The fast growth of the Polish economy provides an opportunity, but not all banks will use it to the same extent. The previous years – a period of record low interest rates, rising burdens and post-crisis legacies, such as the problem of mortgages denominated in CHF – have diversified the situation in the sector. The entities benefiting from the economies of scale will be better suited to take advantage of the new opportunities. Large banks, which have more room for maneuver in their balance sheets and resources available on the current accounts, have been generally quicker to adapt to the changes in the environment and are now able to improve their results much faster. The institutions that have properly utilized the opportunity provided by technological changes are also in a privileged position.

In 2017 the net profits of the banking sector amounted to EUR13.6bn and were 2.3 per cent worse than in the previous year. In 2016, the result was better due to a single large one-off event – the sale of Visa Europe shares, which provided the sector with net earnings of just over EUR465m. In 2017 the banks paid one monthly asset tax instalment more than in the previous year. This year, the value of profits will probably exceed EUR3.5bn, which means a return to the most profitable period of 2011-2014.

“According to bankers, 2018 may be better for the economy and for the banking sector as a result of business growth in various areas, including those related to the implementation of new technologies. This is associated with the very strict control of costs in the banking sector, but also with an increase in prices in some areas,” said Krzysztof Pietraszkiewicz, the president of the Polish Bank Association, at a conference dedicated to the presentation of the economic situation in banks.

Bankers increasingly optimistic

The sentiment of the bankers further improved as the rate of growth of the Polish economy exceeded 5 per cent in the last quarter of 2017. An optimistic outlook for 2018 was indicated by 70 per cent of the respondents surveyed in January by Kantar TNS, which calculates Poland’s banking sentiment indicator Pengab for the Polish Bank Association. This means an increase of 24 percentage points compared to last year. Some 42 per cent of the respondents expect that 2018 will be better than the previous year.

An increase in the prices of banking services is expected by 65 per cent of respondents, while 60 per cent expect banks to increase their revenues. At the same time, the respondents believe that banks will pursue decisive cost-cutting measures. A further decline in the number of branches is expected by 87 per cent of respondents and 83 per cent predict further reductions in employment.

The Pengab index has been calculated for the past 25 years. The research company TNS Kantar asks for an assessment of the economic situation in bank branches which are representative for the structure of the sector. The January survey involved the participation of 130 such units representing all types of banks.

In general the indications of the Pengab index correspond to other business sentiment indices and to the economic cycles, although these correlations have not been thoroughly examined yet. The index reached the highest historical value of 52.6 points in September 1997. The lowest level of 6.1 points was recorded in June 2013, when the economic situation was beginning to improve. The latest local peak in the index was recorded in March of last year when its value reached 30.3 points. Since last autumn, the value of the Pengab index has been growing almost permanently, with a short break recorded in December. The trend since the beginning of last year is also slightly upward.

January is usually not a good month for the banks in terms of the economic conditions. The companies are only gradually rolling out their plans for the year, and consumers are thinking about paying off the debts they incurred before Christmas rather than getting new loans. This time, however, the economic situation was surprisingly good from the beginning of the year. In January the Pengab index reached 26.9 points, following an increase of 5.1 points compared to December. During the preceding three years, the index always dropped in January.

The forecasts are even better than the current situation. For the upcoming quarter bankers are expecting an upswing in virtually all categories of services and products. Increases are expected in mortgage loans, consumer loans, investment loans and working capital loans, as well as in household and corporate deposits. Over the course of one month the Pengab forecast index grew by 7.4 points, reaching 29 points.

Inflow of deposits

The situation in the banks will primarily depend on whether deposits will continue to flow into the current accounts. Bankers have mixed expectations in this respect. An increase in salaries, including in real wages, is driving both consumption as well as non-interest-bearing deposits remaining on current accounts.

On the other hand, however, over time these deposits may even more quickly turn into investments. These will still mainly include real estate investments, because – outside retail treasury bonds – they have been the only alternative for savers for many years. The events on the stock exchange from early February will probably once again scare away the less advanced investors, whose number was growing last year.

According to the responses in the Pengab survey, the bankers’ expectations regarding deposit growth are optimistic, especially when it comes to current accounts. The current assessment ratio for household current accounts increased by 2 points m/m, and by 10 points y/y. The balance of assessments for term deposits increased by 6 points compared to December, and by 1 point compared to the previous year. On the other hand, the balance of forecasts for current accounts increased by 9 points during one month, and the balance of forecasts for term deposits increased by 15 points. However, some banks are already seeing the end of such favorable conditions.

“We’re already noticing a tapering of the increases in deposits. This will affect competition and will generate pressure on the margins,” said Cezary Stypułkowski, the CEO of mBank, at a press conference while presenting the results for the last year.

The impact will be even greater because banks – having improved their capital ratios to the extent that they will not be a limitation for their lending activity in the near future – now have to watch out for the loans to deposits ratio (LtD). At the end of the third quarter this ratio reached 98.1 per cent in the sector. Many banks do not intend to exceed the level of 100 per cent.

This could pose a serious limitation for the lending activity. We should note that according to data of the Polish Financial Supervision Authority, the inflow of deposits from the non-financial sector is gradually decreasing. Over the past year the value of such deposits increased by EUR9.8bn, i.e. only 4.1 per cent. This is much less than the growth recorded in previous years.

Record-high interest income

Thanks to moderate increases in the prices of loans and stock of non-interest-bearing deposits remaining on current accounts, the banks’ interest income is reaching record-high levels. After 11 months of 2017 it was EUR1bn higher than in the corresponding period of 2016. This was mainly due to an increase in interest revenues – by EUR906.2m – compared to 2016. This was mainly due to higher volumes of consumer loans and an increase in the price of loans. The full-year interest income increased by 12.1 per cent compared to 2016, reaching EUR9.9bn.

The banks’ interest expenses also decreased slightly – by just over EUR93m – which was mainly due to the increase in funds held on current accounts. At the same time, there was no further reduction in the interest rates on term deposits. In various market segments it has a tendency towards a slight increase, although the prospect of interest rate hikes is still being pushed back.

Already after the first three quarters of 2017, the banks’ interest income reached a record high in a comparable time scale. After 11 months of 2017 the banks achieved a record-high full-year interest income – EUR9.03bn – which is higher than ever before. For comparison, they achieved an income of EUR8.03bn in the same period of 2016 and EUR8.8bn in the full year 2016. This indicates that from month to month interest income is relatively higher. Last year interest revenues also reached record highs and amounted to EUR13.5bn.

Consumer lending is definitely gaining momentum. According to data of the Polish Financial Supervision Authority, after three quarters of last year the value of such loans increased by 8.1 per cent. This category is mostly responsible for the improvement in the banks’ results. Over time, the profitability of these loans will be slightly reduced by the rising costs of risk.

“The consumer finance portfolio has grown, so there is no way for the cost of risk not to increase,” said the CEO of mBank Cezary Stypułkowski.

Corporate lending

The most important question is whether corporate loans will continue to grow and at what pace. After the first three quarters of 2017, the annual growth rate of loans to small and medium-sized enterprises accelerated to 6.6 per cent, but still remains below 6 per cent in the case of loans to large enterprises.

The banks are hoping that after many quarters of expectations, investment will finally kick off, which to some extent has already been visible in the data for the fourth quarter of 2017. The increase in government, local-government and private investment should be coupled with increased demand for loans from enterprises.

“In terms of investments, especially those carried out by local government units, the trend has already been set. In the fourth quarter corporate loans started growing quite clearly. There has been a breakthrough in the fourth quarter,” said the president of ING BŚK, Brunon Bartkiewicz, at the press conference, while presenting the yearly results.

Although the trend has been set, corporate lending will be influenced by two factors, both on the side of the demand and on the side of the supply. First of all, enterprises still have huge cash holdings that they can use. Meanwhile, on the supply side, the credit risk in this sector has increased.

There were several reasons for this increase in risk. This concerns certain industries, such as renewable energy, which has been affected by the new regulations, and wholesale trade, which has been operating under the watchful eye of the tax authorities, who are attempting to eliminate VAT carousel fraud. But the most important reason for the growing risk stems from the labor market. Due to the shortage of employees and the wage increases, many companies may not be able to properly estimate their own costs while entering tenders or implementing contracts. An additional factor are the delays in investments financed with EU funds. We will now see a heavy accumulation of such investments.

“Investments financed from European Union funds are already flowing in. We estimate the value of contracts at EUR37.2bn. This will strongly increase the level of investment, perhaps even too strongly. This could cause a shock in the economy, and credit risk will increase,” said Brunon Bartkiewicz.

That is why banks are already selecting their corporate clients, trying to avoid exposures in more risky investments. Recent NBP surveys concerning the situation on the credit market indicate, among others, a tightening of lending criteria – which is most visible in the segment of long-term loans for SMEs – and the tightening of certain lending conditions, e.g. increased collateral requirements.

The Pengab index shows moderate optimism regarding an increase in lending to enterprises over the next six months. In the case of working capital loans, the index dropped by 1 point year-on-year. Meanwhile, when it comes to investment loans, there was a moderate increase of 3 points year-on-year.

What determines profitability

At the same time, banking is experiencing a technological race which is likely to continue in the coming years. According to 90 per cent of the bankers surveyed in January, the investment expenditure of banks on new technologies will further increase in 2018. It will probably further accelerate due to the entry into force of the PSD 2 (i.e. a directive changing the landscape of payment services) and the creation of the Polish API standard (a unified interface for access to bank accounts for third parties).

The technologies are not only providing more room to cut costs by closing branches or laying off employees. They are also introducing new elements of the electronic economy. The banks are also starting to monetize the electronic tools provided to their clients.

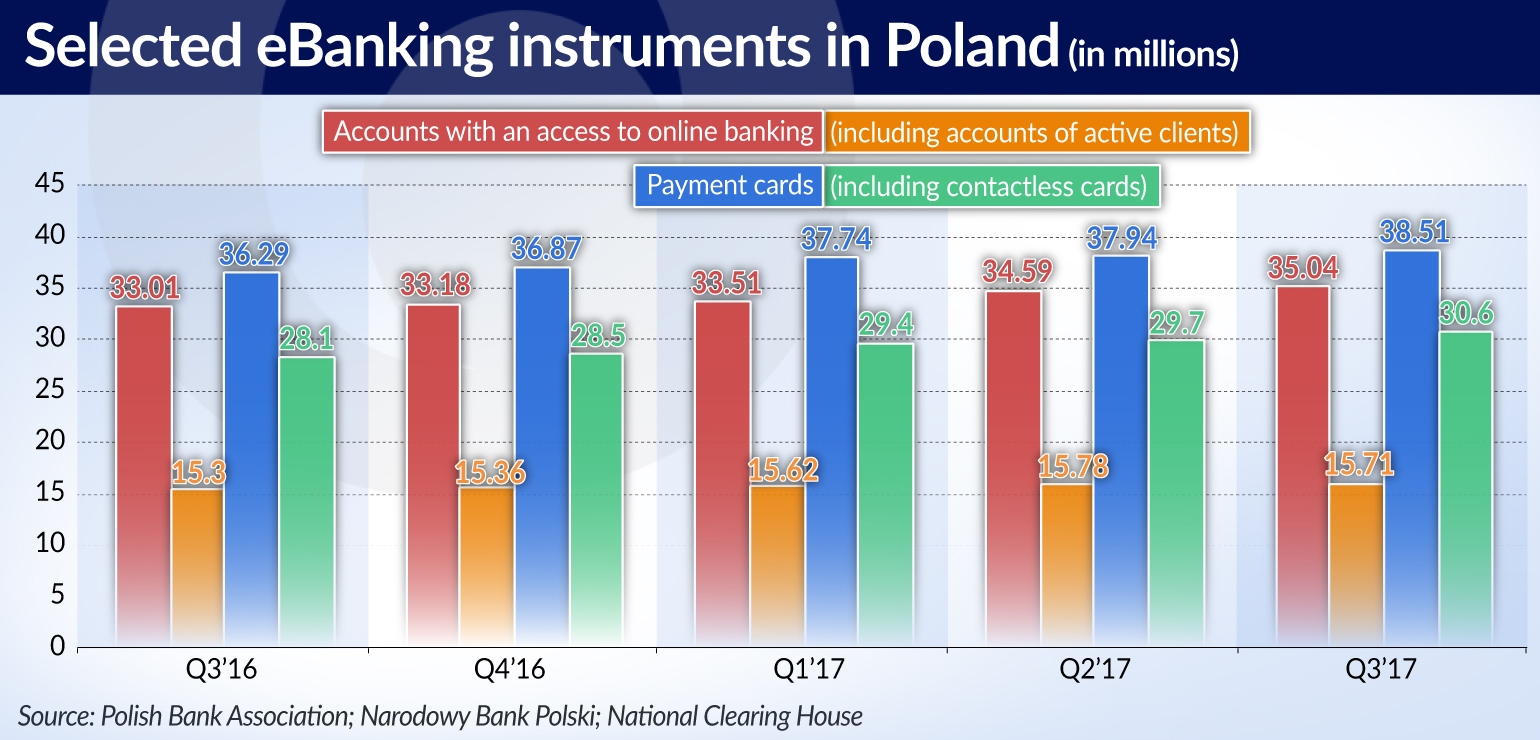

According to the Netbank report for the third quarter of 2017, there is a constant increase in the number of clients with contracts for the provision of online banking services and in the number of people actively using such services both on their personal computers and their smartphones. The number of accounts enabling the use of internet banking services exceeded 35 million out of 61 million total accounts. In the third quarter of last year, the average value of settlements of an active individual customer increased to over EUR1,557, i.e. almost 2 per cent year-on-year.

During the course of the year the number of debit cards increased by 7.3 per cent to 32.3 million and the number of contactless cards increased by almost 9 per cent to 30.6 million. Meanwhile, according to NBP data in 2016 the number of transactions carried out using non-cash payment instruments per one inhabitant increased to 147, i.e. an increase of 15.7 per cent compared to the previous year.

“The number of operations carried out is growing by a dozen or so per cent year-on-year. Banks may benefit from the increased volumes without necessarily raising prices. If we look at the results, the revenues from that source are not increasing rapidly, but the individual operations are cheaper. We earn less on a single operation, and more on the volume,” said Krzysztof Pietraszkiewicz.

“We’re seeing an explosion of transactions, an increase in the number of customers and a shift towards electronic channels, and within the latter – a shift towards the mobile channel,” said Brunon Bartkiewicz.

The biggest problem for the banks is still the question of reducing the share of cash in overall payments, because handling cash is expensive. In the scale of the entire economy it costs about 1 per cent of GDP. NBP data show that in 2016 the share of cash in overall payments in Poland was 63 per cent. This is much less than in the euro area, where this share amounted to 79 per cent.

According to data of the Polish Financial Supervision Authority, in the third quarter of 2017 the return on capital of the entire Polish banking sector decreased to 7.3 per cent. This is probably the minimum level and from now on profitability should start to grow again. The acceleration of the process of restoring profitability will to a large extent depend on the elimination of cash.