Technologia nie jest cudownym lekiem na koszty ubezpieczycieli powstałe w związku z ryzykiem ubezpieczeniowym czy potencjalnie mniejsze zyski w przypadku pogorszenia sytuacji gospodarczej. Tych bolączek insurtech łatwo nie...

Recent years have seen important changes in the payments landscape. Cash usage has been declining in many countries for some time, and this trend has accelerated during the pandemic.

Indie są jednym z liderów w płatnościach natychmiastowych – przesyłanych i rozliczanych w czasie rzeczywistym, w ciągu kilkunastu minut. Ich wdrażanie nabrało tempa w pandemii, a dużą rolę odgrywa w tym procesie...

Szybka digitalizacja usług finansowych w Azji jest następstwem procesu dojrzewania nowych klas bogacących się konsumentów, pandemii, która przyśpieszyła cyfryzację wielu obszarów życia oraz wdrażania zasad i regulacji...

Dynamiczny rozwój platform e-commerce podgrzał zainteresowanie płatnościami odroczonymi. Dostawcy usługi „kup teraz, zapłać później” oferują konsumentom łatwo dostępne i bezpłatne kredyty. Jednak ich liberalne...

Po zeszłorocznej stagnacji fundusze venture capital dokonały w bieżącym roku inwestycji znacznie większych niż w całym 2020 r. Wybierają one głównie duże, dojrzałe startupy finansowe o sprawdzonych modelach...

Pandemia zdynamizowała korzystanie przez konsumentów z zakupów w internecie. Szybko rosnącą formą płatności za nie stają się płatności odroczone. Zwiększają wartość transakcji i są dogodniejsze niż różne formy...

Wprawdzie liczba banków świadczących usługi wyłącznie online nieustannie rośnie i mogą się pochwalić wyższą efektywnością kosztową, jednak niewielu udało się wykorzystać efekt skali i osiągnąć stabilne zyski.

Pandemia powoduje, że zmiany w sektorze bankowym – nie tylko cyfrowe – następują coraz szybciej. Będą się kurczyć dotychczasowe źródła przychodów banków, a wyzwaniem będzie oferowanie nowych usług i korzystanie...

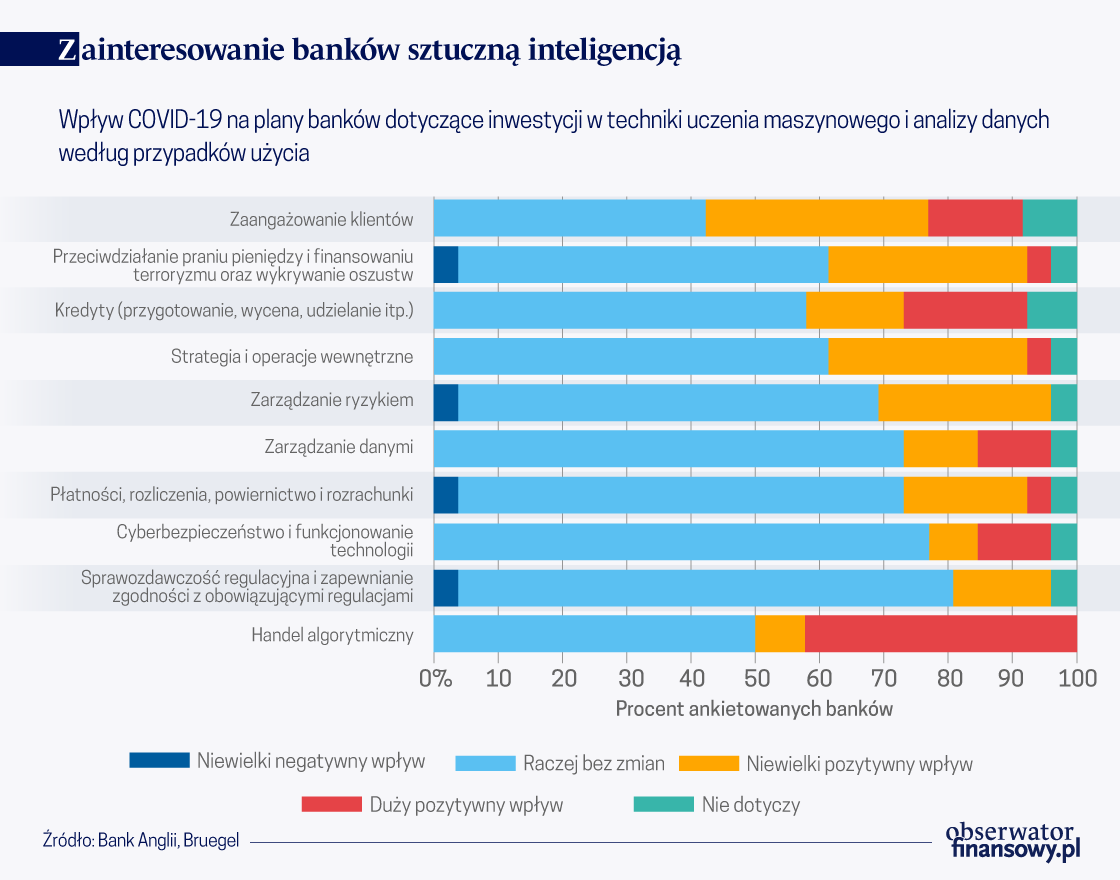

Wybuch pandemii COVID-19 nie zahamował apetytu europejskich banków na wdrażanie rozwiązań z obszaru uczenia maszynowego lub analizy danych, ale może w perspektywie krótkoterminowej ograniczyć ich zdolność do...