more than a year earlier and at the same time, 58 per cent less than in 2014. The value of divestment slightly exceeded EUR1 billion and was the lowest level recorded over the recent three years.

The full report on “Central and Eastern Europe Private Equity Statistics 2016” can be found here.