The possibility was earlier heralded by the Governor of the National Bank, Jorgovanka Tabakovic. Whether the bonds are going to be sold directly or through stock brokers remains to be determined.

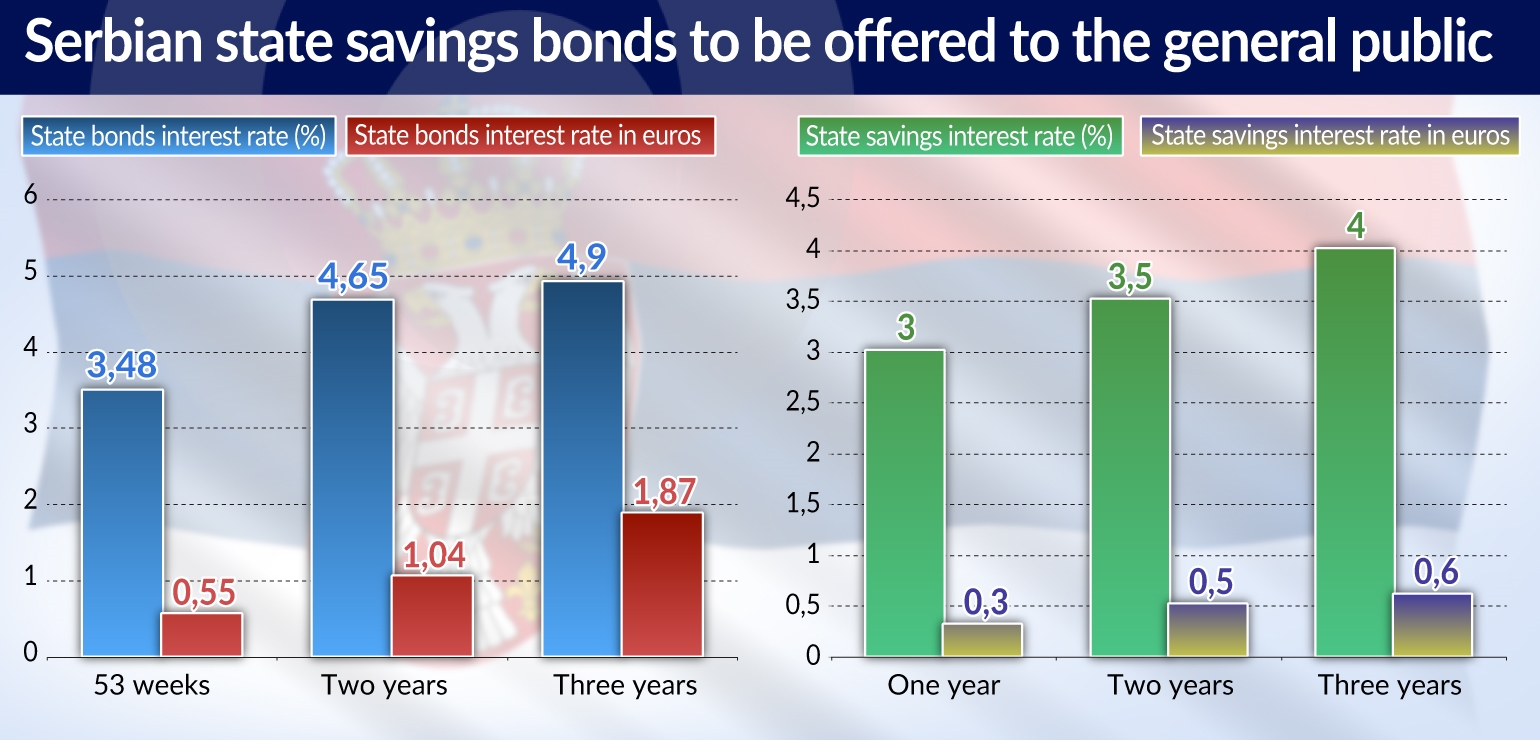

According to a statement made by Tabakovic during the session of the Finance Board of Serbian Parliament, current interest rates that commercial banks offer on private savings are too low, averaging between 0.8 per cent and 1 per cent annually. Planned state bonds are supposed to offer significantly higher rates. Current foreign exchange reserves of Serbia have reached EUR9.14bn, with another EUR420m of private savings deposited in dinars (RSD50.7bn). Data from the National Bank of Serbia shows that foreign exchange savings are growing every year, with a recorded rise of EUR340.9m, or 6.4 per cent between June 30th, 2016 and the same date of this year.

Ljubomir Savic, an economics professor at the University of Belgrade, pointed out that in such circumstances, there is no other reason for people to put their money into bank accounts other than safety. However, at present there are also very few alternatives. Some decide to use the excess funds to start up a business, but such ventures always come with a high risk factor. Investing in real estate is nowhere near as safe or profitable as it used to be, with diminishing housing prices all across Serbia.

Thus, investing in future state bonds with certain interest rates comes as a healthy alternative, especially for those who have limited means. However, there are a few rules that will prove to be a novelty for the average Serbian.

State issued bonds come with higher interest rates than banks are able to offer, the risk of buying them is minimal, and they can be sold on the Belgrade Stock Exchange at any point in time, even before the set deadline with interest calculated up to that specific point. Above all, they are tax free.

The main condition that one must meet before investing in state bonds is to open up an account with one of the registered brokers and deposit a certain amount of money. The alternative to buying state issued bonds on the stock exchange is to acquire them directly from the state during the primary issue. In such case, one can buy up to 50% of the total auction value. The minimum value of acquired bonds is set at RSD50,000 or EUR5,000, with single bond price of RSD10,000 or EUR1,000. True effectiveness of this new policy remains to be seen, as interest rates remain only a fraction higher than in regular bank savings, as presented in the table above.

Milica Milojević is an economist, published economic analyst, and a part-time economic journalist with corporate, banking, and consulting experience. She has written papers on monetary and political economics, and economic history of Serbia and the Balkans.