Tydzień w gospodarce

Category: Raporty

One of the most advanced office furniture factories in Europe is located in Jasło, southern Poland. On an area of 27,000 square meters (sqm), 1,000 so-called furniture pieces are manufactured per hour. However, only several dozen people work there, because the main role is played by robots and the computers that control them. Thanks to the analysis of data flowing from the recipients, it is possible to ensure high flexibility – while some robots automatically execute a large series of desks, others cut desktops according to individual orders. The employees only have to remove the finished components from the production line and pack them up. The factory costs more than EUR26m but the managers of Nowy Styl admit that it is four times more efficient than the previous one.

The factory in Jasło is not the only island of Industry 4.0 in Poland. Large foreign companies, such as GE, Philips, and Volkswagen also have such modern factories in Poland. Apart from Nowy Styl, Polish capital with aspirations is represented by the Forte furniture factory, Wielton, which produces trailers for trucks, and subcontractors of the European automotive industry such as Boryszew. The Polish chemical industry, represented, for example, by Synthos, is also quite advanced. Even some small companies in Poland now have new machines which communicate with each other. The concept of Industry 4.0 applies to companies of various scale and from various industries.

There is no strict definition of what Industry 4.0 means. We can assume, however, that it involves production that utilizes at least some of the following nine technologies: automation, robotization, digital design, processing of large amounts of data (big data), cloud computing, smart sensors, 3D printing, advanced human-machine interfaces, advanced authentication mechanisms, and even augmented reality. In short – production which is less expensive, larger, more flexible and/or better suited to the needs of the recipients thanks to technology.

The list of technologies itself suggests that Industry 4.0 is a relatively new trend, so no one should have a significant advantage on the market yet. The most advanced companies right now are those which were the leaders of automation in Industry 3.0. Many of them are German ones. The number “4.0” first appeared at the Hannover Trade Fair in 2011.

In Poland, most companies are still at an earlier stage of automation of individual work posts. According to the Polish Ministry of Development this is an opportunity rather than a problem.

“It’s true, many Polish companies should be classified as Industry 2.5, so to speak. They are only aspiring to introduce more significant changes. However, the owners will be increasingly likely to make decisions to invest in advanced automation, for example due to the lack of skilled workers, or such decisions will be made by their children, who will inherit the businesses and who are more open to new technology. In both cases they will conclude that it makes no sense to buy 3.0 machines in order to be quickly forced to upgrade them to 4.0, but that it is worth investing in devices which have the potential to cooperate with each other, as well as investing in digital management systems,” explains Jan Filip Staniłko, the Deputy Director of the Department of Innovation in the Ministry of Development.

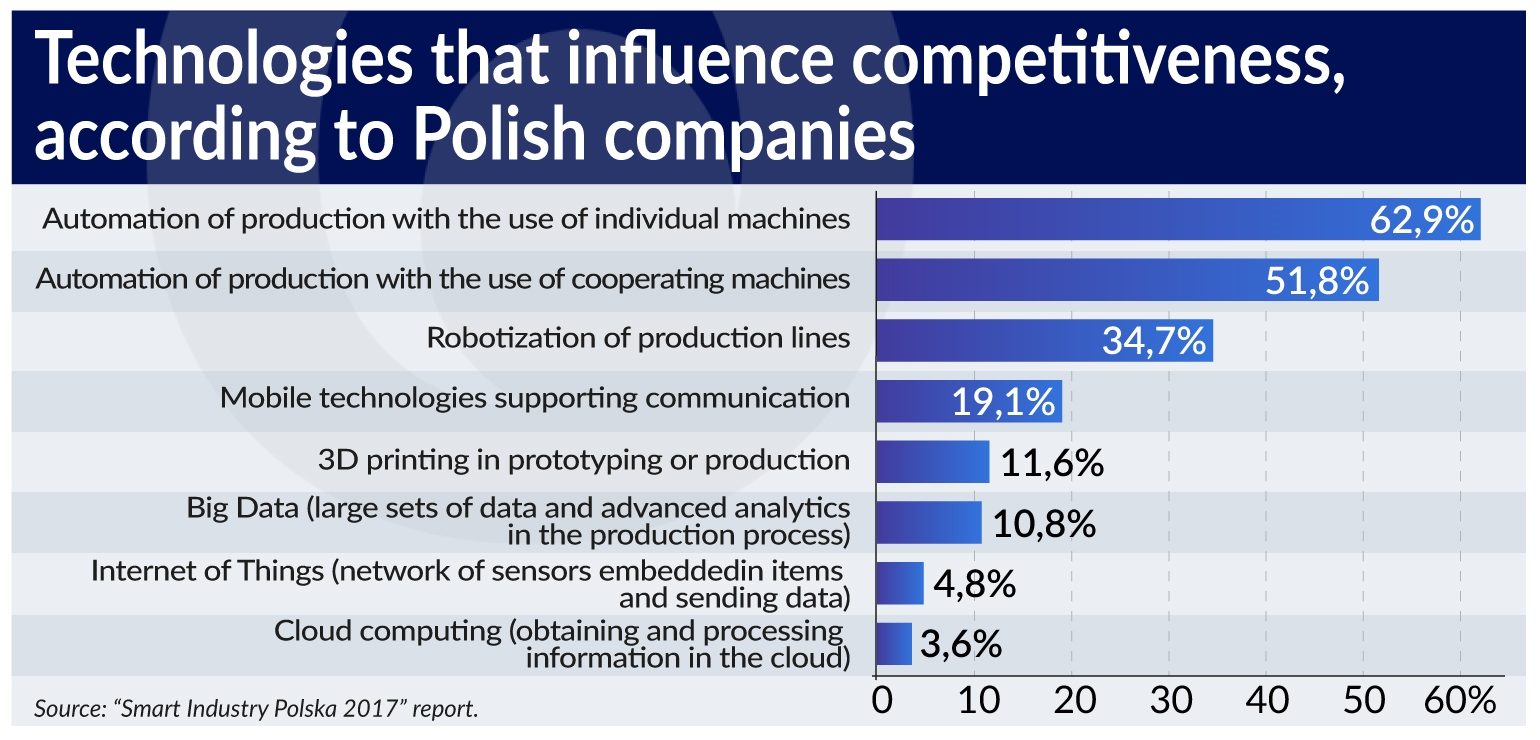

The study “Smart Industry Polska 2017”, commissioned by the Ministry of Development and Siemens, and conducted on a sample of 251 small and medium-sized enterprises (SME), indicates that in 2016 as many as 77 per cent of these companies implemented at least one of the solutions supporting innovation (the most popular was automation with the use of individual machines – 48.6 per cent of the companies; the use of cooperating machines was the 3rd most frequent option, indicated by 27 per cent).

Additionally 10.4 per cent of the companies intend to introduce automation based on individual machines within the next year, while 8.8 per cent want to introduce automation based on cooperating machines. The surveyed entities also have plans to implement mobile technologies (7.2 per cent) and cloud computing (6.8 per cent). Other innovations were mentioned much less frequently.

These indicators are supposed to be improved by the Polish Platform of Industry 4.0. Its launch is planned by the Ministry of Development for January 2018. It will integrate the companies, research institutes, universities and technology parks into a network of providers of technologies and innovative competencies, so that entrepreneurs willing to move towards Industry 4.0 can come across examples of specific implementations. The ministry announced that this will be a foundation financed by both the public and private sector (although at the beginning mostly by the state), and its effectiveness will be measured by the level of digitization and automation of Polish industry.

The officials at the Ministry of Development admit that there are only several companies in the world that are able to develop and deploy all the processes related to automation and digitalization of production almost entirely on their own. This is a signal that cooperation with these companies, e.g. Siemens, GE, ABB, Dassault, Fanuc or Emerson, is crucial.

“We have converging interests. We want to obtain the know-how and the specific commercial solutions, and these companies want a partnership with a government entity which is involved in a more difficult market segment, i.e. with the smaller companies that may later become customers for the solutions of these international corporations,” says Jan Filip Staniłko from the Ministry of Development.

He adds that last year GE, which has nine factories in Poland, signed a letter of intent with the Polish government, designating the company as a partner to the Polish economy. GE’s most advanced factory in Europe, known as the “brilliant factory”, is located in Bielsko-Biała, in southern Poland.

“During the Hanover Trade Fair in April such partnership with Poland was also signed by Siemens, and that is probably not the end,” emphasizes Jan Filip Staniłko.

“It’s a good thing that the state focuses on cooperation with foreign partners and innovation, however, I hope that it will remember that its politics should also be oriented on the rapid and widespread imitation of the best designs from across the world. There is nothing wrong with that, because the entire advanced industry is based on copying the solutions developed by others, their continuous transformation and improvement, and in Poland, which isn’t even a country of Industry 3.0, the potential for imitation is still very high. The average industrial company stands to profit much more if it implements solutions already utilized by its larger competitors who have a stronger position in the global markets. Coming up with improvements and innovative solutions on a global scale also makes sense, but frequently only as a supplement to the much more important process of imitation,” says Maciej Bukowski, PhD, the President of the think-tank WiseEuropa.

He stresses that innovation should not be an end in itself but means to an end, namely the growth of productivity, or the profitability of production. “I hope that the new research and development centers will serve this purpose, that they will employ people who understand the direction in which industry is heading, what technologies are crucial, and what must be improved in their companies in order to increase productivity, reduce production costs, increase sales, or acquire a new market,” explains Maciej Bukowski.

Taking this into account, it would be sensible to find industries in which Poland already has a good position on the world market. In the chapter devoted to re-industrialization, the Plan for Responsible Development focuses on the sectors of the Polish industry which:

These include Polish medicinal products, furniture, the shipbuilding and mining industry, but also the defense industry (e.g. telecommunication and IT technologies, drones, imagery and satellite reconnaissance already supplied to the army by Polish private companies).

Of course the re-industrialization does not mean that all the sectors of Polish industry will immediately join the fourth technological revolution. And even among those that will, the beneficial effects may vary.

“One-third of Polish factories are already willing to use Industry 4.0 solutions. Industries that have a reliable volume of sales, and whose manufacturing processes are crucial in their activities, have the highest chance to become leaders. These are the food industry, the furniture industry, the chemical industry and the automotive industry,” enumerates Jan Filip Staniłko.

“It will be more difficult to assume leadership positions in industries where product innovation is more important than the manufacturing technologies. We don’t really stand a chance in the production of complex machinery or electronics, but we have our niches in product innovation. We have the Aviation Valley, we have the manufacturers of means of transportation – Pesa, Wielton or Solaris. We have a chance in the shipbuilding industry, or in the management of mines through intelligent mining systems, where Famur is the domestic leader,” adds Staniłko.

So, if building Industry 4.0 in Poland is not a pipe dream, what are the barriers to its development? In the aforementioned report “Smart Industry 2017”, the companies primarily indicated formal and bureaucratic difficulties (40.6 per cent), but many also mentioned limited financing opportunities (33.9 per cent), lack of access to skilled personnel (32.3 per cent) and the fear of a lack of return on investment (31.9 per cent).

The diversity of the identified barriers probably shows that Polish SMEs are aware that Industry 4.0 is not a simple “acceleration tool”, which merely increases production rates, but that it requires the introduction of fundamental changes. It’s about a conscious decision that small companies want to become medium-sized companies and that medium-sized enterprises want to become large, with all the consequences that this entails.

“Industry 4.0 is not just the enhancement of production. The transition to digital intelligent production processes is easier than the transition to intelligent enterprise management or platform business models. This means a change in the way value is created, and how the product life-cycle is managed, which requires different competencies of the workers and of the organization. Support for such a change is absolutely necessary. Large enterprises can buy it from consulting firms, but smaller firms must be assisted by the state,” says Jan Filip Staniłko.

“If Poland wants to catch up with Germany, the country that is a model example of implementation of Industry 4.0, it could take up to 40 years. After all, German industry is constantly developing as well. Even the best state policies – the establishment of the Platform of Industry 4.0, the National Institute of Technology, access to financing, good competitions at the National Centre for Research and Development, and a strong capital market in Warsaw – although badly needed in order not to regress, will not significantly reduce the time required to catch up. The goal is a very far-reaching evolution of companies, universities, the state administration, etc. There is a chance to elevate many entities to the level of one of the most well-organized countries in the world, but it will not happen overnight,” concludes Maciej Bukowski.