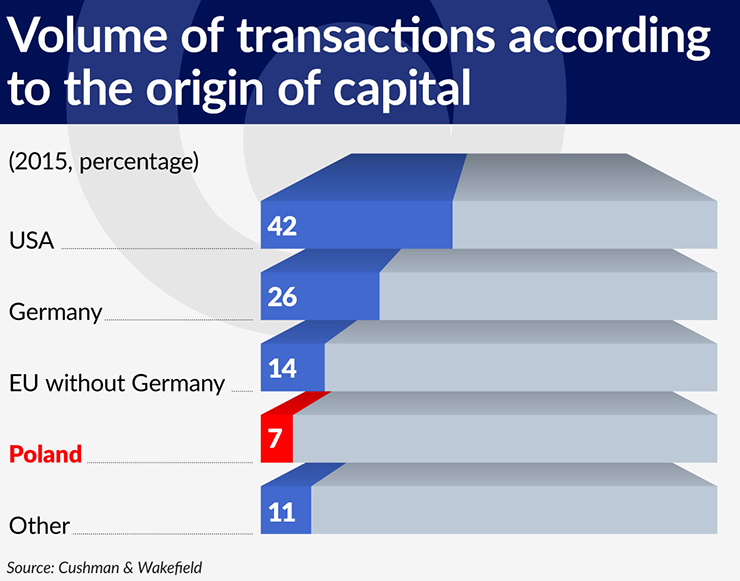

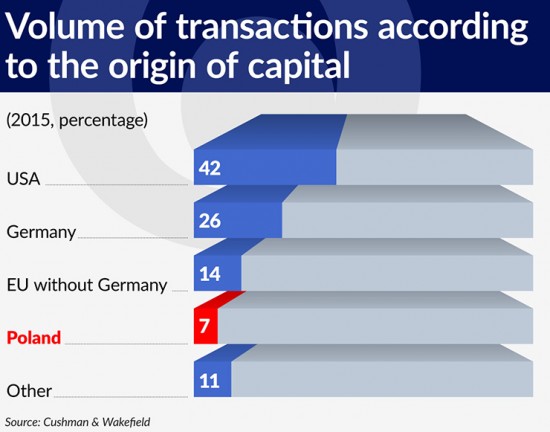

The increase of investment in the commercial real estate in Poland is mainly associated with the influx of foreign capital to this sector. This in turn is associated with the low level of interest rates in the global markets, along with the significant saturation of commercial space in developed countries.

Interest on the Polish commercial real estate market is also influenced by a relatively high GDP growth rate in Poland compared to other EU countries, the size of the economy (measured by the level of GDP) and the steady inflow of European funds.

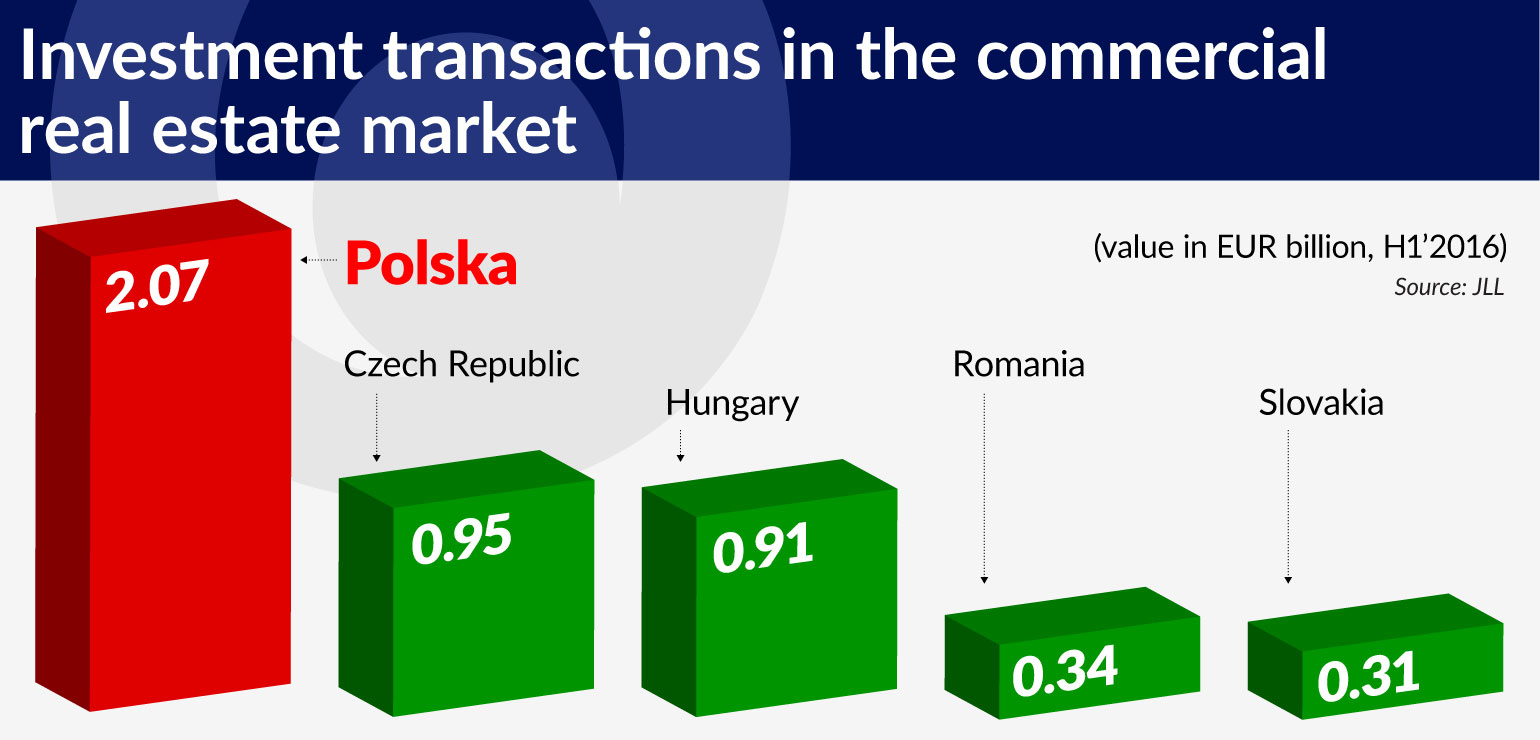

As a result, the value of transactions in the Polish market is the largest among the countries of Central and Eastern Europe.

(Infographics Łukasz Rosocha)

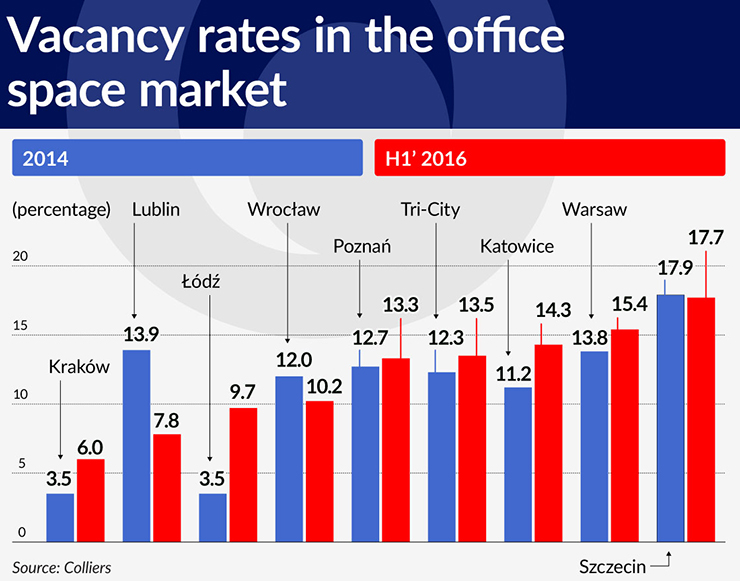

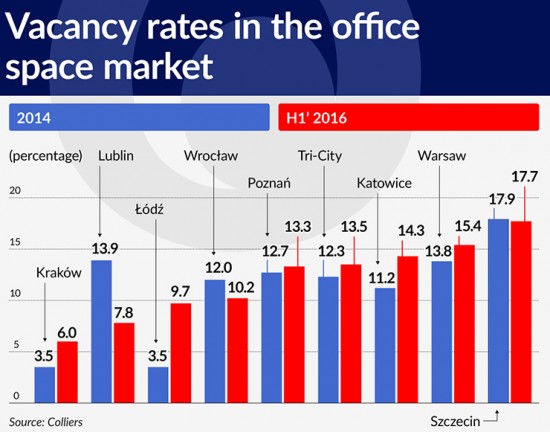

Amid stable demand, the rapid increase in fixed assets in the commercial real estate market leads to the development of imbalances. The negative trends relate primarily to office space. They are further reinforced by the large geographical concentration of the supply of office space. As a result, the vacancy rate is growing. In the biggest cities it has now exceeded 10 per cent.

(Infographics Łukasz Rosocha)

This creates downward pressure on the rental rates or translates into the use of incentives for the tenants in the form of temporary rent relief. Market estimates indicate that effective rents in the office space market in Warsaw are now 15-20 per cent lower on average than the base rates.

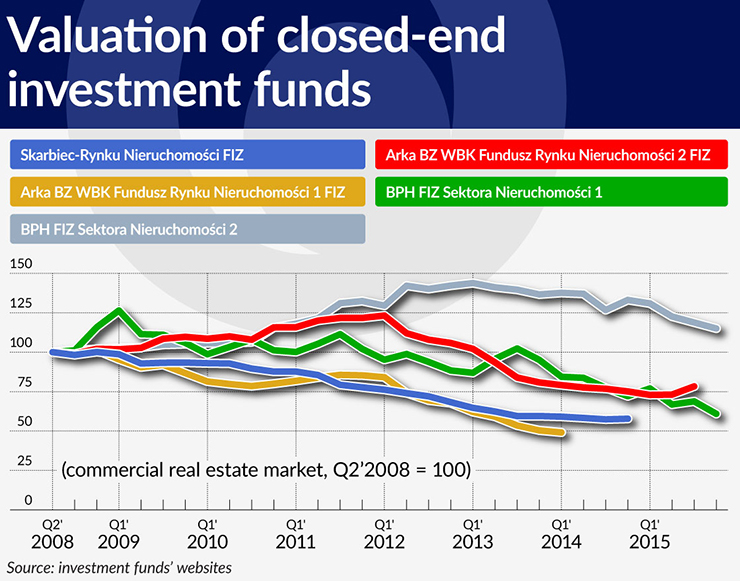

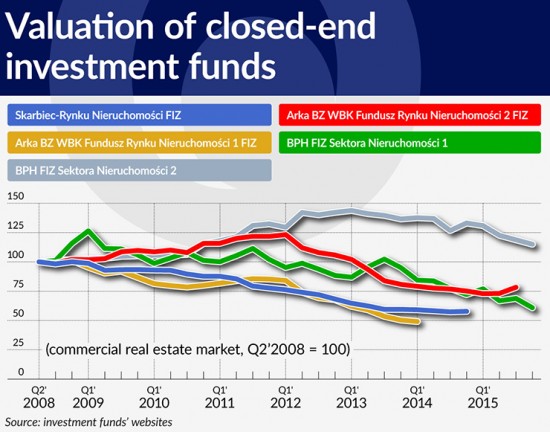

This leads to a reduction in the income generated by the properties which is well reflected in the falling valuations of the participation units in closed-end investment funds which locate their resources in commercial real estate.

(Infographics Łukasz Rosocha)

Despite the increase in vacancy rates, the activity of developers remains relatively high. They point out that the demand for commercial space should be largely supported by tenants moving to new office buildings in more attractive locations.

However, this is not confirmed by the incoming data. Among the investments completed in 2016, 46 per cent have not yet been rented. Business should expect a further increase in the vacancy rate. This is mainly due to the scale of the currently implemented investments in this sector (approx. 40 per cent of which are located in Warsaw). It is estimated that after these investments are completed, the existing office space will increase by 17 per cent.

The growing vacancy rate and declining incomes generated by commercial properties increase the credit risk. In the case of financing the investments with bank loans, this could lead to a deterioration in the quality of the collateral, as well as the borrower’s ability to service the debt.

International experience shows that the prudential policy applied by banks, which consists in requiring a high own contribution of the investor, is not entirely effective (see: Report on the situation on the residential and commercial real estate market in Poland in 2015, NBP). This is mainly due to the low liquidity of the market, which, amid the economic downturn, limits the ability to sell a property, at the same time deepening the decline in its value.

In connection with the continued build-up of imbalances in the commercial real estate market, NBP recommended that banks should be more cautious in financing investment in this sector. We should remember, however, that the leading role on the Polish market is played by foreign investors, and the scale of involvement of domestic banks in the financing of this sector is limited. The total amount of loans granted by the banks operating in Poland for office space real estate is relatively small (about PLN7bn). Therefore, the growing imbalances should not pose a risk to the stability of the domestic financial system.

Marcin Wagner works at the Economic Institute of NBP.